📌 MAROKO133 Breaking startup: PasarPolis funding 💸, Amazon fuels Astro 🚀, SEA’s co

Dear subscribers,

We’re back with a fresh look at Indonesia and Southeast Asia’s tech and digital ecosystem. From funding moves in insurtech and quick commerce, to bold plays in mobility and infrastructure, the region continues to show resilience and ambition. We also spotlight Indonesia’s push in digital manufacturing and the evolving dynamics of consumer behavior, where opportunities are shifting toward the two ends of the market. As always, our aim is to bring you the signals that matter most for founders, investors, and policymakers navigating this fast-changing landscape.

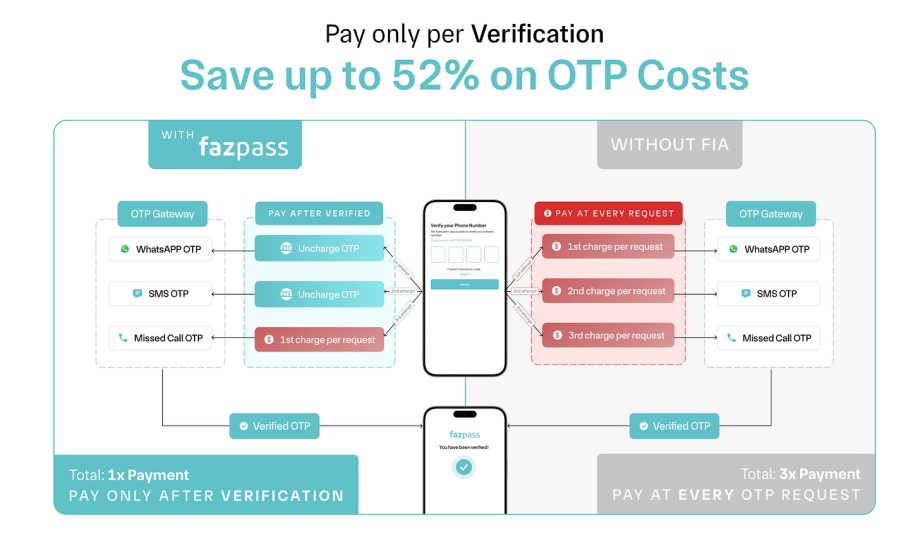

This week’s newsletter is sponsored by Fazpass. Most OTP providers charge per request, making resends and failures costly. Fazpass Intelligence Authentication lets you pay only after a successful verification—cutting costs by up to 52% while ensuring reliable verification through auto-switching across WhatsApp, SMS, or missed calls. [Try Now!]Best regards,

The DailySocial Team

🚨 What’s New

-

PasarPolis secures fresh funding 💸

PasarPolis, Indonesia’s leading insurtech, has raised new funding in an extension round led by Japanese insurance giant Tokio Marine. While the exact figure was not disclosed, sources close to the deal said it was around USD 5 million. The fresh capital will help PasarPolis deepen its presence in Southeast Asia and expand its digital insurance products. -

Amazon backs Astro’s quick commerce push 🚀

U.S. tech giant Amazon has reportedly invested USD 51.9 million in Indonesian quick commerce startup Astro. The move comes just as Amazon officially launched its own 10-minute delivery service in India, signaling stronger ambitions in the region. For Astro, the investment strengthens its financial position in an increasingly competitive market where consolidation is expected.

-

GoTo secures $286M loan facility 💰

GoTo Group has obtained a Rp4.65 trillion (USD 286 million) syndicated loan from DBS Indonesia and UOB. The facility, with a four-year tenor, will be used to refinance existing debt and support general corporate needs, including investment and working capital. As of June 2025, GoTo still had Rp467 billion outstanding from its 2022 loan, which this new funding helps cover. The company emphasized that the loan poses no adverse impact on its operations or financial health, but instead strengthens its liquidity. -

Green SM scales EV taxi service nationwide ⚡🚖

Green SM, the Indonesian EV taxi operator, is accelerating its expansion with three new launches in a single week. The company debuted its service at Soekarno-Hatta International Airport, marking a major step in electrifying airport transport. Soon after, it entered Jakarta’s eastern suburb, Bekasi, broadening coverage in Greater Jakarta’s commuter belt. It also made a strategic move into Makassar, opening access to eastern Indonesia’s economic hub. This rapid rollout reflects Green SM’s ambition to dominate the EV mobility market across the archipelago.

✨ What’s Exciting

-

INA bets big on AI, health, and renewables 🌱🤖

Indonesia’s sovereign wealth fund Indonesia Investment Authority (INA) is sharpening its focus on strategic sectors: digital infrastructure, AI in healthcare, and renewable energy. The fund, now managing USD 10 billion, aims to attract foreign partners and technical expertise to strengthen these industries. INA is diversifying beyond equity into hybrid capital and private credit to support Indonesian companies’ global expansion. This direction aligns with the government’s priorities on data independence, energy transition, and healthcare modernization—areas seen as critical for long-term economic resilience.

