📌 MAROKO133 Update crypto: Tether Eyes $500B Valuation Amid Explosive Stablecoin M

The global stablecoin market is surging in 2025, with institutional giants like SoftBank and ARK Investment pursuing investments in infrastructure players like Tether.

While Tether and other stablecoins continue to expand, analysts warn that rapid adoption carries financial risks, particularly to central banks’ ability to control interest rates and maintain exchange rate stability.

Tether’s Expansion and Investor Interest

Tether is reportedly exploring a $20 billion funding round, which could value the company at around $500 billion, potentially placing it among the world’s most valuable private firms. Tether aims to use the capital to diversify beyond its core stablecoin business, which currently supports a USDT supply exceeding $170 billion.

SoftBank has been steadily expanding its cryptocurrency investments, while ARK Invest, led by Cathie Wood, has pursued multiple high-profile crypto funding deals in recent years.

If completed, the round would mark Tether’s most extensive search for external capital yet. Cantor Fitzgerald, a shareholder in Tether, is advising on the potential transaction. Market observers say the move reflects the stablecoin issuer’s dominant position and growing institutional confidence in digital asset infrastructure.

Supported by large US Treasury holdings and a growing Bitcoin reserve, Tether has emerged as one of the most profitable firms in crypto. In Q2 2025, it posted $4.9 billion in net income, up 277% from a year earlier.

Institutional Cash Pours In as Market Explodes

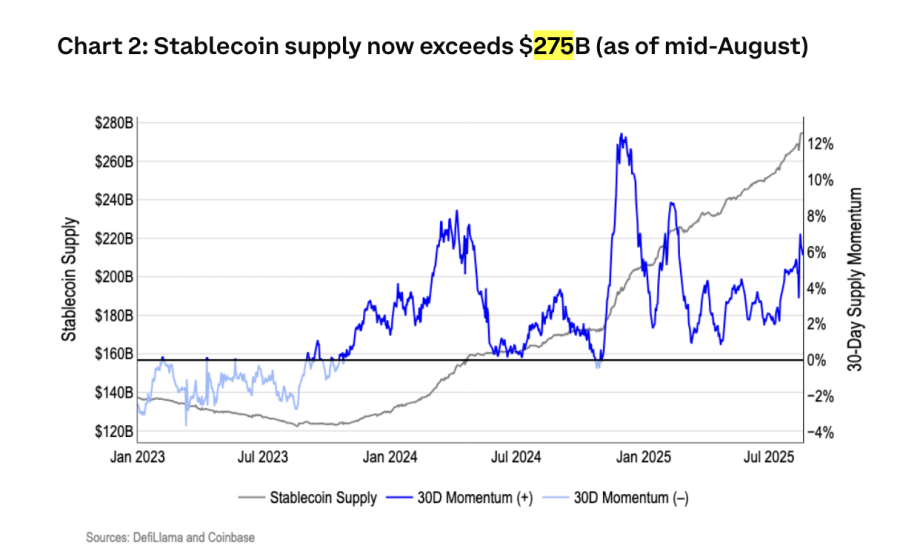

The stablecoin sector is undergoing an explosive growth phase in 2025, driven by unprecedented institutional adoption and emerging regulatory clarity worldwide. According to analysis cited in Coinbase’s August report, the total market capitalization of stablecoins has surged, reaching over $275 billion. Some analysts project the market could reach $1 trillion by 2028.

This growth is fueled by the stablecoins’ utility in cross-border payments, which are used for over 43% of B2B transactions in Southeast Asia. This year marks an inflection point where institutions are actively integrating stablecoins; a Fireblocks survey indicated that 90% of surveyed institutions are now taking action on stablecoin integration, embracing them for treasury management and international settlement.

Beyond Tether’s ambition, other major players are reshaping the landscape: nine major European banks (including ING, UniCredit, and Danske Bank) have joined forces to launch a MiCA-compliant euro-denominated stablecoin, and companies like Finastra have partnered with Circle to integrate stablecoins into bank payment flows.

