📌 MAROKO133 Breaking crypto: Bitcoin Breaks $90K but Exchange Data Shows Rising Se

Bitcoin has surged past $90,000, and Ethereum is trading above $3,000. However, mixed on-chain data reveals a market split between selling pressure and substantial outflows.

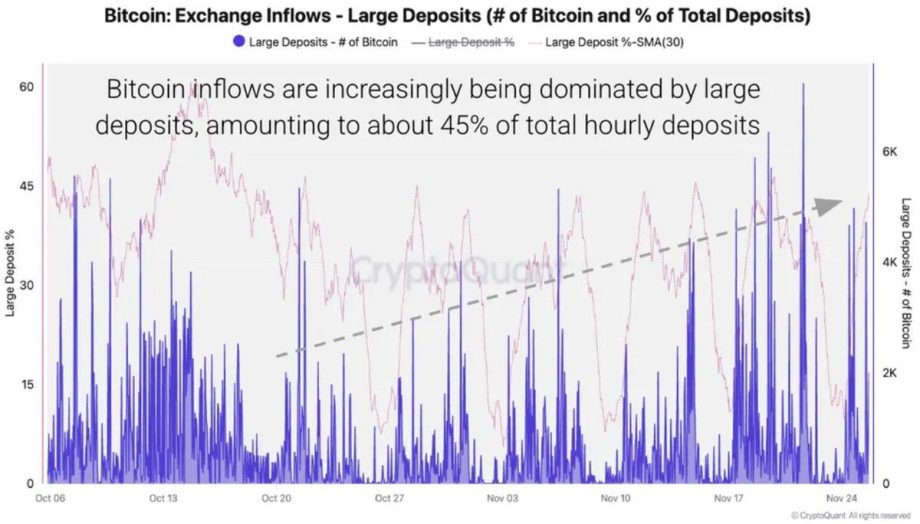

Large deposits to exchanges now represent 45% of all Bitcoin inflows, reaching 7,000 BTC on November 21, according to CryptoQuant. At the same time, an unprecedented withdrawal of 1.8 million BTC from exchanges overnight has fueled speculation about institutional moves. Binance’s stablecoin reserves stand at a record $51.1 billion, suggesting traders are preparing for greater market volatility.

Price Recovery Hides Complex Exchange Activity

Bitcoin trades at $90,418, gaining 3.12% in the past 24 hours. It peaked at $126,080 on October 6, 2025, but is now 30% below its all-time high. Ethereum shows a similar pattern, trading at $3,023.74 with a 1.74% daily increase after reaching $4,946.05 in August 2025.

The price recovery follows a correction that took Bitcoin down to temporarily $80,000 last week, prompting strong reactions in the market. Trading volumes reveal this volatility: Bitcoin’s 24-hour volume hit $69.56 billion, and Ethereum’s reached $21.27 billion.

Yet, price alone does not tell the whole story. On-chain data highlights a complicated environment. Different types of market participants are making contrasting moves, as shown by the split between price direction and exchange flows.

Rising Exchange Inflows Indicate Selling Pressure

Exchange inflow statistics raise concerns for Bitcoin bulls. CryptoQuant data reveals that large Bitcoin deposits to exchanges have climbed steadily since November 24, nearing levels last seen at the end of October. The 30-day moving average of large deposits points to sustained selling pressure.

Deposits of 100 BTC or more now account for 45% of exchange inflows, suggesting whales are preparing for major portfolio changes or liquidations.

This activity matches Bitcoin’s recent drop. Past patterns show that large deposits can lead to further price declines as major holders reduce their positions or shift strategies.

BTC and ETH inflows have totaled $40 billion this week, with Binance and Coinbase taking the lead. Increased deposits often indicate coming liquidity events or active trading strategies.

Analysts at CryptoQuant warn that these trends might reflect technical changes, such as the addition of new exchange wallets to tracking systems. Still, the overall upward trend points to real market forces at work, not just technical noise.

