📌 MAROKO133 Update crypto: G20 Watchdog Sounds Alarm: Privacy Rules Are Handcuffin

The G20’s top financial watchdog has warned that strict privacy and data protection laws are hindering global regulators from effectively overseeing the fast-growing cryptocurrency sector.

In a detailed peer review report released on Thursday, the Financial Stability Board (FSB), a global authority funded by the Bank for International Settlements (BIS), said inconsistencies in national crypto frameworks are creating major barriers to cross-border supervision and systemic risk monitoring.

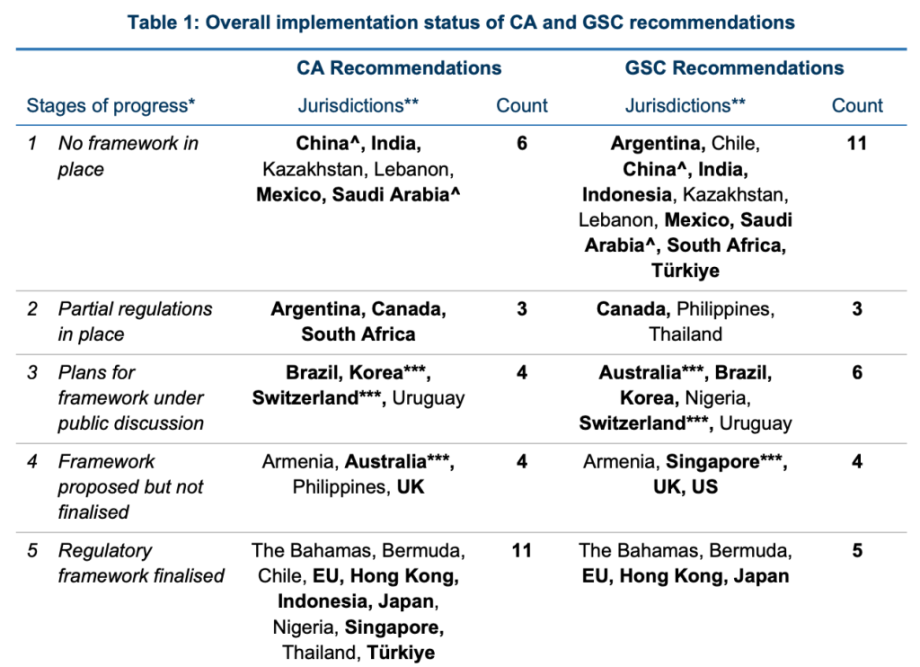

The FSB’s 107-page review outlined persistent gaps in how countries regulate digital assets such as Bitcoin and stablecoins.

It noted that divided supervisory responsibilities, fragmented approaches, and especially data privacy laws are complicating information-sharing among regulators worldwide.

“Secrecy or data privacy laws may pose significant barriers to cooperation,” the FSB wrote, adding that in many jurisdictions, confidentiality rules prevent companies from sharing transaction or risk-related data with foreign regulators.

Lack of Data Access Leaves Regulators “Blind” to Crypto Risks, FSB Finds

This, the report said, “leads to delays in addressing cooperation requests” and in some cases “discourages participation in cooperation arrangements altogether.”

The board said privacy protections, while essential for personal and corporate rights, have become a double-edged sword for global oversight. Without consistent and reliable data access, regulators are unable to identify potential systemic risks in the crypto sector.

The report also said that “regulatory data sources remain limited,” forcing authorities to rely on incomplete information from commercial providers and surveys that often lack accuracy and consistency.

According to the FSB, the uneven regulatory environment across major economies has led to regulatory arbitrage, allowing crypto companies to shift operations across borders to exploit weaker oversight regimes.

The board urged governments to close data gaps and strengthen cooperation mechanisms to avoid further fragmentation of the global crypto market.

The FSB’s warning comes as privacy debates intensify within the crypto industry.

Advocates argue that privacy is essential for protecting users from surveillance and financial exploitation, while regulators view the lack of transparency as a major obstacle to combating money laundering and illicit finance.

The tension reflects a deeper divide between two financial philosophies. For governments, data access is a cornerstone of financial stability and compliance enforcement.

For the crypto community, privacy represents a fundamental right and a necessary layer of security in digital finance.

Privacy advocates note that transparency on public blockchains can expose people and businesses to competitive and security risks.

Public wallet data can reveal salaries, trade volumes, and strategic holdings, information that, in traditional finance, remains strictly confidential.

Experts say that without privacy, enterprises and institutions remain hesitant to adopt blockchain for mainstream financial operations.

Experts, Especially Ethereum, Say Lack of Privacy is Crypto’s Biggest Weakness

Recent initiatives within the Ethereum ecosystem show the industry’s efforts to address these privacy concerns.

The Ethereum Foundation recently launched a 47-member Privacy Cluster coordinated by Blockscout founder Igor Barinov. The group seeks to develop privacy-preserving technologies such as private reads and writes, selective disclosure for digital identities, and a new privacy-focused wallet called Kohaku.

The foundation warned earlier this year that without robust privacy safeguards, Ethereum could risk becoming “the backbone of global surveillance rather than global freedom.”

…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Update crypto: The World’s Most Popular YouTuber Just Filed for a Cryp

Jimmy Donaldson, the 27-year-old creator behind MrBeast —the YouTube channel with more than 446 million subscribers— has filed a trademark application to create a banking platform. The project would also include crypto payments.

The move marks MrBeast’s shift from entertainment to blockchain-driven financial services. If successful, it could establish him as the first influencer to launch a mainstream banking brand in the United States.

MrBeast Eyes Crypto Banking

MrBeast has officially entered the crypto market after filing a trademark to open his own investment services platform.

According to a filing from the United States Patent and Trademark Office (USPTO), the creator applied to trademark “MrBeast Financial” on October 13.

The new venture would offer various online banking services. The filing unveiled offerings such as issuing credit and debit cards, processing cryptocurrency payments, facilitating crypto exchanges through decentralized platforms, and offering other investment services.

If given the green light, MrBeast Financial would mark the first large-scale banking venture spearheaded by a social media influencer in the United States.

According to the USPTO’s standard review process, the trademark will undergo its initial examination around mid-2026. A final decision will likely arrive before the end of next year.

This move isn’t the first time MrBeast, for better or for worse, has ventured into cryptocurrencies.

The Shadow of a $10 Million Crypto Controversy

Last October, MrBeast became embroiled in a scandal after crypto sleuth SomaXBT revealed that the content creator had allegedly made over $10 million by backing low-cap tokens.

The investigation found that MrBeast participated in several Initial DEX Offerings (IDOs), earning substantial profits as token prices surged. However, after his exit, most of these projects lost over 90% of their value. These projects were swiftly identified as pump-and-dump schemes.

One of the most notable examples involves the SuperFarm ($SUPER) token. Dating back to March 2021, this project was supported by influencer Elliot Trades. According to SomaXBT, MrBeast invested $100,000 in the venture and was granted 1 million $SUPER tokens. Shortly after his involvement, the token’s value spiked.

In a separate investigation, Loock Advising alleged that the YouTuber had profited at least $23 million from insider trading incidents linked to rug pulls.

MrBeast’s latest filing suggests he’s ready to formalize his role in finance after years of experimentation with crypto.

Whether MrBeast Financial becomes a legitimate banking platform or another influencer-led experiment, its success will test how far digital creators can extend their influence beyond entertainment and into finance.

The post The World’s Most Popular YouTuber Just Filed for a Crypto Banking App — What Could Go Wrong? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!