📌 MAROKO133 Hot crypto: Crypto Market Hints at a Two-Year Post-Thanksgiving Patter

The crypto market is showing its first meaningful recovery after a harsh November sell-off, and several metrics now resemble the same conditions seen around Thanksgiving in both 2022 and 2023.

Bitcoin has reclaimed the $91,000 level, ETH is back above $3,000, and the wider market has returned to a cautious green. This bounce comes as traders enter a long US holiday weekend that has historically set the tone for December.

Market Indicators Turn Positive After Weeks of Fear

Fear and Greed Index data shows sentiment improving from 11 last week to 22 today, although it remains in “Extreme Fear.”

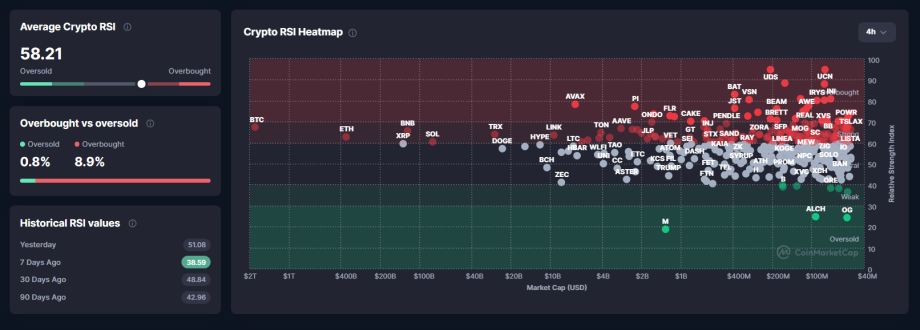

This shift aligns with a steady rise in average crypto RSI, which climbed from 38.5 seven days ago to 58.3 today. The reading signals growing strength after deep oversold conditions earlier in the month.

Momentum also flipped. The normalized MACD across major assets has turned positive for the first time since early November.

About 82% of tracked cryptocurrencies now show positive trend momentum. Bitcoin, Ethereum, and Solana appear in the bullish zone of CoinMarketCap’s MACD heatmap.

Price action supports this shift. Bitcoin is up 6% on the week. Ethereum has gained nearly 8%. Solana climbed almost 8% in the same period.

The market cap has grown to $3.21 trillion, rising 1.1% over the last 24 hours.

A Familiar Post-Thanksgiving Setup Has Emerged

The current recovery mirrors a structure seen twice before. In both 2022 and 2023, the market entered Thanksgiving after a sharp drawdown and then stabilized into December.

In 2022, Bitcoin fell to near $16,000 following the FTX collapse. By Thanksgiving, selling pressure had exhausted, and the market traded sideways into Christmas.

It was a deep bear consolidation phase rather than a rally.

In 2023, Bitcoin entered Thanksgiving at $37,000 after a steep September-October correction. Strong ETF expectations and improving liquidity conditions pushed BTC to $43,600 by Christmas. It was a classic early-bull December rally.

This year, the pattern again repeats one familiar element: the November crash came early, and by Thanksgiving, selling momentum had eased.

Bitcoin’s 90-day Taker CVD has shifted from persistent sell dominance to neutral, signalling that aggressive sellers have stepped back. Funding rates and leverage data support the same interpretation.

Liquidity Damage Still Shapes the Current Cycle

BitMine chairman Tom Lee described the market as “limping” after the October 10 liquidation shock.

He said market makers were forced to shrink their balance sheets, weakening market depth across exchanges. That fragility persisted through November.

However, Lee also argued that Bitcoin tends to make its biggest moves in short bursts when liquidity recovers. He expects a strong December rally if the Federal Reserve signals a softer stance.

On-chain data aligns with this view. Nexo collateral figures show users still prefer borrowing against Bitcoin rather than selling it.

BTC makes up more than 53% of all collateral on the platform. This behavior suppresses immediate sell pressure, helping stabilize spot markets. But it also adds hidden leverage that could amplify future volatility.