Massive Bitcoin Outflow Fuels Accumulation Theories

In contrast to rising inflows, a significant withdrawal stunned observers. An estimated 1.8 million BTC—about $162 billion at current prices—left exchanges in a single overnight session.

This enormous outflow has led to intense speculation about institutional accumulation or strategic portfolio moves. Exchange reserves are now about 1.83 million BTC, sharply down from previous levels. Historically, falling reserves have often accompanied bullish shifts and suggest coins are moving into long-term storage.

The scale of this withdrawal dwarfs regular daily activity, signaling likely coordination among major participants. Still, experts urge caution—some of the movement could result from technical changes, treasury actions, or shifts in institutional custody.

Record Stablecoin Reserves Show Market on Edge

Adding to the uncertainty, Binance’s stablecoin reserves now stand at an all-time high of $51.1 billion. Traders appear to be positioning for buying chances or hedging against more price swings as stablecoins build up on exchanges.

This accumulation of stablecoins comes amid a market correction and wild swings in trading volume. Spot trading volumes peaked near $120 billion, then stabilized. Binance and Coinbase continue to dominate both spot and derivatives action.

Ethereum has moved in tandem with Bitcoin throughout this period. Like Bitcoin, it faces increased deposits and active trading, showing both potential selling and ongoing market engagement.

The post Bitcoin Breaks $90K but Exchange Data Shows Rising Selling Pressure appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Update crypto: Crypto Price Prediction: Best Altcoin to Buy During the

The cryptocurrency market has remained relatively stable over the past 24 hours, with its total cap remaining in the vicinity of $3.08 trillion as U.S. stock markets made gains yesterday.

Bitcoin has remained more or less flat in 24 hours, Ethereum, BNB, and Solana are up by 1%, and XRP has actually declined by 1%, correcting slightly after some big ETF-related rises over the past few days.

While the market does remain in an uncertain mood, there are opportunities amid the bearishness, with newer tokens often outperforming.

One of these is the new ERC-20 token PEPENODE ($PEPENODE), which has raised over $2 million in its presale and is our best altcoin to buy during the crypto crash.

Crypto Price Prediction: Best Altcoin to Buy During the Crypto Crash

PEPENODE remains a very new coin, having opened its sale at the end of September, yet it has still raised just over $2.2 million.

This is an encouraging figure, one that suggests that the market is becoming increasingly interested in the new project, which seeks to make mining more accessible to the average retail trader.

As detailed on the PEPENODE website, the platform provides users with the opportunity to develop and operate virtual mining rigs, without having to buy the expensive and energy-hungry hardware that mining usually requires.

By acquiring PEPENODE and spending the token on more virtual nodes, miners can earn more rewards, which the platform pays out in external coins (e.g., Fartcoin and Pepe).

And they also have the option to sell on their nodes, should they feel that they’ve earned enough from PEPENODE’s unique brand of mining.

This system provides a strong incentive to buy more PEPENODE, meaning that the coin could attract big demand and rise steadily in price over time.

When added to ever-popular Pepe memes and some viral marketing, this all gives PEPENODE a strong foundation for success.

It will have a max supply of 210 billion tokens, which it will allocate between marketing, its treasury, mining rewards, listings, and development.

PEPENODE Could Be 2026’s Big Success Story

The attractive features don’t end there, since holders can also stake PEPENODE in order to earn a staking income.

At the moment, the coin is paying a yield of 587% APY, a rate which rises and falls depending on how many holders are staking.

This means that PEPENODE could become one of the most profitable tokens around when it lists in the next few weeks.

Investors can join its sale by heading over to the PEPENODE website and connecting a compatible wallet, such as Best Wallet.

Its presale price is currently $0.0011638, although this will rise every few days for as long as the sale lasts.

Its launch could coincide with a big market-wide recovery and rally, as altcoin ETF launches drive institutional demand back to crypto.

This is why it’s the best altcoin to buy at the moment, since it could have a very big 2026.

Visit the Official Pepenode Website Here

The post Crypto Price Prediction: Best Altcoin to Buy During the Crypto Crash appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!