📌 MAROKO133 Eksklusif crypto: Confusion as Polymarket Announces Zohran Mamdani’s “

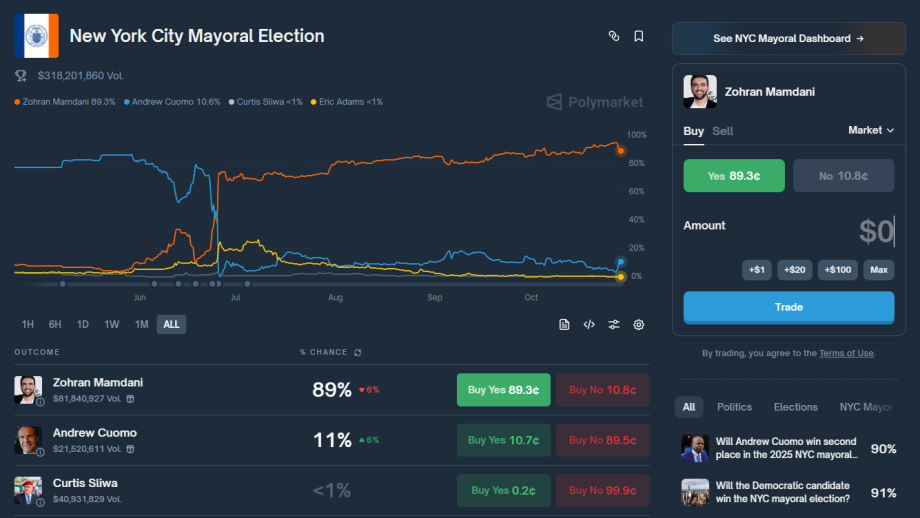

As the New York mayoral race nears its conclusion, Polymarket made a strange announcement about Zohran Mamdani. It claimed that his odds of success were collapsing, giving Andrew Cuomo a shot at victory.

Zohran’s chances remain overwhelmingly likely, leaving the community confused about the statement. Either Polymarket is trying to juice fresh bets on the mayoral race, or it aims to influence the underlying election directly.

Polymarket Derides Zohran

Polymarket, the largest prediction market, has been offering bets on elections of all shapes and sizes. This hasn’t been its most lucrative category, but these bets have occasionally offered valuable data about world events.

However, Polymarket made a bizarre statement about the New York mayoral race today, straining its credibility:

Specifically, Polymarket predicted that Zohran Mamdani’s odds of victory were collapsing, giving Andrew Cuomo a shot at victory.

The platform’s community and outside observers were both bewildered; Zohran’s odds remain above 90% on the platform. Even if today’s single-digit dip continued, he’d still be in a position to win comfortably.

Two Possible Scenarios

Still, this post went viral, so the community has wondered why Polymarket made it. In essence, there are two competing theories.

On one hand, Polymarket bets on the mayoral race have increased by over $4 million in the last few hours. In this way, the platform could’ve spread these rumors to juice its own profits and trading volumes.

However, there is an alternate possibility. Since the DOJ ended its probe into Polymarket, the Trump family has invested heavily in it, and the firm has enjoyed more regulatory breakthroughs since.

Trump has repeatedly commented on his strong dislike for Zohran, so Polymarket may be trying to influence the election’s result.

Of course, the company has its own reasons to dislike Mamdani. He might be somewhat hostile to the crypto industry, especially to its political connections, whereas other candidates have taken a pro-Web3 stance.

Polymarket may envision trouble for itself if Zohran wins, and is hoping to avoid such an outcome.

Either way, neither scenario is particularly flattering. Although some analysts treat Polymarket odds as a barometer for market sentiment, it’s important to remember that the platform isn’t a neutral actor.

The firm already stands accused of enabling Trump-linked insider trading, and it may be trying to directly interfere in politics itself.

The post Confusion as Polymarket Announces Zohran Mamdani’s “Collapse” appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Update crypto: Stablecoin Fear Spreads: South Korea’s Central Bank War

South Korea’s central bank has issued a stark warning over the growing risks of won-pegged stablecoins, cautioning that private issuers could threaten monetary stability if safeguards are not established.

