📌 MAROKO133 Hot crypto: Stablecoin as a Service Drives Growth Amid Liquidity Conce

With the Stablecoin-as-a-Service (SCaaS) model, any business or platform can issue its stablecoin without building a complex infrastructure.

The opportunity is vast, but it comes with risks of liquidity fragmentation, reserve transparency, and evolving global regulatory frameworks.

Anyone Can Issue Stablecoin

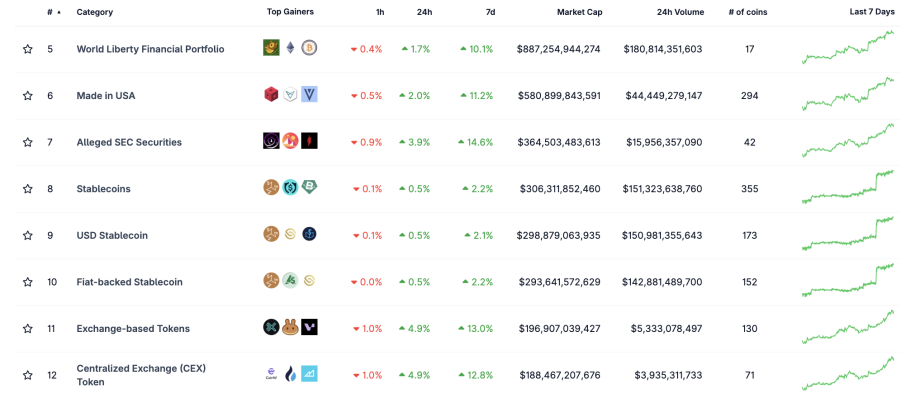

Data from CoinGecko shows that the stablecoin segment currently has a market capitalization of around $306 billion and 355 different coins. Although quite popular today, not everyone can issue and manage stablecoins effectively.

However, a new stablecoin model allows businesses, platforms, or organizations to issue and manage stablecoins without building the entire infrastructure from the ground up.

This model includes standardized mint/burn, customizable reserve mechanisms and fees, and third-party operating interfaces. This is Stablecoin-as-a-Service (SCaaS).

The most recent example is Stripe’s Open Issuance program (launched in September 2025). It enables businesses to mint/burn stablecoins freely and customize fees and reserve allocations while sharing profits from yield after a certain fee. Ethena Labs provides a white-label solution for applications or blockchains. Tech giants like Google have reportedly tested a payment protocol for AI agents using stablecoins, while custodians such as BitGo have also entered the market.

“Stripe announces Stablecoin as a Service. Any company can deploy stablecoins with just a few lines of code. BlackRock, Fidelity, or Superstate manages reserves. An X user commented about Stripe’s SCaaS.

The SCaaS model lowers entry barriers by allowing virtually any business to issue its stablecoin. It also supports tailored stablecoins for specific products or target markets and gives wallets/exchanges/chains additional tools to distribute products with yield potential.

Some users on X argue that SCaaS will become increasingly important as stablecoins become commodities and distributors (wallets, exchanges, chains) seek yield opportunities. Others suggest that SCaaS could be a lifeline for many blockchains struggling to achieve token-market-fit.

High Potential, High Risk

Nonetheless, the risks are significant. Multi-issuance models create the possibility of liquidity fragmentation. For instance, multiple “USD-pegged” stablecoins may coexist but differ in reserves, transparency, or redemption reliability.

Market dynamics could turn SCaaS into a yield-driven bet: issuers might optimize reserve profits to stay competitive, sometimes taking on liquidity risks or investing in less liquid assets. This leaves vulnerabilities when redemptions suddenly surge.

From a legal and operational perspective, SCaaS demands absolute transparency on reserve composition, insurance/redemption mechanisms, and independent auditing processes.

Regulatory decisions at national or regional levels could drastically reshape the multi-issuance landscape.

Even so, SCaaS is still expected to be a natural step forward as stablecoins steadily evolve into a global payment instrument.

The post Stablecoin as a Service Drives Growth Amid Liquidity Concerns appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Hot crypto: Bitcoin Price Prediction: Banking Giant JPMorgan Compares

Bitcoin could be trading much higher if valued against gold, according to new analysis from JPMorgan. The bank argues that the cryptocurrency is undervalued on a risk-adjusted basis and could, in theory, rise to $165,000 — around 40% above its current $120,000 level.

