📌 MAROKO133 Update crypto: AVAX Surges as Avalanche Expands Stablecoin Payments in

Avalanche is entering a new chapter of its growth journey, with news of partnerships with major enterprises and adoption in stablecoin payments in Korea. A wave of on-chain indicators shows a surge in network activity.

These updates are not just marketing “tweets” but are supported by real operational evidence, including DEX volume and Bitwise’s ETF filing. This evidence indicates strong demand, liquidity, and institutional interest.

Expanding Influence in Asia

Avalanche (AVAX) is spearheading the digitalization of Asia’s economy, especially in Korea, a vibrant crypto market with over 15 million accounts in domestic crypto exchanges.

Recently, BDACS partnered with Woori Bank to launch KRW1, a stablecoin backed 1:1 by the Korean won. After a successful PoC, it is now in the pilot phase. Avalanche provides secure, high-speed infrastructure to support KRW1. INEX, an exchange offering lifetime 0% fees, signed an MOU with Ava Labs to pilot online and offline stablecoin payments.

In Japan, Avalanche is equally active, as Densan (65,000+ stores) and SMBC – one of the country’s three largest banks – collaborate to develop a stablecoin for national payments. With tokenized whisky from Bowmore & Suntory and automotive finance models from Toyota Blockchain Lab, AVAX is blending tradition with innovation, proving its appeal to global enterprises.

“Avalanche’s key differentiator is its proven history of delivering success with institutions. From KKR’s healthcare fund tokenization in 2022 to the State of Wyoming’s stablecoin in 2025, these have consistently been industry-first and highly complex projects.” Justin Kim | Head of Asia, Ava Labs, shared in Tiger Research’s latest report.

Explosive Network Performance, AVAX Eyes $42

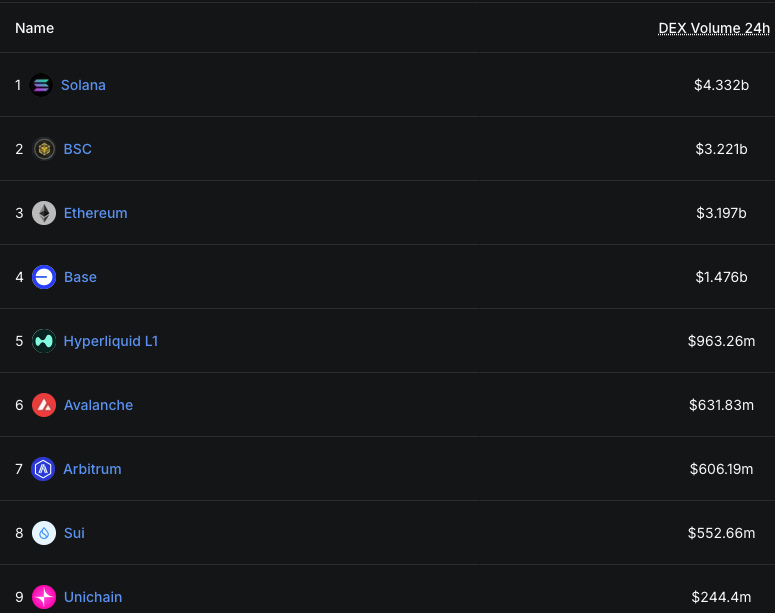

In 2025, Avalanche is “firing on all cylinders”. Network transactions have skyrocketed, fueling record activity across L1s. DEX volume on Avalanche hit $12 billion in August, and in the past 24 hours, it reached $630 million, surpassing Arbitrum and Sui (SUI). This marks an 8x increase over the last two months.

The value of RWAs on Avalanche has exceeded $450 million. Projects like Grove Finance target $250 million in institutional credit, and SkyBridge is tokenizing $300 million in investment funds. Uptop is expanding its NBA loyalty program.

In addition, Wyoming launched FRNT – the first state-backed stablecoin for real-world use – and Exit Festival adopted smart ticketing for 500,000 attendees. These figures are not just dry data; they prove AVAX attracts real users, from DeFi to entertainment.

The entry of Solana’s former head of communications into Ava Labs is expected to boost growth, bringing marketing expertise to help AVAX compete with other L1s. The Avalanche Foundation appointed Lord Chris Holmes, a UK parliamentarian and technology policy expert, to its board. This appointment strengthens Avalanche’s regulatory credibility and supports global expansion.

Breaking Out of Pennant

From a technical perspective, AVAX shows no signs of “cooling off,” especially after breaking out of a bull pennant pattern. With solid support at $27, many analysts believe the next target is $42. At the time of writing, AVAX is trading at $31,82, up 6% in the last 24 hours. AVAX surged to $30, its highest since February, following news of two $500 million Treasury bond deals to expand institutional reach.

This optimistic forecast comes from strong network signals and expectations of institutional inflows through AVAX ETFs. Four AVAX ETFs have been filed and are awaiting approval in 2025. If the SEC gives the green light, institutional capital could propel AVAX to new heights, similar to the impact of Bitcoin ETFs.

The post AVAX Surges as Avalanche Expands Stablecoin Payments in Korea and Japan appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Eksklusif crypto: Tokyo Fashion Brand Expands Into Bitcoin and AI Hari

On Wednesday, Japanese casual apparel retailer Mac House announced that shareholders approved a name change to Gyet Co., Ltd., signaling a strategic shift into crypto and digital assets.

The move highlights a broader corporate plan centered on cryptocurrency, blockchain, and artificial intelligence. It reflects the company’s ambition to launch a global Bitcoin treasury program, drawing attention from both domestic and international observers.

“Yet” and Its Global Significance

Gyet’s amended corporate charter introduces wide-ranging digital initiatives, adding cryptocurrency acquisition, trading, management, and payment services. The new objectives also cover crypto mining, staking, lending, and yield farming, as well as blockchain system development, NFT-related projects, and research in generative AI and data center operations. These changes indicate a clear intent to diversify beyond apparel and position the company within global technology and finance sectors.

The rebranding reflects Gyet’s aim to operate with a broader international outlook. Its new name conveys three concepts: “Growth Yet,” “Global Yet,” and “Generation Yet,” signaling a desire to create technology-driven value for future generations while expanding beyond Japan’s domestic market.

Bitcoin Purchasing and Mining

Gyet declared its digital asset ambitions in June 2025 and in July signed a basic cooperation agreement with mining firm Zerofield. The company has since begun a $11.6 million Bitcoin acquisition program and is testing mining operations in US states such as Texas and Georgia, where electricity costs are relatively low. Its goal of holding more than 1,000 BTC is modest globally, but the model—funding purchases and mining with retail cash flow—remains unusual for an apparel business.

Within Japan, Gyet follows companies such as Hotta Marusho and Kitabo, which have also diversified into cryptocurrency activities distinct from their original operations. This move may accelerate corporate Bitcoin holdings as a financial strategy, attract interest in overseas mining ventures by Japanese firms, and reduce perceived barriers for non-tech companies exploring Web3 or AI projects.

Hybrid DAT Model: Traditional Commerce Meets Digital Asset Management

Gyet plans to grow its Bitcoin reserves through both direct purchases and mining while pursuing AI-based services and potential acquisitions to broaden its business portfolio. The company intends to combine its nationwide retail presence with emerging digital technologies to create a hybrid model of traditional commerce and cryptocurrency management.

To support expansion, Gyet increased its authorized share count from 31 million to 90 million, giving it greater flexibility for future financing and capital planning.

The post Tokyo Fashion Brand Expands Into Bitcoin and AI appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!