📌 MAROKO133 Hot crypto: Korea Dumps Crypto for Stocks? KOSPI Hits Record as Crypto

South Korea’s KOSPI index soared to record peaks in early November, while crypto trading volume dropped over 80%.

This sharp divergence has disappointed crypto investors as capital flows decisively toward traditional equities.

Record Equity Rally and Unprecedented Crypto Decline

The Korean Composite Stock Price Index (KOSPI), South Korea’s primary stock market index, reached its all-time high as crypto exchange volumes fell to their lowest since late 2023. KOSPI represents the performance of all common stocks traded on the Korea Exchange (KRX).

According to a local media report on November 4, KOSPI’s daily trading volume surged to KRW 34.04 trillion, marking a 208% increase from KRW 11.05 trillion on January 2, 2025, the first trading day of the year.

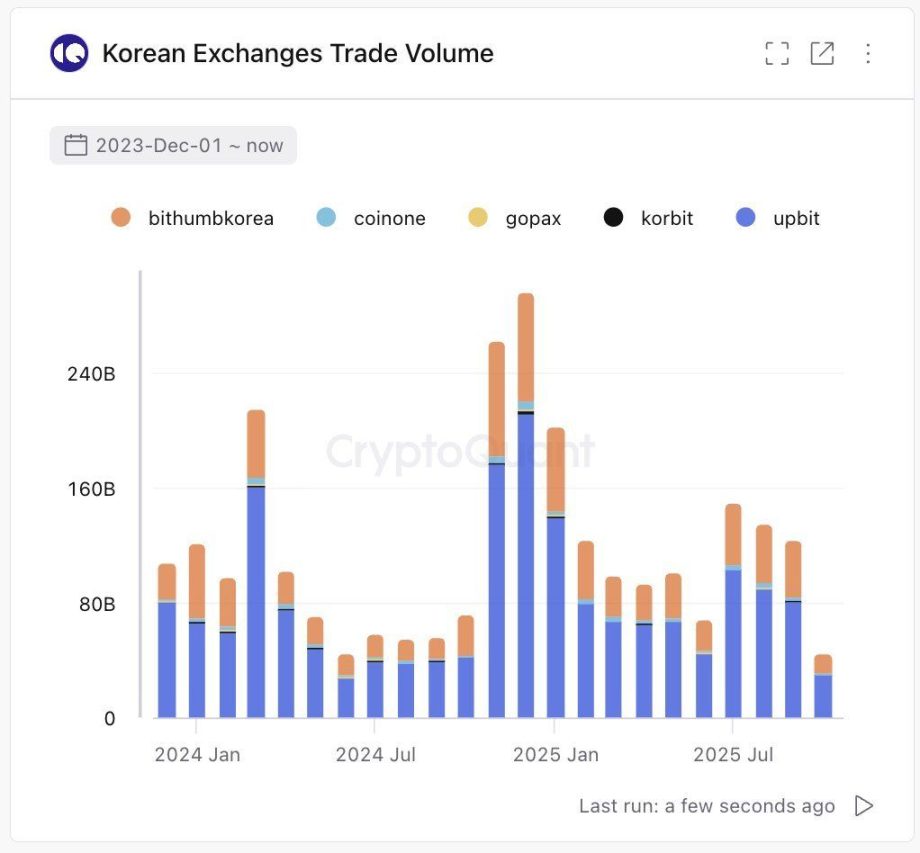

During the same period, Korea’s five major crypto exchanges saw their daily trading volume decrease to KRW 5.57 trillion. These five are KRW-based exchanges, such as Upbit, Bithumb, Coinone, Korbit, and Gopax. This represents a 45% plunge from January, when trading volumes comfortably exceeded KRW 10 trillion.

CryptoQuant’s data shows that trading on the five exchanges collapsed to near-zero levels. This compares to early-2025 highs above 240 billion units.

The KOSPI jumped 71.8% year-to-date, making it the world’s top-performing major stock index. This surge has been driven by continued momentum in domestic stocks, particularly Samsung Electronics and SK Hynix, powered by the new administration and investor enthusiasm for artificial intelligence.

Upbit, South Korea’s biggest crypto exchange, saw its 24-hour trading volume drop 12.8% to $2.02 billion as of October 31, 2025. The sharp decline signals a waning appetite among investors for digital asset speculation.

“Where did all the Korean retail investors in the crypto circle go? Answer: To the stock market next door,” analyst AB Kuai Dong observed.

President Lee Jae-myung’s Market-Friendly Policies Drive Rally

South Korea’s stock market began its ascent in May this year during the Presidential election campaign. The election was held after the lifting of martial law, so the opposition leader Lee Jae-Myung’s victory was widely anticipated.

