📌 MAROKO133 Update crypto: Feds Bust Crypto ATM CEO in Massive $10 Million Money L

Federal prosecutors have charged the founder of a Chicago-based cryptocurrency ATM company in a multi-year money-laundering conspiracy that allegedly moved at least $10 million in fraud and drug proceeds through crypto kiosks nationwide.

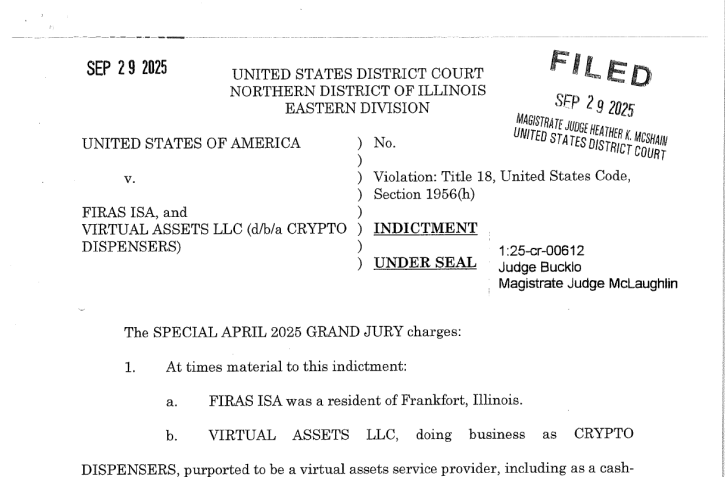

Firas Isa, 36, founder and CEO of Virtual Assets LLC, which operated publicly as Crypto Dispensers, was indicted on one count of money-laundering conspiracy, carrying a maximum sentence of 20 years in federal prison.

Isa and the company have pleaded not guilty. A status hearing is scheduled for January 30, 2026, before U.S. District Judge Elaine E. Bucklo in Chicago.

Crypto ATM Network Used to Wash Millions From Fraud and Drug Trafficking

According to the indictment, unsealed in the Northern District of Illinois, Isa and a co-conspirator operated Virtual Assets as a cash-to-crypto exchange.

The exchange offered a network of ATMs and bank accounts that allowed users to deposit cash, checks, or wired funds for conversion into digital assets.

Prosecutors allege that between 2018 and 2025, the operation processed millions of dollars sent by criminals and, at times, by fraud victims unknowingly depositing illicit funds.

The money was allegedly converted into cryptocurrency and transferred to external wallets to obscure its source.

Investigators say Isa knew the proceeds were tied to wire-fraud schemes and narcotics trafficking.

The indictment describes transactions where Isa and a co-conspirator allegedly collected cash from fraud operations, converted it into crypto, and routed the assets through multiple wallets to conceal ownership and control.

The case, brought by a special April 2025 grand jury, includes a forfeiture notice seeking any property linked to the alleged crimes, including a personal money judgment.

If specific assets cannot be recovered, prosecutors plan to pursue substitute property as permitted under federal law.

Officials stressed that an indictment is only an allegation and that the defendants are presumed innocent unless proven guilty.

Lawmakers Push New Rules for Crypto ATMs After Spike in Scam Complaints

The charges arrive as federal and state authorities intensify crackdowns on crypto ATM-related fraud nationwide, which has surged, particularly targeting older victims.

In September, the District of Columbia’s Attorney General filed a separate lawsuit against Athena Bitcoin, one of the largest crypto ATM operators in the United States.

The suit alleges that 93% of the company’s deposits in Washington, D.C., during a five-month period were tied to scams, many involving elderly residents pressured into transferring savings through Bitcoin kiosks.

Prosecutors in that case say the company charged undisclosed fees as high as 26% while failing to implement meaningful safeguards.

Federal data shows sharp increases in losses connected to cryptocurrency ATMs. The FBI reported nearly 11,000 related complaints in 2024, totaling more than $246 million.

The Federal Trade Commission found that losses rose from $12 million in 2020 to $114 million in 2023, with victims aged 60 and above accounting for more than two-thirds of reported cases. Median losses in that age group reached $10,000 per incident.

Lawmakers have begun responding with new proposals. In February, Senator Dick Durbin introduced the “Crypto ATM Fraud Prevention Act,” which would impose transaction caps, require direct communication with users conducting higher-value transfers, and mandate refunds for certain fraud victims.

Durbin described the measure as an attempt to curb scams that increasingly involve intimidation tactics targeting seniors.

Multiple states are pursuing similar regulatory approaches. Wisconsin legislators recently introduced bills to bring the state’s more than 580 crypto kiosks under money transmitter licensing requirements.

