📌 MAROKO133 Eksklusif crypto: Hedera’s 800% Fee Hike in 2026: Will It Bear Impact

Hedera has attempted a modest recovery in recent sessions, yet HBAR remains capped below a key technical barrier. The altcoin continues to trade under the 23.6% Fibonacci Retracement level, limiting upside momentum.

While Hedera is preparing structural changes for 2026, investors remain focused on whether these developments can meaningfully influence HBAR price performance.

Hedera Hikes Its Service Fee

Hedera announced in July that it will increase its ConsensusSubmitMessage transaction fee by 800% starting January 2026. The fee will rise from $0.0001 to $0.0008. ConsensusSubmitMessage transactions allow users to submit data to the Hedera network for trusted timestamping and ordering.

Despite the magnitude of the percentage increase, the absolute cost remains minimal. Industry participants have debated the precedent of higher network fees, yet the change is unlikely to materially affect demand. The fee adjustment primarily targets enterprise use cases and does not significantly alter the cost structure for most applications or users.

Hedera Holders Are More Bearish Than Bullish

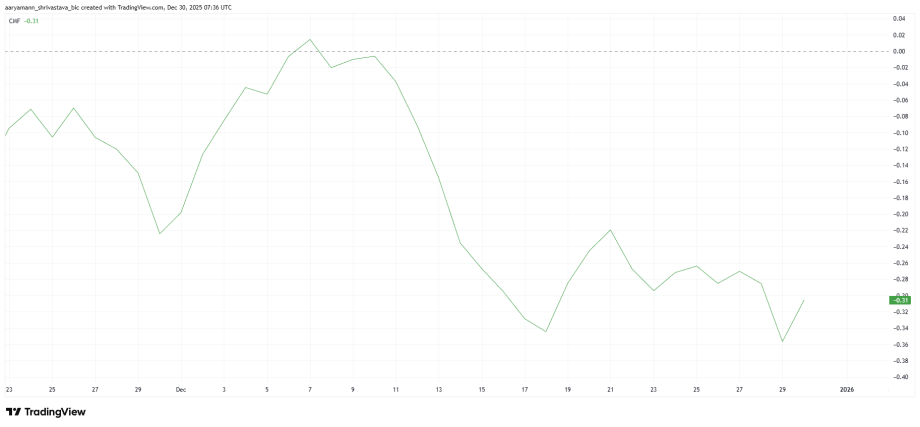

Technical indicators reflect a cautious to bearish investor outlook. The Chaikin Money Flow, or CMF, remains well below the zero line, signaling sustained capital outflows from HBAR. This suggests that investors are reducing exposure rather than positioning for a recovery.

The absence of strong bullish macro signals has reinforced this trend. Risk appetite across altcoins remains muted, and HBAR has not attracted consistent inflows. Given current conditions, this bearish capital flow dynamic is likely to persist into 2026 unless broader sentiment improves materially.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Derivatives data further highlights weak macro momentum. The liquidation map shows that traders are positioning for downside risk. Short exposure in HBAR currently stands near $8.21 million, while long exposure is significantly lower at approximately $4.5 million.

This imbalance indicates that bearish contracts dominate market positioning. Traders appear more confident in a potential price decline than a sustained rebound. Such skewed positioning often amplifies downside volatility, especially during periods of low liquidity or negative market catalysts.

HBAR Price Needs To Flip This Critical Level Into Support

HBAR trades at $0.112 at the time of writing, holding above the immediate $0.109 support level. However, price remains constrained below the 23.6% Fibonacci Retracement line near $0.115. This confluence continues to act as a strong resistance zone, limiting upward progress.

The prevailing technical and on-chain signals suggest that any recovery attempt will likely remain shallow. Consolidation above $0.109 appears more probable than a decisive breakout for HBAR. This range-bound behavior reflects weak demand and limited speculative interest under current market conditions.

A shift in the broader cryptocurrency market could alter this outlook. If macro conditions turn decisively bullish, HBAR may benefit from renewed risk appetite. Flipping the 23.6% Fibonacci level into support would confirm a recovery move, opening a potential path toward $0.120.

The post Hedera’s 800% Fee Hike in 2026: Will It Bear Impact on HBAR’s Price? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: Monad Price Prepares for a 64% Surge— But a $50 Milli

Monad (MON) trades near $0.021, down 7% in the past 24 hours but still up 4% over the week. Monad price is also 56% below its post-listing high of $0.048.

Even with that drop, the chart still leans bullish because an inverse head and shoulders pattern is holding the structure together. That pattern survives as long as bulls hold one key level. Yet, bearish risks do not look distant.

Inverse Head and Shoulders Pattern Holds as Dip Buyers Step In

Monad continues to respect an inverse head and shoulders setup. That pattern is known for a bullish reversal when the price clears the neckline. Support has formed at $0.020. The neckline sits near $0.024.

A daily close above $0.024 confirms the breakout. That breakout signals a measured 64% move toward $0.040. And while the Monad price has corrected over 7% in the last 24 hours, dip buying support keeps the breakout hopes alive.

Money Flow Index (MFI) tracks buying pressure with price and volume. Between December 26 and 29, the price trended lower while MFI made higher highs. That is a bullish divergence. It shows possible dip buying and retail support.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This behavior helps defend the pattern. If MFI drops under its recent swing low, the dip support weakens. If MFI clears recent highs, it strengthens the case for $0.024. Right now, retail buyers are doing just enough to keep $0.020 safe.

Derivatives Lean Long, But Squeeze Risk Builds Below $0.020

Derivative positioning shows why the setup feels unstable. On Hyperliquid’s 7-day MON-USD chart, liquidation clusters show a clear long bias. Long liquidations stack near $93.62 million. Short liquidations sit near $45.26 million.

Long liquidation pressure is more than 100% higher than short liquidation pressure. Traders are positioned for upside.

This creates risk. A close below $0.020 triggers a liquidation band where over 50% of the long cluster sits. That level includes $50.34 million in cumulative long leverage. A break could force a long squeeze and drag the price lower.

Sellers may be waiting for this trigger. If $0.020 fails, the liquidation loop accelerates the move.

On the flip side, a clear close above $0.024 liquidates most major Monad short clusters. That would confirm the breakout and open higher levels.

Key Monad Price Levels for Bulls and Bears

Monad trades between two levels that decide direction. Above $0.024, the breakout is active. The $0.029 area confirms momentum and could lead the move towards $0.040.

Below $0.020, the structure weakens. That exposes $0.016 and invalidates the pattern, breaking down the head of the inverse pattern. It turns the chart bearish again. Until then, the pattern leans bullish but barely.

Right now, the market is waiting for the neckline or the long squeeze trap. One breakout unlocks the 64% move. One bear-led breakdown triggers the squeeze and makes $0.016 attainable.

The post Monad Price Prepares for a 64% Surge— But a $50 Million Long Squeeze Looms Below appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!