Lee is a lawyer but used to invest in the stock market. He has long shown interest in stock market stimulus. His market-friendly rhetoric during the campaign helped fuel investor optimism, which has now translated into the KOSPI’s record-breaking performance.

AI semiconductor suppliers Samsung Electronics and SK Hynix have led the surge. Samsung shares rose approximately 95% year-to-date, while SK Hynix gained an impressive 242%, both significantly outperforming the broader market.

Last week, the APEC summit was held in Gyeongju, Korea, and world leaders, including Donald Trump and Xi Jinping, attended it. NVIDIA CEO Jensen Huang also visited Korea for the CEO Summit. He made headlines by enjoying beer and chicken with the Samsung and Hyundai chairpersons.

Huang also met with President Lee and announced plans to prioritize supplying more than 260,000 AI Chips to Korea’s government and some of the country’s biggest businesses, including Samsung, SK Hynix, and Hyundai. Following these “Jensen Moments”, the Korean stock market hit record highs for two consecutive days.

Crypto Market Feels Sidelined Amid Stock Boom

Korea is famous for its high crypto trading volumes, and listings on Upbit and Bithumb are still considered major catalysts for price increases in the global crypto market. However, as funds rush into the surging stock market, Korea’s domestic crypto market feels somewhat marginalized.

The recent weakness in crypto markets is not unrelated to this trend. In terms of returns, the reality is that the stock market is far outpacing Bitcoin, which rose 11% YTD.

Crypto market participants have expressed frustration. CryptoQuant CEO Ki Young Ju concurred with an analyst who suggested the president boost equities to divert speculation from real estate.

Future Outlook for Both Markets

South Korean political speculators say President Lee has shown considerable interest in the crypto market. During the last presidential election, he campaigned on policies including Bitcoin spot ETF approval and stablecoin adoption, and even explained stablecoins during TV debates.

A ruling party politician recently told a BeInCrypto reporter, “In the future, President Lee will be remembered as someone who lifted both the stock and crypto markets—a model similar to today’s Trump.”

For now, South Korea’s markets show a rare split between traditional and digital assets. Whether this marks a temporary phase or a more profound shift in investor behavior remains to be seen as political and economic dynamics continue to evolve. On Tuesday, the market underwent a -2.7% correction, yet crypto market also went through a downturn.

The post Korea Dumps Crypto for Stocks? KOSPI Hits Record as Crypto Volume Collapses 80% appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Eksklusif crypto: [LIVE] Bitcoin Price Tracker: Is BTC Going To Hold o

Bitcoin is facing significant pressure on November 4, sliding below $103,000 after losing the crucial 85th percentile cost basis (~$109K), a level that has historically acted as strong support during macro-driven pullbacks.

BTC now trades around $103K, with analysts focusing on the next major threshold at the 75th percentile cost basis (~$99K), a zone that previously halted deeper corrections. The weakness persists despite macro conditions that should have supported risk assets.

Crypto continues to underperform equities even after the Federal Reserve’s 25 bps rate cut and its plan to end quantitative tightening (QT) by December.

While the S&P 500 is up 1.66% over the past month and 16.76% YTD, Bitcoin has fallen over 15% in the last 30 days and is up just 4.2% YTD. Liquidity is expanding globally — U.S. M2 has grown by more than $2 trillion since mid-2023 — yet almost none of it is reaching crypto.

ETF inflows remain stalled, digital asset treasury activity across major tokens has dried up, and more than $19 billion in leverage was flushed around the last FOMC event.

Wintermute’s November 2025 report notes that a return of ETF or DAT flows will be essential for any meaningful recovery.

Altcoins have suffered even steeper declines. Over the past week, gaming tokens are down 21%, layer-2s 19%, memecoins 18%, and mid- and small-caps 15–16%. Only AI and DePIN tokens show relative resilience, dropping just 3–4% on the strength of TAO.

Analysts warn this downturn is not a typical “buy the dip” setup but a broader test of liquidity resilience, worsened by the ongoing U.S. government shutdown, which the CBO estimates is erasing $7–14 billion in economic output.

On-chain data shows this fiscal freeze is already constricting Bitcoin’s liquidity profile. The key question now is whether Bitcoin can defend the $100K psychological barrier, or if deteriorating conditions will force a retest of $99K support. Stay tuned for live price updates as volatility intensifies.

Stay tuned for live price updates and real-time market reactions as volatility accelerates.

BTC Drops Below $103K – Is Sub-$100K Coming?

The post [LIVE] Bitcoin Price Tracker: Is BTC Going To Hold or Fall Below $100K Today? appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!