The proposal also includes setting daily transaction limits, imposing stricter identity verification procedures, and requiring fraud warnings on machines.

Spokane, Washington, voted to ban crypto ATMs entirely following federal investigations that linked kiosks in the region to large-scale fraud schemes.

International regulators have moved in the same direction. New Zealand imposed a complete ban on cryptocurrency ATMs as part of updated anti-money laundering reforms, while Australia’s financial intelligence agency introduced stricter rules and declined to renew a registration for a local operator.

The post Feds Bust Crypto ATM CEO in Massive $10 Million Money Laundering Operation appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Eksklusif crypto: Paper Hands Exit Bitcoin as Fear Takes Hold – Volati

Bitcoin has entered one of its most severe short-term capitulation phases of this cycle, with fresh on-chain data revealing that short-term holders are now realizing losses at levels historically seen only near major market turning points.

According to analysis from CryptoQuant, the Short-Term Holder Spent Output Profit Ratio has fallen to extremely depressed levels around 0.97.

This means recent buyers are selling coins at a clear loss, while the transfer of 65,200 BTC to exchanges confirms that fear-driven panic is actively translating into realized losses.

This capitulation structure is reinforced by STH-MVRV dropping far below 1.0, placing nearly all recent buyers underwater in one of the weakest profitability zones on record.

The conditions that typically precede cyclical recoveries are now gradually aligning, though volatility may persist as weak hands continue their exodus from the market.

This insight came as ETFs are also bleeding, with BlackRock’s iShares Bitcoin Trust (IBIT) recording its largest single-day outflow since launch, as investors withdrew $523 million yesterday.

Whale Flight Leaves Retail Traders Exposed to Elevated Risk

CryptoQuant CEO Ki Young Ju highlighted structural weakness across Bitcoin’s futures market, noting that average order size shows futures whales have left while retail now dominates trading activity.

Inflows from spot to futures exchanges have collapsed, ending the season when whales posted BTC as collateral for long positions.

The estimated leverage ratio remains high even as Binance’s deposit cost basis sits at $57,000, meaning traders have already captured large gains from ETF and institutional flows.

Open interest still exceeds last year’s levels, yet aggregated funding rates remain neutral rather than fearful, suggesting complacency persists despite deteriorating conditions.

Coinbase Premium has fallen to a nine-month low, likely driven by ETF-related institutional selling that has produced three consecutive weeks of net negative flows.

Strategy’s mNAV stands at 1.23 while near-term capital raising appears difficult, compounding pressure on institutional demand channels.

Mixed Signals Emerge as Miners Complete Balance Sheet Adjustments

While Bitcoin has declined 21% from its recent peak of $119,771 to current levels around $91,869, miner behavior reveals strategic positioning rather than panic.

According to a CryptoQuant analyst, miners distributed coins on only 11 days versus 19 accumulation days over the past 30-day window, with volumes nearly balanced at 6,048 BTC sold against 6,467 BTC accumulated.

The most significant shift occurred in the last seven days, when Bitcoin saw a net accumulation of 777 BTC despite trading 12.6% lower than 30 days prior.

The 30-day net position has flipped back to positive territory at +419 BTC as of November 17th, suggesting vulnerable miners have completed necessary liquidations and are no longer a primary source of selling pressure.

Speaking with Cryptonews, Farzam Ehsani, Co-founder and CEO of VALR, warned that “to confirm the end of the rally, the market must fall below the $92,000 zone, which will be the final signal of a break in the structure.”

He added that “a breakout above $105,000 is necessary to return to a confident growth pattern,” emphasizing that selling on rebounds will remain the dominant strategy until clear resistance levels are breached.

Bitcoin’s realized cap growth has stalled for three days, while market cap is growing more slowly than realized cap, indicating sustained selling pressure.

The PnL Index flipped short on November 8th as whales take profits, with cycle theory suggesting a potential bottom around $56,000 near the realized price.

Despite current weakness, Ehsani noted that negative trends by mid-November have not eliminated positive expectations for December.

“A classic Santa Claus rally is possible if economic releases align and Fed communication softens,” he stated, suggesting Bitcoin may return to the $111,000–$116,000 range by year-end if ETF demand remains strong and macro conditions improve.

The Crypto Sentiment Index registered a value of 10 over the weekend, echoing lows from late February, while the Bitcoin Fear and Greed Index currently sits at 15, indicating extreme fear among market participants.

The post Paper Hands Exit Bitcoin as Fear Takes Hold – Volatility May Persist, Analyst Warns appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!