The Bank of Korea (BOK) said in a new report titled “Currency in the Digital Age: Harmony of Innovation and Trust” that the rapid expansion of stablecoin activity poses systemic vulnerabilities, including potential depegging events and illicit capital flows.

The central bank’s concerns come at a time when South Korea is actively debating how to regulate stablecoins.

Can South Korea Balance Stablecoin Innovation With Monetary Stability?

The BOK, led by Governor Rhee Chang-yong, reiterated its position that only regulated financial institutions, preferably banks, should issue such assets, arguing that “non-bank issuers could undermine monetary control and capital management.”

The central bank’s latest analysis emphasized that the severity of reserve asset volatility could directly affect the domestic financial market, warning that improper collateral management may lead to depegging risks similar to those seen with foreign dollar-backed stablecoins.

The report highlighted risks to monetary stability from privately issued stablecoins, particularly those that might fail to maintain a one-to-one reserve ratio with the Korean won.

The BOK cautioned that improper reserve management, foreign capital outflows, and speculative trading could trigger a loss of peg confidence, echoing the failures seen in algorithmic stablecoins such as TerraUSD in 2022.

The report shows that stablecoins, while potentially improving payment efficiency and supporting financial innovation, could also undermine the effectiveness of monetary policy and disrupt foreign exchange management.

It called for robust reserve audits, issuance caps, and central oversight to prevent liquidity shocks.

The statement follows months of mounting tension between the BOK and the government.

In June, South Korea’s ruling Democratic Party proposed the Digital Asset Basic Act, which would allow local firms to issue stablecoins with a minimum capital requirement of 500 million won ($367,000) while ensuring full redemption guarantees.

The bill, backed by President Lee Jae-myung’s pro-crypto administration, seeks to increase transparency and competition in the local digital asset market.

However, the Bank of Korea has consistently opposed letting non-bank entities issue won-pegged stablecoins.

At the time, Governor Rhee insisted that any digital currency backed by the won should remain under the central bank’s purview.

“Allowing private companies to issue won-denominated stablecoins without adequate supervision could weaken monetary control,” Rhee said earlier this month.

The Stablecoin Race Is On — and Korea’s Banks Aren’t Waiting.

Despite central bank opposition, commercial banks have been preparing for a gradual rollout.

In June, eight major banks, including KB Kookmin, Shinhan, Woori, and Nonghyup, formed a consortium to develop a joint won-linked stablecoin.

The consortium plans to pilot two issuance models: a trust-based system, where customer deposits are held separately as reserves, and a deposit-linked system, where stablecoins mirror customer deposits on a one-to-one basis.

The banks say the initiative aims to “secure independence and competitiveness” amid fears that foreign dollar-backed stablecoins could dominate the domestic market.

The consortium’s creation marks a shift in South Korea’s financial sector, which has historically maintained distance from digital assets.

Bank executives privately acknowledge a “shared sense of crisis” that foreign dollar-pegged stablecoins could dominate the domestic market if local issuance lags behind.

Meanwhile, the Financial Intelligence Unit (FIU) is restructuring its anti-money laundering (AML) protocols to address the upcoming “institutionalization” of stablecoins.

The agency has commissioned research on risk mitigation and is drafting new AML guidelines for stablecoin issuers to be completed by December.

Officials said the findings will form the foundation for updated oversight rules under the amended Specific Financial Information Act next year.

South Korea’s Stablecoin Bills Stall in Parliament as Agencies Vie for Control

Notably, the government is also tightening coordination across agencies.

While President Lee previously proposed dismantling the Financial Services Commission (FSC), it remains active in crypto oversight and is expected to serve as the main licensing authority for KRW-pegged stablecoins.

Pending bills from both ruling and opposition lawmakers would give the FSC power to approve issuers, enforce redemption standards, and impose emergency orders in case of market disruption.

Political debate has slowed progress, however. Four separate draft bills are stalled in the National Assembly as lawmakers and regulators clash over whether fintech and IT firms should be allowed t…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!