📌 MAROKO133 Eksklusif crypto: 3 Things to Know About PI’s Breakout Rally and What

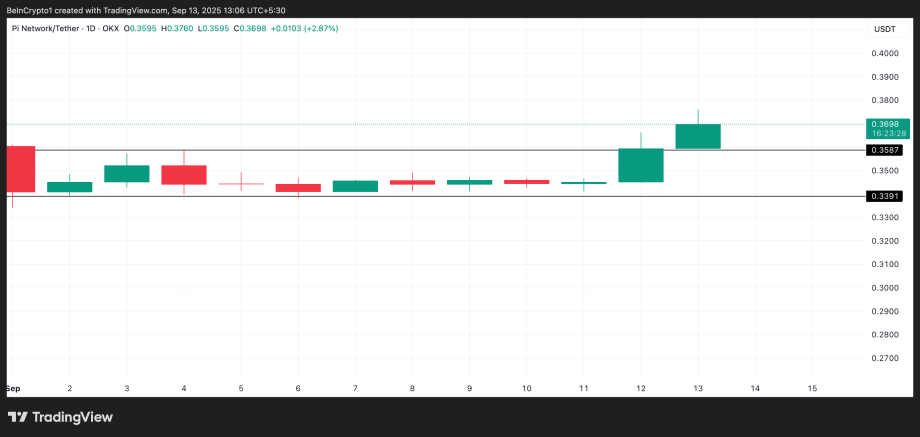

PI Network’s native token, PI, staged a breakout on the daily chart on Friday, pushing above a resistance line that has capped its gains since mid-August.

The move comes amid renewed momentum across the broader crypto market. With technical indicators signaling a surge in demand, PI could be poised for a fresh leg higher.

Market Sentiment Turns as PI Clears Barrier

During Friday’s trading session, PI saw a sharp uptick in demand, closing the day above the upper line of a horizontal channel that had kept its price trending sideways since August 19.

That ceiling, formed at the $0.3587 level, has now been flipped into a support floor, marking a significant shift in market sentiment.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

PI Pushes Past Resistance With New Demand

Readings from PI’s technical indicators confirm this surge in new demand for the token. For example, the token’s Chaikin Money Flow (CMF) currently rests above the zero line and is in an upward trend, signalling buy-side pressure. At press time, the metric sits at 0.04.

The CMF measures the strength of buying and selling pressure by tracking how capital flows in and out of an asset over a set period.

A CMF value above zero indicates that money is flowing into the token, while values below zero suggest outflows.

In PI’s case, the CMF at 0.04 during a price rally signals that investors are actively accumulating the token rather than selling into strength. This trend suggests the breakout is supported by genuine demand, reducing the likelihood of a false move and strengthening the case for further upside.

In addition, PI’s rally over the past day has pushed its price above its 20-day Exponential Moving Average, which now forms dynamic support below it at $0.3545.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving more weight to recent prices.

When an asset trades above its 20-day EMA, it reflects short-term bullish momentum and suggests that recent buying activity is strong enough to keep prices above their average trend.

Holding above this level for PI indicates that bulls are in control and that the EMA could act as a dynamic support floor on potential pullbacks. It could also provide a base for the token to sustain its upward trajectory.

PI Eyes $0.39 Breakout as Bulls Test Market Strength

If demand climbs, PI could attempt a breach of its next major resistance at $0.3903. A break above this barrier could set the stage for a rally toward $0.4661.

However, a failed retest of the breakout line could cause PI to return to its sideways pattern. If selloffs worsen, it could even break below the support formed by its 20-day EMA and plummet toward $0.3391.

The post 3 Things to Know About PI’s Breakout Rally and What It Means for Traders appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: Arthur Hayes: Chasing Quick Gains in Bitcoin Is a Los

BitMEX co-founder Arthur Hayes is urging Bitcoin investors to shift their mindset away from short-term thinking and flashy expectations.

Key Takeaways:

- Arthur Hayes says short-term thinking and flashy expectations are hurting Bitcoin investors.

- He argues that Bitcoin outperforms traditional assets when adjusted for inflation and currency debasement.

- Despite his long-term outlook, many young investors still treat crypto as a fast track to wealth.

In a recent interview with Kyle Chasse, Hayes said the obsession with comparing Bitcoin to record highs in stocks and gold is misplaced and reflects a misunderstanding of Bitcoin’s long-term value.

“If you thought you were buying Bitcoin and the next day you were buying a Lamborghini, you’re probably getting liquidated,” Hayes said, calling out the impatience of newer investors.

Bitcoin Trails Behind as Stocks and Gold Set Fresh Records

Bitcoin is currently trading at $116,007, still below its all-time high of $124,100 set on August 14.

Meanwhile, the S&P 500 and gold both hit fresh record highs this week, $6,587 and $3,674, respectively, fueling questions about why Bitcoin hasn’t kept pace in recent weeks.

But Hayes dismissed those comparisons. “The premise of that question is flawed,” he said, when asked about Bitcoin attracting global capital flows similar to other asset classes.

“Bitcoin is the best performing asset when you think about currency debasement ever.”

Hayes argued that in inflation-adjusted terms, most traditional markets are lagging. “Deflate the housing market by gold, and it’s not even close to 2008 levels,” he said.

Even the S&P 500, he noted, appears weaker when measured against gold. “If you deflate things by Bitcoin, you can’t even see it on the chart.”

Despite the short-term volatility, Hayes remains firm in his belief that Bitcoin will outperform over time.

In April 2025, he projected BTC could reach $250,000 by year-end. That prediction was echoed weeks later by Unchained Market Research Director Joe Burnett.

For Hayes, Bitcoin is a long-term game, not a get-rich-quick trade.

Despite Hayes’ warning, young men are emerging as the dominant demographic in crypto ownership, viewing digital assets not just as investments, but as quick paths to wealth.

$1M Bitcoin in 2026 Would Signal US Economic Crisis

As reported, Galaxy Digital CEO Mike Novogratz has pushed back on predictions that Bitcoin could hit $1 million in the near term, warning that such a move would likely reflect a collapse in the US economy rather than a crypto success story.

“People who cheer for the million-dollar Bitcoin price next year, I was like, guys, it only gets there if we’re in such a shitty place domestically,” Novogratz told Natalie Brunell on the Coin Stories podcast recently.

“I’d rather have a lower Bitcoin price in a more stable United States than the opposite.”

Novogratz explained that extreme currency devaluations often fuel demand for alternative safe havens, and Bitcoin, often dubbed digital gold, becomes a hedge against economic turmoil.

However, he cautioned that such conditions would come at the expense of civil society.

On the other hand, Eric Trump has reiterated his $1 million Bitcoin prediction, citing rising demand from governments and major institutions.

The post Arthur Hayes: Chasing Quick Gains in Bitcoin Is a Losing Strategy appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!