-

Indonesia showcases digital manufacturing at Hannover Messe ⚙️🇮🇩

Indonesia showcased its advancements in digital manufacturing at the Hannover Messe 4.0 Expo, highlighting the country’s push toward Industry 4.0 transformation. The showcase highlighted Indonesian smart factory, automation, and digital solutions aimed at boosting productivity and competitiveness. Officials stressed that manufacturing innovation is key to economic growth and positioning Indonesia in the global supply chain, while reaffirming the nation’s commitment to international collaboration in industrial digitalization.

🔮 What’s Next

Latest report by Lightspeed Venture Partners stated that Southeast Asia’s consumer landscape is increasingly shaped by a barbell economy, where the most attractive opportunities lie at the two ends of the spectrum: affluent consumers with spending power…

Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

📌 MAROKO133 Update startup: PasarPolis funding 💸, Amazon fuels Astro 🚀, SEA’s cons

Dear subscribers,

We’re back with a fresh look at Indonesia and Southeast Asia’s tech and digital ecosystem. From funding moves in insurtech and quick commerce, to bold plays in mobility and infrastructure, the region continues to show resilience and ambition. We also spotlight Indonesia’s push in digital manufacturing and the evolving dynamics of consumer behavior, where opportunities are shifting toward the two ends of the market. As always, our aim is to bring you the signals that matter most for founders, investors, and policymakers navigating this fast-changing landscape.

This week’s newsletter is sponsored by Fazpass. Most OTP providers charge per request, making resends and failures costly. Fazpass Intelligence Authentication lets you pay only after a successful verification—cutting costs by up to 52% while ensuring reliable verification through auto-switching across WhatsApp, SMS, or missed calls. [Try Now!]Best regards,

The DailySocial Team

🚨 What’s New

-

PasarPolis secures fresh funding 💸

PasarPolis, Indonesia’s leading insurtech, has raised new funding in an extension round led by Japanese insurance giant Tokio Marine. While the exact figure was not disclosed, sources close to the deal said it was around USD 5 million. The fresh capital will help PasarPolis deepen its presence in Southeast Asia and expand its digital insurance products. -

Amazon backs Astro’s quick commerce push 🚀

U.S. tech giant Amazon has reportedly invested USD 51.9 million in Indonesian quick commerce startup Astro. The move comes just as Amazon officially launched its own 10-minute delivery service in India, signaling stronger ambitions in the region. For Astro, the investment strengthens its financial position in an increasingly competitive market where consolidation is expected.

-

GoTo secures $286M loan facility 💰

GoTo Group has obtained a Rp4.65 trillion (USD 286 million) syndicated loan from DBS Indonesia and UOB. The facility, with a four-year tenor, will be used to refinance existing debt and support general corporate needs, including investment and working capital. As of June 2025, GoTo still had Rp467 billion outstanding from its 2022 loan, which this new funding helps cover. The company emphasized that the loan poses no adverse impact on its operations or financial health, but instead strengthens its liquidity. -

Green SM scales EV taxi service nationwide ⚡🚖

Green SM, the Indonesian EV taxi operator, is accelerating its expansion with three new launches in a single week. The company debuted its service at Soekarno-Hatta International Airport, marking a major step in electrifying airport transport. Soon after, it entered Jakarta’s eastern suburb, Bekasi, broadening coverage in Greater Jakarta’s commuter belt. It also made a strategic move into Makassar, opening access to eastern Indonesia’s economic hub. This rapid rollout reflects Green SM’s ambition to dominate the EV mobility market across the archipelago.

✨ What’s Exciting

-

INA bets big on AI, health, and renewables 🌱🤖

Indonesia’s sovereign wealth fund Indonesia Investment Authority (INA) is sharpening its focus on strategic sectors: digital infrastructure, AI in healthcare, and renewable energy. The fund, now managing USD 10 billion, aims to attract foreign partners and technical expertise to strengthen these industries. INA is diversifying beyond equity into hybrid capital and private credit to support Indonesian companies’ global expansion. This direction aligns with the government’s priorities on data independence, energy transition, and healthcare modernization—areas seen as critical for long-term economic resilience.

-

Indonesia showcases digital manufacturing at Hannover Messe ⚙️🇮🇩

Indonesia showcased its advancements in digital manufacturing at the Hannover Messe 4.0 Expo, highlighting the country’s push toward Industry 4.0 transformation. The showcase highlighted Indonesian smart factory, automation, and digital solutions aimed at boosting productivity and competitiveness. Officials stressed that manufacturing innovation is key to economic growth and positioning Indonesia in the global supply chain, while reaffirming the nation’s commitment to international collaboration in industrial digitalization.

🔮 What’s Next

Latest report by Lightspeed Venture Partners stated that Southeast Asia’s consumer landscape is increasingly shaped by a barbell economy, where the most attractive opportunities lie at the two ends of the spectrum: affluent consumers with spending power…

Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!