📌 MAROKO133 Update crypto: Bloomberg Analysts Warn Bitcoin’s Slide Below $86K Is J

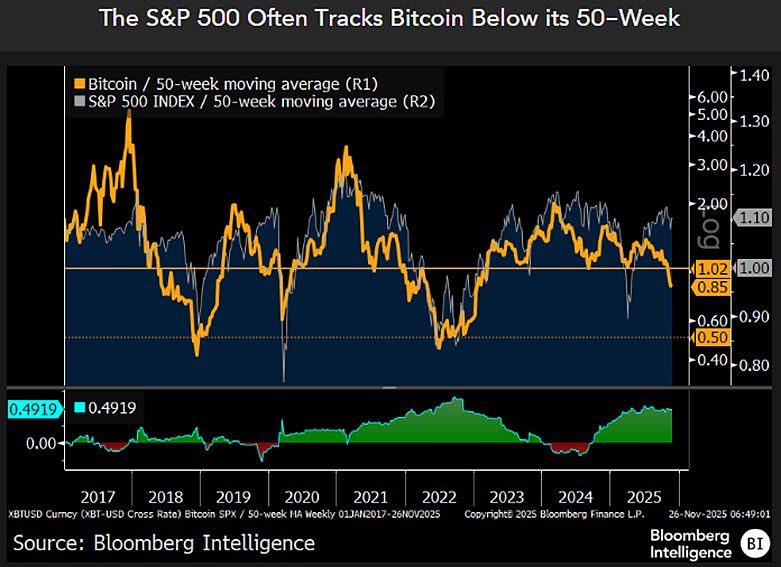

Bitcoin’s overnight plunge below $86,000 has sparked fresh warnings from Bloomberg Intelligence, with senior commodity analyst Mike McGlone cautioning that the 7% drop marks only the opening chapter of a deeper bear market correction.

The stark forecast comes as crypto markets reel from their worst monthly decline since February, with exchange volumes collapsing to $1.59 trillion and bitcoin ETFs bleeding $3.48 billion in net outflows during November alone.

McGlone projects Bitcoin could tumble more than 35% from current levels, potentially revisiting the $50,000 threshold last seen in 2024.

His analysis cites normal market reversion, record-setting gold prices, suppressed stock market volatility, and the unlimited supply of competing cryptocurrencies as key factors supporting this bearish outlook.

Yen Carry Trade Unwind Could See Bitcoin Drop Below $75k

The immediate catalyst for Bitcoin’s bearish market structure emerged from Tokyo, where mounting speculation around a December rate hike by the Bank of Japan has impacted leveraged positions.

Polymarket bettors now assign a 52% probability to a 25-basis-point increase at the BOJ’s December 18-19 meeting, while bond investors place those odds even higher at 76%.

“Bitcoin dumped cause BOJ put Dec rate hike in play,” BitMEX co-founder Arthur Hayes wrote Monday, noting that a USD/JPY rate between 155 and 160 “makes BOJ hawkish.”

The connection runs deeper than surface correlation; conservative estimates peg the yen carry trade at $3.4 trillion, though realistic figures approach $20 trillion.

For three decades, global markets borrowed near-zero Japanese money to fund everything from tech stocks to treasuries to Bitcoin itself.

That era ended last month, which triggered a sell-off in markets.

Traders are now increasingly reluctant to take directional risk without downside protection, hedging, and additional clarity about macroeconomic liquidity conditions.

Data from Glassnode reveals a massive overhead supply block sitting between $93,000 and $99,000, with a second resistance layer at $101,000 to $105,000.

“Every bounce into this zone faces sell-pressure from trapped buyers,” warned Laqira Protocol CEO Sina Osivand.

Meanwhile, the $83,000 to $86,000 band is emerging as the new cost basis for fresh demand; if this level fails to hold, liquidity hunts toward $78,000 to $75,000 become likely.

Analyst Warns Bitcoin Could Test $60-65k Support.

“Bitcoin’s drop below $90,000 is the result of a collision between the fragile market structure and weak liquidity conditions observed over the weekend,” VALR CEO Farzam Ehsani told Cryptonews.

MSCI’s anticipated decision to potentially exclude companies holding over half their assets in cryptocurrency also intensified selling pressure.