The movement is gaining momentum in Asia as well. South Korea’s major financial institutions are deeply engaged in preparing for the stablecoin era, aggressively pursuing a “Two-Track Strategy” involving both internal development and strategic partnerships to launch their own Korean Won-backed stablecoins.

For example, a group of at least eight major banks, including KB Kookmin Bank and Shinhan Bank, is reportedly forming a consortium to create a joint venture and infrastructure specifically for the co-issuance of a Won-backed stablecoin. Furthermore, leading banks are meeting directly with foreign stablecoin issuers, such as the US company Circle (USDC issuer), to discuss cooperation, while simultaneously establishing internal task forces to conduct Proof-of-Concept (PoC) testing for real-world settlement using their own digital currency systems.

Rising Stablecoin Use Poses Financial Risks

A new report from Moody’s Ratings, published on September 25, warns that digital currency ownership has surged globally, reaching 562 million people by 2024, up 33% from the previous year. Emerging markets in Southeast Asia, Africa, and Latin America are leading adoption, often using cryptocurrencies for inflation hedging, remittances, and financial inclusion.

The rapid expansion of stablecoins introduces systemic vulnerabilities. Widespread use could reduce central banks’ control over interest rates and currency stability, a trend termed “cryptoization.” Banks may experience deposit erosion as savings shift into stablecoins or crypto wallets, and underregulated reserves could trigger liquidity runs requiring government intervention.

However, uneven regulatory frameworks leave countries exposed. Advanced economies are beginning to regulate stablecoins more rigorously, with Europe implementing MiCA and the US passing the GENIUS Act, while Singapore applies a tiered framework. In contrast, many emerging markets lack comprehensive rules, and fewer than one-third of countries have full-spectrum regulation in place.

The post Tether Eyes $500B Valuation Amid Explosive Stablecoin Market Growth appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Update crypto: Crypto Whales Bought These 3 Altcoins In The Final Week

Bitcoin’s steady decline this week, culminating in its dip below the critical $110,000 level yesterday, has severely dampened broader market sentiment.

The pullback has gradually pushed many altcoins to multi-week lows, creating strategic accumulation opportunities for large investors. Amid this, crypto whales have been buying select altcoins, signaling renewed confidence in specific tokens. This piece examines some of them.

World Liberty Financial (WLFI)

Donald Trump-linked WLFI is one of the key altcoins attracting whale interest this week. This comes amid the 13% dip in the altcoin’s value over the past seven days.

According to on-chain data from Santiment, whale addresses holding between 1 million and 10 million WLFI tokens have increased their holdings by 26.72 million during the week under review.

Today, World Liberty Finance announced that its team will implement a token buyback and burn mechanism this week. If this move also sparks renewed bullish momentum, combined with the recent uptick in whale demand, WLFI’s price could rise to $0.2059.

Conversely, if demand wanes, the token could see a pullback toward $0.1814.

PEPE

Solana-based meme coin PEPE has also seen significant interest from crypto whales.

According to Nansen, large investors holding more PEPE tokens worth more than $1 million have increased their supply by 1.36%, taking advantage of broader market weakness to build positions.

This accumulation reflects growing confidence among high-net-worth investors, who view the current market dip as a strategic entry point.

Sustained whale activity could support further gains for PEPE and drive its price upward to $0.00000984.

On the other hand, a slowdown in whale buying may leave the token vulnerable to further short-term declines. In this scenario, its price could plunge to $0.00000830.

Polygon Ecosystem Token (POL)

POL’s price has dwindled 16% in the past seven days. Amid this dip, large wallet addresses holding between 100,000 and 1 million tokens are actively accumulating the altcoin, capitalizing on lower price levels across the broader crypto market.

Per Santiment, during the week in review, the supply of this investor cohort has gone up 220,000 POL tokens.

This trend suggests that POL whales are taking advantage of its lackluster performance and positioning ahead of anticipated market recovery.

If accumulation persists, POL could reverse its downtrend and climb to $0.2308.

However, renewed selloffs could push the token’s price toward $0.1092.

The post Crypto Whales Bought These 3 Altcoins In The Final Week Of September 2025 appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!