📌 MAROKO133 Hot crypto: Bitcoin Critical Holders’ Profit Crashes To Monthly Low: W

Bitcoin has shown mixed price action in recent sessions, marked by sharp fluctuations and tentative recovery attempts. BTC rebounded after a brief breakdown, yet momentum remains fragile.

A key concern is weakening confidence among one of Bitcoin’s most influential cohorts, which could complicate efforts to sustain a broader price recovery.

Bitcoin Holders Witness A Dip In Gains

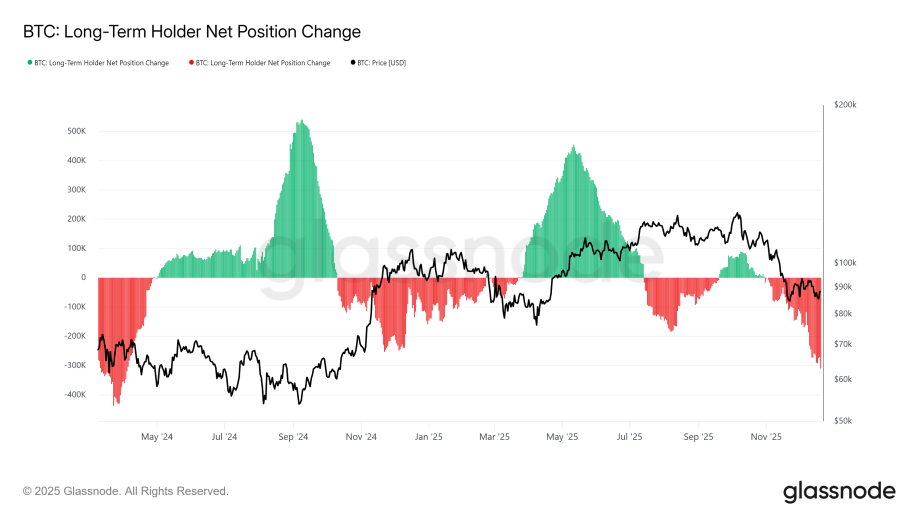

Bitcoin long-term holders have increased selling activity over the past several days. On-chain data shows the 30-day change in long-term holder supply has dropped to a 20-month low.

Similar levels were last recorded in April 2024, signaling elevated distribution pressure.

This behavior suggests long-term holders are reducing exposure to protect remaining gains. As unrealized profits shrink, selling accelerates to avoid losses. Such actions often weigh on price recovery, as supply increases without a matching rise in new demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Macro indicators provide additional context. The long-term holder net unrealized profit or loss metric has declined to a monthly low. This drop indicates profits among this group are eroding, increasing sensitivity to further downside moves.

Historically, falling LTH NUPL readings trigger defensive selling. However, once the indicator declines further, selling pressure often slows.

At those levels, long-term holders typically pause distribution, allowing Bitcoin price to stabilize and potentially recover if demand improves.

BTC Price Is Awaiting Stronger Cues

Bitcoin trades near $87,900 at the time of writing, remaining below the $88,210 resistance. The asset recently bounced after briefly slipping under the $86,247 support. This recovery shows buyers are still active at lower levels, though conviction remains cautious.

A short-term climb toward $90,308 remains possible. However, resistance near that level could cap gains. Given ongoing long-term holder selling, Bitcoin may continue consolidating near the $88,201 zone while the market absorbs excess supply.

Upside potential improves if long-term holders shift their stance. A slowdown in selling could reduce overhead pressure.

In that scenario, Bitcoin may break above $90,308 and target $92,933. Such a move would invalidate the bearish thesis and signal renewed confidence among key market participants.

The post Bitcoin Critical Holders’ Profit Crashes To Monthly Low: Will Price Further Suffer? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Hot crypto: Bitcoin Price Prediction: Why $88,000 Could Be the Calm Be

Bitcoin is trading near $88,750, holding steady after last week’s pullback as the market pauses just below a critical technical pivot. While short-term charts reflect hesitation following a bearish flag breakdown earlier in December, broader fundamentals continue to frame Bitcoin as a market in consolidation rather than decline.

Macro Signals Keep BTC Supported

From a macro perspective, Bitcoin remains underpinned by easing inflation expectations and a shifting US rate outlook. Recent US CPI data showed continued disinflation, reinforcing market bets that the Federal Reserve could move closer to rate cuts in 2026. Lower real yields tend to reduce the opportunity cost of holding Bitcoin, supporting demand during periods of consolidation.

Institutional positioning also remains constructive. Spot Bitcoin ETFs continue to anchor long-term inflows, even as short-term traders rotate out during volatility.

At the same time, regulatory clarity is slowly improving across major jurisdictions, helping Bitcoin retain its role as a core digital asset rather than a speculative outlier.

Market Structure Shows Absorption, Not Panic

Despite the recent dip, selling pressure has remained contained. Bitcoin’s failure to break decisively below the $84,500–$85,000 zone suggests that longer-term buyers are stepping in on weakness.

Repeated lower-wick candles near this area point to absorption rather than forced liquidation, a pattern often seen during corrective pauses inside broader uptrends.

Bitcoin Technical Picture: Compression Near Resistance

On the 4-hour chart, Bitcoin price prediction remains inside a broad ascending channel that has guided price since late October.

The drop below the 50-EMA near $88,200 and 100-EMA around $89,050 confirms short-term pressure, but momentum indicators are stabilising. RSI has recovered toward 57, holding above oversold levels and hinting at fading downside momentum.

Price is now compressing below the $88,200–$89,200 pivot zone, an area that combines prior support and channel midline resistance. This compression suggests the market is preparing for a directional move rather than drifting lower.

Bitcoin Price Prediction and Outlook

If Bitcoin reclaims and holds above $89,200, TradingView path projections point to a recovery toward $92,000, followed by a retest of $94,200, the previous range high. Failure to reclaim resistance keeps downside risk open toward $84,500, with deeper support near $80,600.

As volatility tightens and confidence gradually rebuilds, Bitcoin’s current pause looks less like exhaustion and more like preparation for its next decisive move.

PEPENODE: A Mine-to-Earn Meme Coin Nearing Presale Close

PEPENODE is gaining momentum as a next-generation meme coin that blends viral culture with interactive gameplay. With over $2.37 mn raised and the presale approaching its cap, interest is building fast as the countdown enters its final stretch.

What makes PEPENODE stand out is its mine-to-earn virtual ecosystem. Instead of passive holding, users can build digital server rooms using Miner Nodes and facilities, earning simulated rewards through a visual dashboard. The concept brings gamification and competition into the meme coin space, giving holders something to do before launch.

The project also offers presale staking, allowing early participants to earn boosted rewards ahead of the token generation event. Leaderboards and bonus incentives are planned post-launch to keep engagement high.

With 1 $PEPENODE priced at $0.0012016 and limited allocation remaining, the presale is entering its final opportunity window for early buyers.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Why $88,000 Could Be the Calm Before a $94,000 Push appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!