📌 MAROKO133 Hot crypto: Pi Coin Finds Support—Here’s Why The Price Could Skyrocket

Pi Coin shocked the market this week with a steep crash that pushed the altcoin to a new all-time low.

However, the asset quickly bounced back, recovering some of its losses. Interestingly, investors appear to be treating this decline as an entry point rather than an exit signal.

Pi Coin Investors Pour Money

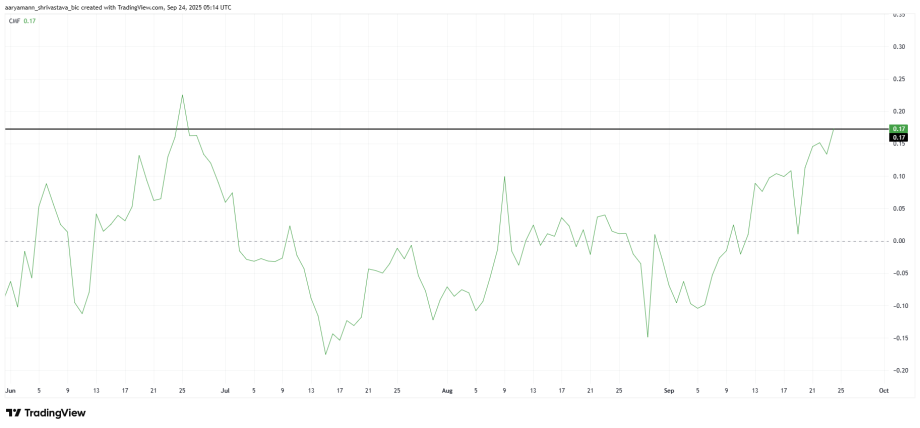

The Chaikin Money Flow (CMF) shows strong investor conviction in Pi Coin. Despite the crash, the indicator has sharply climbed to a three-month high, signaling significant inflows into the asset. This suggests that investors are not abandoning Pi Coin but instead allocating fresh capital at discounted levels.

This behavior highlights growing confidence among market participants who see the recent decline as an opportunity. Buying activity during periods of weakness often fuels price recovery, and Pi Coin seems to be benefiting from this pattern. The strong inflows could provide the foundation for a potential breakout if momentum continues.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The broader momentum also hints at a shift in direction. The Relative Strength Index (RSI) has slipped into oversold territory below 30.0, a level that often signals saturation of bearish momentum. Historically, Pi Coin has reversed trend after dipping into this zone.

If market conditions remain stable, Pi Coin could replicate past recoveries from oversold levels. The RSI suggests that selling pressure may have peaked, opening the door for a rebound. A favorable shift in sentiment across the broader crypto market could accelerate this move.

PI Price Could Bounce Back

At the time of writing, Pi Coin is trading at $0.282, struggling to break past the $0.286 resistance. Flipping this barrier into support will be critical for initiating a sustainable recovery.

While the next significant resistance lies at $0.334, even a push past $0.300 could boost market confidence. The current technical setup, combined with strong inflows, points toward a potential recovery rally in the near term.

However, if bearish momentum regains strength, this recovery attempt could collapse. A failure to hold above $0.260 would place Pi Coin at risk of revisiting its all-time low of $0.230, leaving investors exposed to deeper losses.

The post Pi Coin Finds Support—Here’s Why The Price Could Skyrocket appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: Arthur Hayes Fuels Tether IPO Speculations Amid $500

The Tether IPO (Initial Public Offering) chatter is up again, this time propagated by BitMEX co-founder and former CEO Arthur Hayes.

It centers around the stablecoin issuers’ valuation, which some say could rival renowned companies like SpaceX, OpenAI, Costco, and Coca-Cola.

Is Tether Considering Going Public?

According to Arthur Hayes, Tether going public could spell doom for Circle after the USDC stablecoin issuers’ IPO. BeInCrypto reported the success of Circle’s IPO, after the firm raised the cap for its IPO, which was initially oversubscribed 25x.

“Next up a US IPO. Bye bye Crcle,” wrote Hayes.

The remark followed revelations that Tether seeks funding at a $500 billion valuation. Reportedly, Tether is in talks with investors to raise as much as $20 billion.

The deal could push the stablecoin issuer into the highest ranks of the world’s most valuable private companies, like OpenAI and Elon Musk’s SpaceX.

According to Tether CEO Paolo Ardoino, the company is considering a raise from a group of high-profile investors. The funds achieved will reportedly be channeled toward maximizing the company’s strategy across diverse business lines.

Meanwhile, community members see Tether’s move as an opportunistic raise while their leverage and market value are still at their peak.

“…what happens if yields fall back to 2%,” posed global macro investor Raoul Pal.

Notably, this is not the first time there has been buzz about a prospective Tether IPO. In June, market analysts valued the stablecoin giant at $515 billion.

Jon Ma, a builder on Artemis, said that such a valuation would make Tether the 19th most valuable company globally.

Despite the bullish projection, Ardoino clarified in June that Tether has no intention of going public, signaling confidence in the company’s current private structure and trajectory.

Tether’s Prospective IPO Against Circle’s Public Listing

A dissection of Tether’s prospective IPO against Circle’s public listing accentuates Arthur Hayes’ sentiment.

As indicated, Tether looks to raise $20 billion at a $500 billion valuation. In comparison, Circle’s market cap is around $35 billion, making it a 14x difference.

Meanwhile, Tether’s USDT stablecoin has a market cap of $173 billion, approximately 2.3x that of Circle’s USDC ($73.6 billion).

In the same way, Tether is a significantly more profitable operation than Circle. This is partly due to the latter’s revenue-sharing agreement with the Coinbase exchange on a large portion of its USDC.

Unlike Tether’s USDT distribution in global markets, Circle has to rely heavily on Coinbase to move USDC at scale. This arrangement significantly reduces Circle’s profits compared to Tether, which does not have to pay for its distribution.

“…when evaluating an investment in a stablecoin issuer, [you have to ask yourself] how will they distribute their product?” Hayes noted in a recent blog.

While Circle made losses, Tether generated approximately $5 billion in Q2 2025. Of this, $3.1 billion was recurring (yield-based) income.

Excluding MTM (mark-to-market) gains, Tether’s $500 billion valuation is 40x last quarter’s annualized P/E (price-to-earnings) ratio. Therefore, there may not be an actual need for Tether to seek a public listing.

“…if they did, I think the founders would look to spin off a US-regulated entity separately and keep the non-business private,” one user noted.

Against this backdrop, the general sentiment is that the reason cannot be remotely related to the need for more money to generate other revenue streams.

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!