📌 MAROKO133 Breaking crypto: DASH Takes the Lead as Market Recovers, But Traders E

After last weekend’s brutal market bloodbath, during which several altcoins lost over 90% of their value within minutes, the crypto market is showing early signs of recovery.

Among the biggest movers today is DASH, a privacy-focused digital asset, which has surged 35% in the past 24 hours to reach a 10-month high, making it today’s top gainer. However, beneath the surface, market data paints a more cautious picture.

DASH’s Rally Faces a Reality Check

The recent uptick in demand for privacy coins has led to a sustained rally in DASH’s price since last week. Currently exchanging hands at $57.87, the altcoin’s value has rocketed nearly 70% in the past seven days.

However, this price rise may be nearing its end. On-chain and technical indicators point to a gradual buildup in buyers’ exhaustion, which may trigger a reversal in the near term.

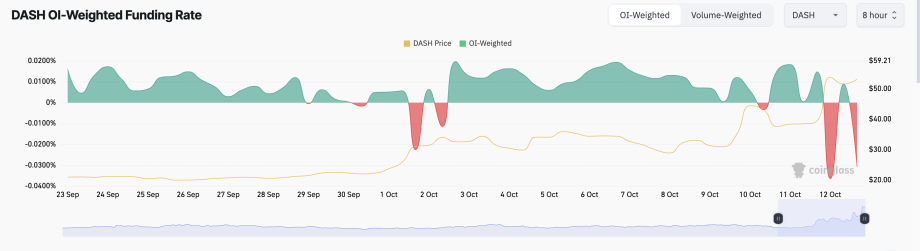

According to Coinglass data, futures traders have increasingly opened short positions against DASH over the past two trading sessions. Its negative funding rate of -0.037% at press time reflects this.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The funding rate is a periodic fee exchanged between traders in perpetual futures markets to keep contract prices aligned with the spot price.

When positive, it implies that long positions are dominant and that long sellers are willing to pay short sellers to keep their positions open, a strong indicator of bullish sentiment.

Conversely, when an asset’s funding rate is negative, as with DASH, a growing number of traders are betting on its reversal. This means that the price surge could be losing steam and due for a correction.

DASH Bulls Begin to Lose Grip

Moreover, spot market data shows that DASH is overbought, indicating that the current buying momentum is nearing exhaustion. At press time, its Relative Strength Index (RSI) is at 84.45 and trending upward, signaling an overextended market.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

DASH’s RSI readings confirm that the asset is deep in overbought territory, supporting the view that its recent surge may not be sustainable. This signals that buying momentum is likely peaking, and a cooling-off phase could follow as traders begin to lock in profits.

Will $52 Support Hold or Break Below $50?

At its current price, DASH trades above the support floor formed at $52.05. Once buying activity reaches exhaustion, the token could attempt to test this support level. If it fails to hold, DASH’s price could plummet under $50 to trade at $44.64.

On the other hand, if demand for the altcoin persists, its price could rally past $61.48.

The post DASH Takes the Lead as Market Recovers, But Traders Expect the Party to End Soon appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Hot crypto: Why Is Crypto Up Today? – October 13, 2025 Terbaru 2025

The crypto market is up today following the weekend’s correction, with the cryptocurrency market capitalization rising by 4.4%, going back to $4 trillion. 97 of the top 100 coins have appreciated over the past 24 hours. At the same time, the total crypto trading volume is at $270 billion.

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have seen their prices increase over the past 24 hours.

Bitcoin (BTC) appreciated 2.9%, currently trading at $115,097. It’s the second-lowest rise of the category.

Ethereum (ETH) is up by 8.7%, now changing hands at $4,152. This is the third-highest increase in the category.

The highest one is Binance Coin (BNB)’s 14.9% to $1,318. It’s followed by 10% by Dogecoin (DOGE), now trading at $0.2087.

The lowest increase is Tron (TRX)’s 2.2% to $0.3227.

When it comes to the top 100 coins, 97 have seen an increase, the highest of which is 51.1% by ChainOpera AI (COAI), followed by Bittensor (TAO)’s 32.1% to $402. A dozen more coins have recorded price increases.

On the other hand, MemeCore (M) fell the most: 7.7% to $2.05.

‘Now That the Dust Has Settled, Many Blue-Chip Tokens Have Seen a Strong Rebound’

Nick Forster, Founder at onchain options platform Derive.xyz, commented that we saw “an unprecedented market meltdown” on Friday, as well as $19 billion in liquidations across the industry.

“The crash was triggered by renewed fears of a U.S.-China trade war, after Donald Trump threatened an additional 100% tariff on Chinese imports,” Forster says. “This came on the heels of China announcing new restrictions on rare earth element exports, escalating tensions between the two economies.”

Moreover, “with order books thinned out, forced liquidations and panic selling had an outsized impact on price, fueling a self-reinforcing cascade of liquidations and accelerating the flash crash.”

Nic Puckrin, crypto analyst and co-founder of The Coin Bureau, said that “the bloodbath we saw in markets over the weekend is a brutal reminder that, as the crypto market grows and matures, the risks are amplified.”

“The arrival of spot crypto ETFs and institutional interest has lulled investors into a false sense of security, but it remains the only market that trades after hours. In this environment, thin liquidity, overleverage, and the involvement of big players make for a toxic cocktail.”

Ironically, Puckrin says, “now that the dust has settled, many blue-chip tokens have seen a strong rebound – including Ethereum, which is looking particularly strong back above $4,000. As such, many spot investors find themselves in a similar position to where they were before the flash crash. This is certainly an argument against excessive leverage in a market with fluctuating liquidity in such an uncertain geopolitical climate.”

“The good news is that this has cleaned out the excessive leverage and reset the risk in the market, for now. However, Bitcoin now faces another uphill battle to break past key resistance levels that will allow it to reach a meaningful new all-time high this year,” he concluded.

Levels & Events to Watch Next

At the time of writing on Monday morning, BTC trades at $115,097. On 10 October, the coin dropped from $121,561 to $109,883 on 12 October. Since then, it has recovered to the current price.

Over the past 24 hours, the coin moved between the low of $111,247 and the high of $115,792. Over the past week, its intraday low was $109,883, and the intraday high was $126,080.

If BTC moves above $117,000, a short-term rally toward $124,000 could follow, and then toward $126,000 to retest previous highs. However, a drop below $108,000 may lead to $103,000 and below $100,000 towards $98,200.

Ethereum is currently trading at $4,152. The price fell from $4,350 on Friday to $3,683 the following day.

In the past day, ETH moved between $3,802 and $4,196, as well as between $3,686 and $4,747 in a week.

A breakout above $4,055 could open doors for a move toward $4,200 and $4,330. However, a drop below $3,720 may lead to the $3,512 zone.

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!