📌 MAROKO133 Breaking startup: 🚀 Nusantara Lima lifts off. 💸 Accion closes $61.6m f

Dear subscribers,

We’re back with a concise briefing for founders, investors, VCs, and regulators across Indonesia, the region, and beyond. Inside: the week’s essential shifts in capital, expansion, partnerships, and policy—distilled for fast decision-making. Enjoy!

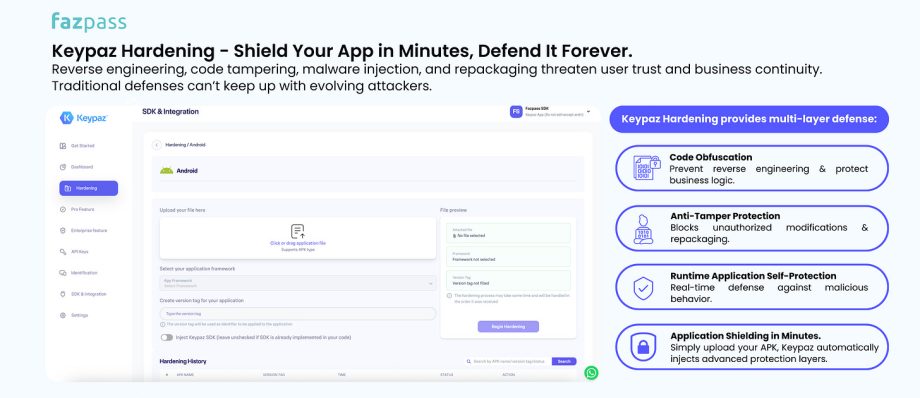

This week’s newsletter is sponsored by Fazpass. Shield Your App in Minutes, Stay Protected Forever.

Keypaz Hardening makes reverse engineering, tampering, and malware a thing of the past. With instant multi-layer defense code obfuscation, anti-tamper, runtime self-protection, and one-click shielding you keep your app, your users, and your business safe. [Try Now!]Best regards,

The DailySocial Team

🚨 What’s New

-

Indonesia launched the Nusantara Lima (N5) satellite on 10 Sep 2025 aboard a SpaceX Falcon 9 from Cape Canaveral. Owned by PT Satelit Nusantara Lima (a PSN subsidiary) and developed with Boeing and Hughes, N5 operates at 113°E with 160 Gbps capacity—the largest in Southeast Asia. The mission is to extend high-speed internet across the archipelago to enable distance learning, telehealth, and MSME digital participation. Early local impacts—such as service improvements at Airu Community Health Center (Papua) and “digital village” pilots in East Java—point to better public services and broader economic inclusion. [Read more]

-

Bali-based Bliink unveiled a travel-management platform for MSMEs. A companion whitepaper highlights that 97% of Indonesian businesses are MSMEs, most still managing travel manually—leading to up to 30% cost leakage, 60% higher last-minute fares, 1 in 4 employees misclassifying personal expenses, and hundreds of hours lost to manual processes. CEO Larry Chua targets up to 30% savings via corporate fares, policy controls, integrated booking-to-reimbursement (cutting admin time by up to 50%), pay-as-you-go billing, and 24/7 human + AI support. [Read more]

-

Investors in Kopi Kenangan—including GIC and Peak XV Partners—are exploring partial stake sales with a financial adviser, according to sources. Talks are early and may not result in a deal or defined stake size. A transaction could value the grab-and-go coffee chain at US$1.2–1.4B (subject to change). Founded in 2017, the company operates 800+ outlets across 45 Indonesian cities, with offices in Jakarta, Singapore, and Malaysia. [Read more]

-

Awanio partnered with Techna-X Berhad and PMBI Technology Sdn. Bhd. (Malaysia) to advance Indonesia’s digital sovereignty through technology transfer, talent development, and a regional innovation hub spanning cloud, virtualization, and AI. The collaboration covers training curricula, Indonesia–Malaysia talent exchanges, and capacity-building for faster, safer cloud adoption in public and private sectors. CEO Irfan Yuta Pratama aims to boost local competencies and regional go-to-market, nurturing competitive “local hyperscaler” capabilities. [Read more]

👏 What’s Exciting

Carro lines up dual-listing options and Australia expansion

Carro (Temasek/SoftBank-backed) is evaluating a potential dual listing while preparing an Australia launch and 2–3 acquisitions as early as next quarter, said CEO Aaron Tan. The firm is in talks with banks including HSBC and UBS (no advisers appointed yet); possible venues include the U.S., Hong Kong, and Singapore. Tan highlighted a path to US$120–150m EBITDA next year, aided by 20–30% tech-cost reductions from AI adoption. The push follows last year’s Hong Kong entry via the Beyond Cars acquisition and would bring Carro’s full service suite to Australia.

Accion closes US$61.6m early-stage fintech fund

Accion closed Accion Venture Lab Fund II (rebranded to Accion Ventures) at US$61.6m to back ~30 inclusive-fintech startups serving MSMEs and low-income customers across Africa, South & Southeast Asia, Latin America, and the U.S. LPs include FMO, Proparco, ImpactAssets, Ford Foundation, MetLife, and Mastercard. In Indonesia, Accion has previously supported Finfra, Amartha, Semaai, MyRobin, Fairbanc, and Bababos—signaling continued interest in embedded finance and alternative-data solutions, alongside hands-on operational support and networks.

