📌 MAROKO133 Update startup: PasarPolis funding 💸, Amazon fuels Astro 🚀, SEA’s cons

Dear subscribers,

We’re back with a fresh look at Indonesia and Southeast Asia’s tech and digital ecosystem. From funding moves in insurtech and quick commerce, to bold plays in mobility and infrastructure, the region continues to show resilience and ambition. We also spotlight Indonesia’s push in digital manufacturing and the evolving dynamics of consumer behavior, where opportunities are shifting toward the two ends of the market. As always, our aim is to bring you the signals that matter most for founders, investors, and policymakers navigating this fast-changing landscape.

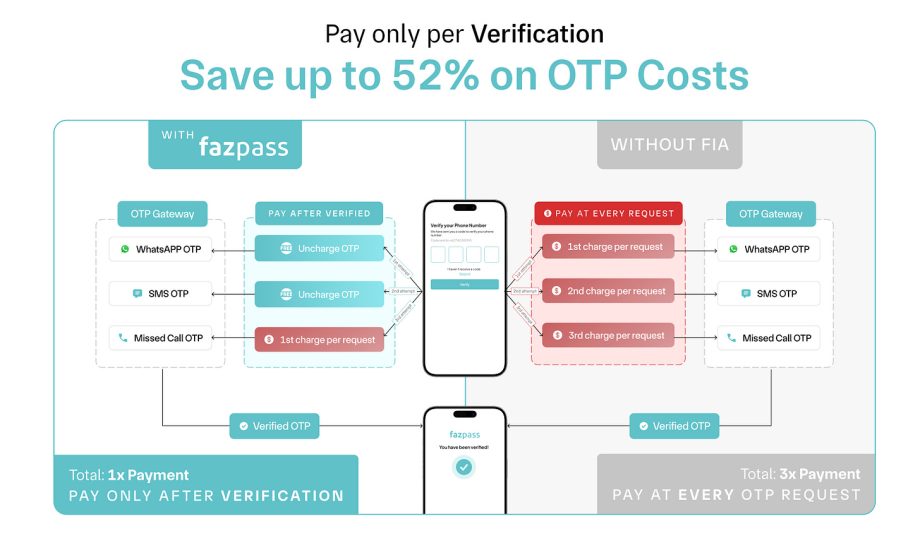

This week’s newsletter is sponsored by Fazpass. Most OTP providers charge per request, making resends and failures costly. Fazpass Intelligence Authentication lets you pay only after a successful verification—cutting costs by up to 52% while ensuring reliable verification through auto-switching across WhatsApp, SMS, or missed calls. [Try Now!]Best regards,

The DailySocial Team

🚨 What’s New

-

PasarPolis secures fresh funding 💸

PasarPolis, Indonesia’s leading insurtech, has raised new funding in an extension round led by Japanese insurance giant Tokio Marine. While the exact figure was not disclosed, sources close to the deal said it was around USD 5 million. The fresh capital will help PasarPolis deepen its presence in Southeast Asia and expand its digital insurance products. -

Amazon backs Astro’s quick commerce push 🚀

U.S. tech giant Amazon has reportedly invested USD 51.9 million in Indonesian quick commerce startup Astro. The move comes just as Amazon officially launched its own 10-minute delivery service in India, signaling stronger ambitions in the region. For Astro, the investment strengthens its financial position in an increasingly competitive market where consolidation is expected.

-

GoTo secures $286M loan facility 💰

GoTo Group has obtained a Rp4.65 trillion (USD 286 million) syndicated loan from DBS Indonesia and UOB. The facility, with a four-year tenor, will be used to refinance existing debt and support general corporate needs, including investment and working capital. As of June 2025, GoTo still had Rp467 billion outstanding from its 2022 loan, which this new funding helps cover. The company emphasized that the loan poses no adverse impact on its operations or financial health, but instead strengthens its liquidity. -

Green SM scales EV taxi service nationwide ⚡🚖

Green SM, the Indonesian EV taxi operator, is accelerating its expansion with three new launches in a single week. The company debuted its service at Soekarno-Hatta International Airport, marking a major step in electrifying airport transport. Soon after, it entered Jakarta’s eastern suburb, Bekasi, broadening coverage in Greater Jakarta’s commuter belt. It also made a strategic move into Makassar, opening access to eastern Indonesia’s economic hub. This rapid rollout reflects Green SM’s ambition to dominate the EV mobility market across the archipelago.

✨ What’s Exciting

-

INA bets big on AI, health, and renewables 🌱🤖

Indonesia’s sovereign wealth fund Indonesia Investment Authority (INA) is sharpening its focus on strategic sectors: digital infrastructure, AI in healthcare, and renewable energy. The fund, now managing USD 10 billion, aims to attract foreign partners and technical expertise to strengthen these industries. INA is diversifying beyond equity into hybrid capital and private credit to support Indonesian companies’ global expansion. This direction aligns with the government’s priorities on data independence, energy transition, and healthcare modernization—areas seen as critical for long-term economic resilience.

-

Indonesia showcases digital manufacturing at Hannover Messe ⚙️🇮🇩

Indonesia showcased its advancements in digital manufacturing at the Hannover Messe 4.0 Expo, highlighting the country’s push toward Industry 4.0 transformation. The showcase highlighted Indonesian smart factory, automation, and digital solutions aimed at boosting productivity and competitiveness. Officials stressed that manufacturing innovation is key to economic growth and positioning Indonesia in the global supply chain, while reaffirming the nation’s commitment to international collaboration in industrial digitalization.

