📌 MAROKO133 Breaking crypto: The $108K Wall: Where Long-time Holders Unload Their

Bitcoin’s price surged after the US Senate passed a bill to reopen the government, but the rally quickly stalled near a critical resistance level at $108,000.

Analysts attribute the sluggish upward momentum to ongoing selling pressure from Long-Term Holders (LTHs), who have liquidated over 370,000 BTC since July.

Key Resistance Level Holds Strong

Bitcoin’s price spiked by $2,000 around 1:30 am UTC on Tuesday, reaching approximately $107,500 after the US Senate passed the government shutdown resolution. This marked the highest price level in a week, since November 4. However, the surge was unsustainable, lasting less than five minutes before the price retreated to the pre-spike level of $105,500 by 2:00 pm.

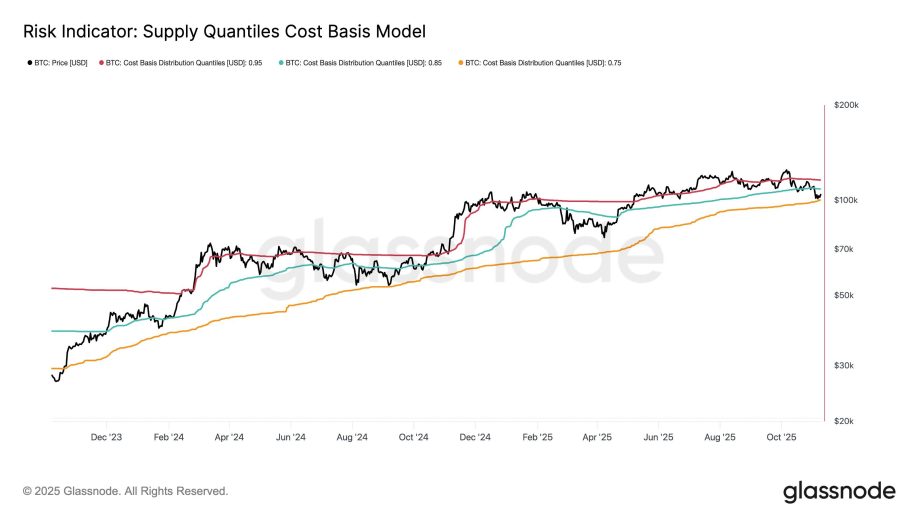

Analysts believe Bitcoin will face significant difficulty breaking the strong resistance zone near $108,000 in the near term. On-chain data platform Glassnode identified this technical hurdle: “The next key level is the 85th percentile cost basis (~$108.5K); a zone that has historically served as resistance during recovery moves.”

This 85th percentile cost basis previously acted as a strong support line during multiple price dips following the October 10 crash. However, after the price decisively broke below it in early November, the principle of technical analysis suggests the level has now flipped into a powerful resistance zone.

Long-Term Holders Maintaining ‘Peak Spending’

Crypto analyst Ali Martinez pointed to persistent LTH selling as the primary obstacle to a sustained rally. “Long-term holders are currently at peak spending, having already sold 371,584 Bitcoin $BTC since July,” Martinez noted.

The LTHs’ average acquisition price remains low at $37,915 (as of Nov 8). While LTH selling typically diminishes as the price nears its cost basis, the current price is well above that level, indicating the profit-taking incentive remains high.

CryptoQuant analyst XWIN Research Japan confirmed the continuing LTH selling pressure, diagnosing the $107K–$118K range as a major resistance zone. The analyst noted LTH exchange inflows are “nearly double normal levels,” which “creates supply friction” against upward price movement.

Interestingly, the LTH-SOPR metric—which tracks long-term profit realization and often signals reduced selling pressure when it falls—has declined during this period. XWIN Research Japan interpreted this paradoxical situation not as a reduction in selling volume but as “reduced conviction among holders, selling into strength but with less profit margin” than previously seen.

The post The $108K Wall: Where Long-time Holders Unload Their Bitcoins appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: Gemini Shares Slip After First Earnings Report Since

Gemini’s stock fell in post-market trading after the firm released its first quarterly earnings report since its initial public offering (IPO) in September.

The crypto exchange experienced a 52% increase in net quarterly revenue, but posted a net loss of $159.5 million, as operating expenses more than doubled from the same period a year earlier.

Gemini’s Q3 Financial Performance

The third quarter of 2025 was a pivotal one for the Gemini exchange, which went public in September 2025 and began trading under the symbol GEMI on the Nasdaq. In the latest shareholder letter, the firm highlighted that its net revenue reached $49.8 million, a 52% from the previous quarter.

Transaction revenue rose 26% quarter-over-quarter to $26.3 million. Meanwhile, services revenue surged 111% to $19.9 million. The service segment benefited from increased use of Gemini’s credit card, staking, and custody products.

Still, the strong revenue growth was overshadowed by mounting expenses. Gemini posted a net loss of $159.5 million, compared with $90.2 million a year earlier, as costs swelled amid its IPO. The exchange’s loss per share was $6.67, falling short of analysts’ estimates of a $3.24 loss.

Total operating expenses more than doubled to $171.4 million, up from $76.8 million a year earlier. The largest increases came from salaries and compensation.

It rose to $82.5 million, with sales and marketing increasing to $32.9 million as the company intensified its promotional efforts. Adjusted EBITDA came in at negative $52.4 million.

“We believe the increase in operating expenses this quarter primarily reflected higher marketing and customer reward investments, and elevated stock-based compensation costs associated with our transition to life as a public company. Our expense trends otherwise remained consistent with our investment in growth and platform scale,” the shareholder letter read.

Gemini also recorded mixed results from its crypto-related positions, including a $106.8 million gain on digital assets but an $83.1 million loss on related-party crypto loans.

Despite the strong revenue momentum, the widening losses tempered investor sentiment, sending Gemini’s shares lower after the earnings release. Google Finance data showed that GEMI closed at $16.84, up more than 4% on the day. However, in post-market trading, the stock dropped 6.18%.

This performance contrasts sharply with competitors like Coinbase. The exchange’s stock climbed after it revealed a $433 million profit for the third quarter. Now, investors will be watching to see whether Gemini can shift from growth spending to profitability in the quarters ahead.

The post Gemini Shares Slip After First Earnings Report Since Nasdaq Debut appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!