The calculation hinges on volatility. JPMorgan points out that Bitcoin’s price swings compared to gold have been narrowing, with the BTC-to-gold volatility ratio now below 2.0. That makes Bitcoin look more attractive relative to the yellow metal.

Analysts note that if Bitcoin’s $2.3 trillion market cap were to align with the $6 trillion invested in gold bars, coins, and ETFs, once adjusted for relative risk, Bitcoin would need to rise by roughly 42%.

Seasonal Strength Supports Uptober Rally

The timing of this call adds to its weight. Bitcoin closed September around $114,000, up 5% for the month and breaking a pattern of seasonal weakness. Historically, when Bitcoin ends September in positive territory, the final quarter tends to deliver significant rallies. In years like 2015, 2016, 2023, and 2024, fourth-quarter gains averaged more than 50%.

This history has traders speculating whether the current “Uptober” rally could extend through year-end. Macroeconomic conditions may help: weaker U.S. labor data and expectations of Federal Reserve rate cuts have bolstered Bitcoin’s appeal as a hedge against economic uncertainty.

- September’s 5% gain improves Q4 odds for stronger returns

- Previous positive Septembers led to 50%+ rallies in Q4

- Current price near $120,000 sits about $45,000 below JPMorgan’s $165,000 model

Bitcoin Price Prediction: Bearish Butterfly Forms as BTC Eyes $128K

Bitcoin is trading at $120,421 after breaking resistance near $119,500, extending its “Uptober” momentum. On the surface, the chart looks bullish. Price is holding above both the 50- and 100-period moving averages, while higher lows confirm an upward trend.

A bullish engulfing candle last week reinforced buyer strength, and traders are now watching $124,600 as the next resistance, with a potential push toward $128,000.

Momentum indicators also reflect this strength. The Relative Strength Index (RSI) is elevated near 75, showing strong demand. While this suggests buyers are in control for now, it also signals the market is stretched and could be vulnerable to pullbacks once short-term enthusiasm cools.

Why the Pattern Signals a Bearish Risk

Beneath the bullish tone lies a technical warning: Bitcoin is forming a Bearish Butterfly harmonic pattern, a structure that often signals exhaustion near the top of a rally.

The projected completion zone sits between $128,000 and $130,000. In plain terms, Bitcoin may continue to climb into this range, but once it does, the probability of a sharp reversal increases.

Think of it like climbing a ladder: each step up feels strong, but the top rungs are weaker and risk snapping under weight.

Traders who only see the climb may miss the risk building overhead. If Bitcoin fails to hold above $128K–$130K, a retracement could bring it back toward $118,500, or deeper supports near $113,500.

For traders, the strategy is twofold: capitalize on near-term bullish momentum, but remain cautious as Bitcoin nears the reversal zone.

This dual outlook explains why the market can rise while still flashing bearish warnings — a reminder that even strong rallies carry risks at the top.

Presale Maxi Doge ($MAXI) Blends Meme Power With Gym-Bro Energy

Maxi Doge ($MAXI) is a meme-fueled token designed for degens who thrive on 1000x leverage and relentless hustle. More than just a meme coin, $MAXI represents a community-driven culture that fuses trading intensity with gym-bro energy, caffeine, and competitive camaraderie.

By holding $MAXI, investors unlock staking rewards, trading contests, and access to gamified partner events. The smart contract has been audited by SolidProof and Coinsult, giving added confidence in the project’s foundations.

Momentum is strong. The presale has already raised over $2.7 million, with tokens priced at just $0.0002605. This figure will rise as the presale progresses, making early entry more attractive.

$MAXI holders gain access to:

- Staking rewards with dynamic APYs

- Trading contests with leaderboard prizes

- Community-driven partner events and future integrations

You can buy $MAXI on the official Maxi Doge website using ETH, BNB, USDT, USDC, or a bank card.

Visit the Official Maxi Doge Website Here

The post Bitcoin Price Prediction: Banking Giant JPMorgan Compares BTC to Gold – And Sees a Path to $165K Soon appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!