🔮 What’s Next

Latest report by Lightspeed Venture Partners stated that Southeast Asia’s consumer landscape is increasingly shaped by a barbell economy, where the most attractive opportunities lie at the two ends of the spectrum: affluent consumers with spending power…

Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

📌 MAROKO133 Breaking startup: Xendit acquires Payex 🇲🇾, Danantara targets $10B dep

Dear subscribers,

We’re back in your inbox with a fast, zero-fluff briefing for founders, investors, VCs, and regulators across Indonesia, Southeast Asia, and beyond. This week: Xendit’s Malaysia push, Dunkin’s new operator, Danantara’s $10B deployment plan, TikTok’s license reinstatement, HSBC’s tokenised deposits rollout, and a governance watch on P2P lending—distilled into what matters and why.

Best regards,

The DailySocial Team

What’s New

-

Xendit expands into Malaysia 🇲🇾. Indonesia’s leading payment gateway has completed the full acquisition of Payex, a Bank Negara–licensed payment gateway provider, and will rebrand it as Xendit Malaysia. Announced at the Selangor Smart City & Digital Economy Convention 2025, this move follows Xendit’s initial investment in Payex in early 2023. Since entering Malaysia, Xendit has onboarded 4,500+ businesses, processed over MYR 5 billion (~US$1.1 billion) in transactions, and plans to expand its local team, partnerships, and education initiatives. The new entity will be led by Jayson Poon, former central bank official. [Read More]

-

Dunkin’ Donuts Indonesia enters new era 🍩. F&B local startup, DailyCo, through its subsidiary PT Diamonds Donuts Internasional (DDI), has officially taken over the master franchise license of Dunkin’ Donuts Indonesia from PT Dunkindo Lestari, effective October 7, 2025. The first new outlet is planned for Jakarta in Q4 2025, followed by gradual expansion through both flagship and neighborhood cafés. The move marks Dunkin’s major comeback in Indonesia’s growing bakery (US$50B+, 9.4% CAGR 2025–2029) and coffee (7% annual growth through 2031) markets. [Read More]

-

Danantara to deploy $10B investments in 3 months 💰. Indonesia’s sovereign investment body, Danantara, aims to channel US$10 billion by January 2026, with 80% focused domestically. Current investments include projects in Saudi Arabia, renewable energy, and waste-to-power. CIO Pandu Sjahrir highlighted Indonesia’s mix of high yield and stability supported by low inflation and a young population. Danantara also aims to boost local capital market liquidity—currently around US$1B in daily turnover—far below India’s US$10–11B. [Read More]

-

TikTok back in business 🎥. Indonesia has lifted TikTok’s license suspension after the company provided aggregated operational data requested by the government, including livestream, monetization, and web traffic activity. The suspension, imposed on October 3, followed incomplete compliance during unrest linked to a delivery driver’s death. With over 100 million users, TikTok’s return underscores its reliance on Indonesia as its largest Southeast Asian market, amid ongoing debates over data transparency and user trust. [Read More]

What’s Exciting

1️⃣ HSBC tokenizes deposits in Singapore 🪙. HSBC has expanded its Tokenised Deposit Service (TDS) to Singapore after launching in Hong Kong. The service allows instant 24/7 settlement using DLT-based digital tokens representing fiat deposits. Ant International became the first client to complete SGD and USD transactions across HSBC Singapore and Hong Kong, highlighting TDS’s potential in liquidity and FX management. The bank plans further rollouts in the UK and Luxembourg, positioning Singapore as a global treasury hub.

2️⃣ SBI Holdings joins Amar Bank 🇯🇵🇮🇩. Japan’s SBI Holdings has acquired over 5% stake in Amar Bank, becoming its third-largest institutional investor after Tolaram and Jagat Raya Imajinasi. Amar Bank CEO Vishal Tulsian said the partnership will enable synergy with SBI’s vast ecosystem, furthering Amar’s mission to transform retail and MSME banking in Indonesia.

What’s Next: Strengthening Fintech Governance Before the Snowball Effect Hits ⚖️

Indonesia’s fintech lending industry continues its rapid climb — outstanding loans reached Rp 87.61 trillion as of August 2025, up 21.6% YoY, according to the Financial Services Authority (OJK). Despite a relatively low 2.6% delinquency rate, the surge signals growing systemic risk if governance gaps persist.

Several players still fall short of the minimum capital requirements (Rp 12.5B for P2P platforms; Rp 100B for multifinance firms). OJK is urging recapitalization or new investor entry to prevent potential liquidity shocks. The Dana Syariah case — where lenders faced withdrawal delays despite a 99.82% repayment rate — underscores how weak governance can erode investor trust.

OJK has intensified enforcement, issuing hundreds of administrative sanctions in August 2025 and coordinating with law enforcement to uphold compliance and solvency standards.

With fintech lending expanding fast, stronger governance and risk management are urgently needed. If capital adequacy, transparency, and compliance issues are left unchecked, isolated incidents could escalate into a systemic crisis. As Dana Syariah’s case shows, trust is fragile and rebuilding it starts with firm, proactive regulation.

🔗 Sumber: dailysocial.id

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!