The rule change would affect issuers collectively holding over $137 billion in digital assets and approximately 5% of all Bitcoin in existence, including Strategy, Marathon, Riot, Metaplanet, and American Bitcoin.

“Since index funds are required to adhere to a strict basket-forming methodology, any rule change automatically triggers a review of their holdings, potentially leading to forced sell-offs,” Farzam Ehsani added.

December sentiment and the crypto market’s dynamics heading into the New Year will depend partly on whether Michael Saylor’s company reaches an agreement with regulators and index firms.

Traders on Kalshi have slashed odds of Bitcoin reclaiming $100,000 this year to just 29%.

Ehsani warned that if the market continues declining, Bitcoin could test the $60,000 to $65,000 range, though he noted that major institutional players might view those levels as accumulation opportunities.

“Strategy is a key player in the crypto market, and its potential problems could cause Bitcoin’s price to drop by another 30%,” he added.

The December 18 BOJ policy decision now stands as the critical pivot; a hike with hawkish stance could push Bitcoin toward $75,000, while a pause might trigger a short squeeze back toward $100,000 within days

The post Bloomberg Analysts Warn Bitcoin’s Slide Below $86K Is Just the Beginning appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Update crypto: Michael Saylor’s Strategy Forms $1.44B USD Reserve and

Strategy has created a U.S. dollar reserve totaling $1.44 billion, marking an expansion of its balance sheet strategy as it positions itself as the world’s largest “Bitcoin Treasury Company.”

The reserve will be used to support dividend payments on preferred stock and meet interest obligations, providing enhanced liquidity cushions amid volatile digital-asset markets.

The fund was financed through proceeds from ongoing at-the-market stock sales. Strategy said its goal is to maintain coverage for at least 12 months of dividend obligations, ultimately extending that to 24 months or more. The reserve will remain at the company’s discretion and may be adjusted based on market conditions and capital requirements.

Founder and Executive Chairman Michael Saylor described the USD Reserve as the next step in the company’s evolution, complementing its Bitcoin reserve.

“We believe it will better position us to navigate short-term market volatility while delivering on our vision of being the world’s leading issuer of Digital Credit,” he said.

CEO Phong Le added that Strategy now holds 650,000 Bitcoin, representing roughly 3.1% of total eventual supply. The firm’s USD Reserve currently covers 21 months of dividends, he noted.

Revised 2025 Outlook Reflects Bitcoin Price Volatility

Strategy has also updated the assumptions behind its FY2025 earnings guidance following recent declines in Bitcoin’s trading price.

If Bitcoin ends 2025 within the range of $85,000 to $110,000, Strategy said it expects operating income to fall anywhere between a loss of $7.0 billion and a profit of $9.5 billion, while net income could range from a loss of $5.5 billion to a gain of $6.3 billion.

Diluted earnings per share are projected to come in between a loss of $17.0 per share and earnings of $19.0 per share. These projections rely on the successful completion of planned capital raises that would allow Strategy to achieve its 2025 Bitcoin Yield Target and deploy the resulting proceeds into additional Bitcoin purchases.

Updated Bitcoin KPI Targets for 2025

Under the same Bitcoin price assumptions and incorporating anticipated common stock issuance to maintain the USD Reserve, Strategy said it now expects its Bitcoin yield for the year to fall between 22.0% and 26.0%. The company also forecasts Bitcoin dollar gains of between $8.4 billion and $12.8 billion.

Strategy said it expects to reach these targets through a combination of preferred stock offerings, disciplined equity issuance, and continued accumulation of bitcoin.

Market Reaction and Peter Schiff’s Criticism

The announcement drew swift and vocal commentary from market observers, including well-known Bitcoin critic Peter Schiff, who posted on X that Strategy’s establishment of a USD Reserve indicates “the beginning of the end of $MSTR.”

Schiff argued that Strategy was “forced to sell stock not to buy Bitcoin, but to buy U.S. dollars” in order to cover interest and dividend obligations, calling the business model “broken” and alleging that the company was relying on equity sales to sustain its financial commitments.

The post Michael Saylor’s Strategy Forms $1.44B USD Reserve and Updates FY2025 Bitcoin-Linked Guidance appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!