Indonesia’s podcast audience shifts to video

Populix research presented at Radiodays Asia (3 Sept 2025) shows a decisive shift toward video podcasts in Indonesia<…

Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

📌 MAROKO133 Eksklusif startup: 💸 Honest lands funding.⚖️ TikTok, Netflix face scru

Dear Subscriber,

This week brings a mix of momentum and growing scrutiny in Indonesia’s digital economy. Fintech player Honest secured a major funding boost to strengthen its lending and product expansion, while Sriwijaya Capital launched a new private equity fund. TikTok continues to face mounting regulatory challenges. Even Netflix has entered the spotlight as officials revisit the taxation framework. At the same time, the expansion of players like Tyme and Indies Capital Partners signals continued investor appetite for Southeast Asia’s tech ecosystem. Southeast Asia’s tech funding cools sharply, with digital finance emerging as the region’s key growth engine.

This week’s newsletter is sponsored by Biznet Gio CloudBiznet Gio Cloud: Reliable Cloud Designed for Optimal Performance

Bring your preferred web apps online with virtual machines or ready-to-use platforms. Start with cost-effective web hosting, VPS, or elastic cloud servers.

Learn MoreBest regards,

The DailySocial Team

🆕 What’s New

-

💸 Honest Secures Major Funding Boost – Honest, a fast-growing Indonesian fintech platform, has secured an impressive $100 million in equity funding alongside an additional $40 million in debt facilities. The new capital will fuel the company’s efforts to enhance its lending capabilities and expand its product suite, focusing on empowering small businesses and consumers with better financial access. With this funding milestone, Honest continues to strengthen its position in Indonesia’s competitive fintech landscape and signals investor confidence in the country’s digital finance potential. Read more

-

🤝 Sriwijaya Capital Makes PE Fund Debut – Sriwijaya Capital has made its debut in the private equity space with a $200 million growth fund, officially licensed by Singapore’s Monetary Authority (MAS). The fund is backed by anchor limited partners from Indonesia’s leading conglomerates — Barito Pacific, Indika Energy, and Sinar Mas — underscoring strong institutional confidence in the firm’s long-term strategy. With this launch, Sriwijaya Capital aims to invest across strategic sectors and scale high-potential Indonesian and regional companies, positioning itself as a key emerging player in Southeast Asia’s investment landscape. See the post

-

🛍️ E-Commerce Tax Rule Postponed – The Indonesian government has announced a delay in implementing the new income tax regulation (PPh 22) for e-commerce sellers, citing concerns over maintaining consumer purchasing power. The policy, originally aimed at strengthening tax compliance among online traders, will now undergo further review. This move reflects the government’s balancing act between fiscal objectives and supporting digital economy growth amid current market challenges. Full story here

-

⚖️ TikTok Faces Regulatory Heat – TikTok is under mounting regulatory pressure in Indonesia as authorities tighten oversight of major tech firms. The platform was fined IDR 15 billion by the Business Competition Supervisory Commission (KPPU) for late reporting of its Tokopedia acquisition, setting a key precedent for merger transparency. Adding to its challenges, the Ministry of Communication and Informatics has temporarily suspended TikTok’s license after it failed to provide requested data on live demos and gaming content, reflecting rising tensions over compliance and data-sharing standards. Read the coverage

-

🎬 Netflix Under Tax Spotlight – Indonesia’s Ministry of Finance has spotlighted Netflix’s substantial revenue growth in the local market, raising questions about its tax contributions. Officials noted that despite significant earnings from Indonesian subscribers, the streaming giant has yet to fully comply with domestic tax obligations. The statement hints at potential policy shifts aimed at ensuring equitable taxation across foreign digital service providers operating in Indonesia. Details here

✨ What’s Exciting

-

💡 Garuda Spark Hubs Drive Indonesia’s Digital Readiness – Komdigi has inaugurated the Garuda Spark Innovation Hub in Jakarta and Bandung, with plans to expand further into Medan, as part of its effort to create collaborative spaces for startups and digital talent—reinforcing Indonesia’s vision to become a leading digital nation. The initiative aligns with the country’s improving Indonesia Digital Society Index (IMDI), which reached 44.53 in 2025, signaling strong progress in digital readiness across four pillars: infrastructure, digital skills, industry, and literacy. These efforts aim to accelerate innovation, nurture millions of digital talents, and strengthen Indonesia’s digital sovereignty by fostering local startup ecosystems and empowering regional digital talent across diverse sectors. Read more

-

💡 Indonesia Launches Innovation Hub with Microsoft – Indonesia is set to launch an Innovation Hub in collaboration with Microsoft and support from the United Arab Emirates, aiming to strengthen digital transformation and startup growth. The initiative will focus on fostering AI research, cybersecurity development, and public-private partnerships to accelerate Indonesia’s tech-driven economy. This strategic move highlights the nation’s ambition to become a regional leader in digital innovation. Read more

-

…

Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!