We May Be Entering a Two-Year Holiday Pattern

Three factors now look similar to the post-Thanksgiving conditions of 2022 and 2023:

- Seller exhaustion: Taker CVD shifting to neutral signals the end of forced selling for now.

- Momentum recovery: MACD and RSI metrics have reversed sharply after bottoming earlier in November.

- Liquidity stabilization: Market makers are still wounded, but volatility has cooled, and ETF outflows have slowed.

If this pattern continues, December could produce one of two outcomes based on the last two years:

- A sideways consolidation like 2022 if liquidity remains thin.

- A short, sharp rally like 2023 if macro conditions turn supportive.

The deciding factor will likely be the Federal Reserve’s tone in early December and the behavior of Bitcoin ETF flows. Thin liquidity means even moderate inflows …

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Hot crypto: MegaETH to Refund All Pre-Deposit Funds After “Sloppy Exec

Ethereum Layer-2 project MegaETH said it will refund all funds raised through its Pre-Deposit Bridge after operational failures disrupted the launch of its native stablecoin, USDm.

Key Takeaways:

- MegaETH will refund all USDm pre-deposits after admitting operational failures during the launch.

- A misconfigured multisig transaction triggered an early reopening that sent deposits past $400 million.

- Refunds are pending a smart-contract audit, with a new USDC-USDm bridge planned before mainnet beta.

The announcement came on Thursday in a post on X, where the team admitted missteps during the rollout.

“Execution was sloppy and expectations weren’t aligned with our goal of preloading collateral to guarantee 1:1 USDm conversion at mainnet,” MegaETH wrote.

MegaETH’s USDm Pre-Deposit Launch Stalls After Bridge Outage

MegaETH opened pre-deposits for USDm on Tuesday with an initial $250 million limit. The launch, however, encountered repeated disruptions from the start.

A technical problem with a third-party bridge provider rendered the service inaccessible for about an hour, while users waited for deposits to resume.

Once the platform came back online, the $250 million threshold was reached within minutes. The team then announced it would raise the deposit cap to $1 billion. That decision quickly complicated matters.

During the process of increasing the cap, a multisignature transaction that controls the contract parameters was incorrectly configured.

Instead of requiring three out of four approvals, the transaction was set to require all four signatures.

That error allowed an external party to execute the queued transaction nearly 34 minutes before the bridge was officially meant to reopen.

As a result, deposits resumed earlier than planned and quickly surpassed $400 million.

MegaETH attempted to contain the situation by reducing the cap to $400 million, then later lifting it to $500 million. The project ultimately scrapped plans to expand the limit to $1 billion entirely.

Following the incident, MegaETH confirmed that it will return all funds to participants. The refund contract is currently under audit, with repayments set to begin shortly after the review is completed.

“Depositor contributions will not be forgotten,” the team said.

Looking ahead, MegaETH plans to reopen its conversion bridge between USDC and USDm ahead of its Frontier mainnet release, which will serve as the network’s beta phase.

The goal, the team said, is to establish stable liquidity before a wider rollout.

MegaETH Pitches 100,000 TPS Layer-2

MegaETH is an Ethereum Layer-2 network designed to improve transaction speed and reduce costs for blockchain applications, positioning itself alongside platforms like Base, Polygon, and Arbitrum.

While Ethereum processes about 30 transactions per second, MegaETH claims a theoretical capacity of up to 100,000 TPS, with sub-millisecond latency and fees below $0.01.

The project uses a proof-of-stake model with a performance-based system to calculate staking rewards.

Holders who stake MEGA tokens will also take part in governance through a decentralized autonomous organization (DAO), allowing them to vote on future changes.

Both the DAO and the full staking framework are expected to launch 12 to 18 months after mainnet goes live.

The post MegaETH to Refund All Pre-Deposit Funds After “Sloppy Execution” appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!