📌 MAROKO133 Eksklusif crypto: TRUMP Coin Says Goodbye to Bitcoin, Charts Its Own P

OFFICIAL TRUMP is showing signs of a short-term recovery after weeks of steady decline, but the movement may not be as promising as it appears. The meme coin is trading cautiously, as both Bitcoin’s rally and the absence of trader enthusiasm are limiting its upside potential.

Current market patterns suggest that the late-year recovery may, in fact, be setting the stage for a deeper correction in Q4.

OFFICIAL TRUMP Loses Bitcoin And Broader Market’s Impact

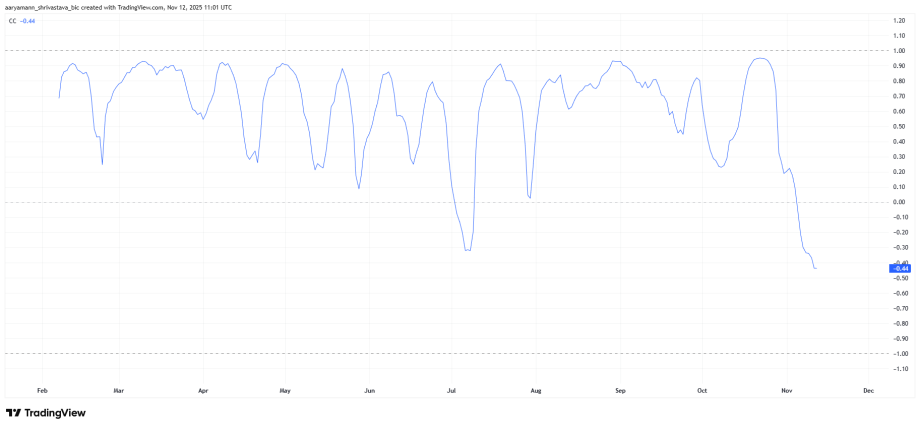

At the moment, OFFICIAL TRUMP’s correlation with Bitcoin is notably weak, sitting at -0.44. In simple terms, this means TRUMP’s price tends to move in the opposite direction of Bitcoin’s. This inverse relationship could pose a challenge, especially since Bitcoin historically performs strongly in Q4.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If Bitcoin maintains its bullish trajectory through the final months of 2025, TRUMP could face downward pressure. While this decoupling might have protected it during Bitcoin’s previous dips, the same independence could now leave the meme coin vulnerable as the broader market strengthens without it.

The Futures Of TRUMP

The funding rate paints a concerning picture for TRUMP’s macro outlook. Short positions have dominated the market longer than long contracts, reflecting growing skepticism among traders. This imbalance signals fading investor confidence and the lack of a clear directional bias, both of which are vital for recovery.

Without renewed commitment from long-term holders, any attempt at a sustainable rebound remains fragile. The absence of positive funding momentum highlights traders’ caution and the risk that further liquidations could amplify downside volatility in the coming weeks.

TRUMP Holders Could Reverse The Outcome

Despite the macro weakness, the Chaikin Money Flow (CMF) indicator offers a glimmer of hope. Currently hovering near the -10.0 level, the metric has historically preceded recovery rallies for TRUMP. This level has often marked accumulation zones where buyers step in temporarily before broader corrections resume.

With an ascending wedge forming on the charts, TRUMP could see a short-term bounce before facing renewed selling pressure. The pattern suggests a potential brief recovery, but overall bearish structure remains dominant as 2025 draws to a close.

TRUMP Price May See A Breakdown

OFFICIAL TRUMP has been trading within an ascending wedge for the past two and a half weeks, sitting at $7.86. This chart formation is typically a bearish signal, often preceding downward moves.

If the TRUMP price faces any bearish cues, either from investors or the above-mentioned factors, it would break down below the threshold. Weak buying strength could extend the decline, sending it falling by 19% towards $6.24 support.

Alternatively, if the CMF pattern holds, TRUMP could bounce off the lower trend line and surge past $8.36 to test $9.00. While this move would invalidate the short-term bearish outlook, the broader downtrend is still intact.

The post TRUMP Coin Says Goodbye to Bitcoin, Charts Its Own Path Toward the End of 2025 appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Hot crypto: MicroStrategy Briefly Worth Less Than Its Bitcoin as Marke

Strategy (formerly MicroStrategy) traded below the value of its Bitcoin holdings this week, signalling rare investor caution toward the largest corporate holder of BTC.

The stock slipped to an intraday market cap of about $65.34 billion, falling under the $66.59 billion value of its 641,692 Bitcoin.

Worrying Signs For MicroStrategy?

This created a temporary negative premium. It showed that equity markets priced MicroStrategy’s corporate and dilution risks higher than the value of its digital assets.

The move stands out because MicroStrategy usually trades above the value of its holdings.

Bitcoin markets added more context. BTC hovered between $100,000 and $105,000 during the week, drifting about 2% lower.

Sentiment remains fragile, with the crypto Fear and Greed Index sitting in extreme fear territory.

Despite that cautious backdrop, Bitcoin held a tighter range than MicroStrategy’s stock. Traders viewed BTC as the cleaner exposure while treating MicroStrategy as a leveraged proxy.

This divergence strengthened as MicroStrategy continued raising capital through equity and preferred share offerings.

Moreover, the company recently added another 487 BTC for $49.9 million. The purchase kept its long-term strategy unchanged, even as its stock faced selling pressure.

Investors appeared concerned about future dilution and the firm’s growing leverage.

However, the discount was short-lived. MicroStrategy’s stock quickly moved back above its effective net asset value.

Even so, the event highlighted a shift in behaviour among institutional traders.

The market is rewarding direct Bitcoin exposure over corporate structures that hold Bitcoin. It also signals that equity investors now differentiate between BTC as an asset and MicroStrategy as a business with operational and financing risks.

For Bitcoin holders, the episode reinforces the asset’s relative strength despite weak sentiment.

For equity investors, it shows that Strategy may face more volatility than Bitcoin itself as its capital strategy expands.

The event marks a subtle shift in market psychology. Investors still value MicroStrategy’s large Bitcoin position, but they are no longer paying a consistent premium for its leverage.

The post MicroStrategy Briefly Worth Less Than Its Bitcoin as Market Flags Corporate Risk appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!