📌 MAROKO133 Hot crypto: Polygon Price Rallies 50% Amid On-Chain Demand, But Will i

POL, the Polygon network’s native token, has surged more than 50% in a week. The POL price move did not come from a single spike or headline-driven burst. Instead, it was backed by steady on-chain demand across the network.

As price pauses near recent highs, the focus shifts. This is no longer about upside momentum alone. The key question now is whether POL moves into a healthy consolidation or a deeper correction.

Steady On-Chain Demand Holds as Momentum Starts to Cool

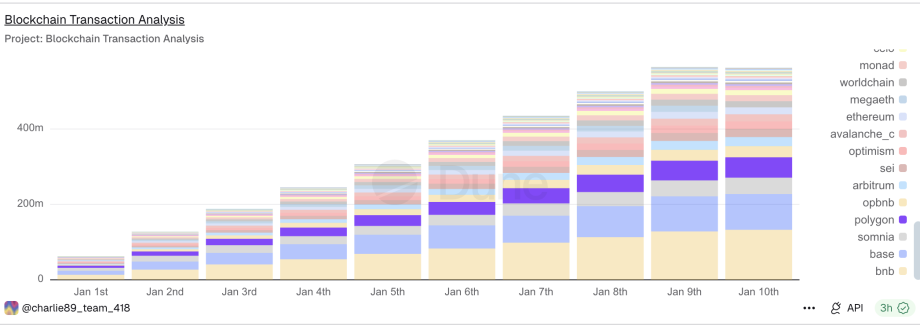

On-chain data shows Polygon has maintained steady usage throughout early January. Daily unique addresses have stayed firm, and transaction activity has continued to rise in line with other major EVM networks. This points to consistent network demand rather than short-term speculation.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That steady on-chain demand helps explain why POL rallied so strongly. Users are not leaving the network, and activity has not faded after the price jump. This forms a solid base under the move.

However, momentum signals are starting to diverge. The Relative Strength Index, or RSI, measures price momentum by comparing recent gains to recent losses. When RSI moves higher while price fails to follow, it suggests momentum is

not translating into price follow-through.

Between mid-October and early January, POL’s price is forming lower highs while RSI is printing higher highs. This setup is known as a hidden bearish divergence. It does not signal panic or an immediate breakdown. Instead, it points to cooling strength and rising pullback risk after a strong run.

This divergence only confirms if the next price candle forms under $0.174. For now, it simply warns that the rally may need time to break.

Whales Reduce Exposure as Retail Keeps Buying

Holder behavior helps explain how this reset could play out.

Large holders have been reducing exposure ahead of the recent price pause. Wallets holding between 100 million and 1 billion POL began trimming balances around January 3. Since then, their holdings have fallen from roughly 743.6 million POL to about 708.3 million POL.

The next whale tier, holding between 10 million and 100 million POL, followed later. This group started reducing balances around January 7, dropping from about 571.7 million POL to roughly 563.0 million POL.

At the same time, smaller holders have moved in the opposite direction. Retail cohorts, often holding between 10 and 10,000 POL, have steadily increased their balances throughout the rally and into the current pause.

This split matters. Whales appear to be responding to momentum cooling and chart signals. Retail participants, on the other hand, may be reacting to visible on-chain demand and rising network activity.

That combination often leads to consolidation. It can also create a deeper cooldown risk if sentiment-driven buying runs into fading momentum.

POL Price Levels That Define Consolidation or Deeper Correction

POL price action now decides the outcome. If POL holds above $0.155, the move is likely to stay a consolidation. This level has acted as a key support zone in early November, and holding it would allow the market to absorb selling without breaking structure.

A clean move back above $0.188 would ease bearish momentum signals. A stronger close above $0.213 would fully invalidate the divergence and reopen the path toward $0.253.

On the downside, a sustained break below $0.155 would shift the setup toward a reset. That opens room toward $0.142, with a deeper extension possible near $0.098 if selling accelerates.

For now, POL remains supported by steady on-chain demand.

The rally is not breaking, but momentum is cooling, and large holders are stepping back. Whether this becomes a simple consolidation or a deeper dip depends on how the price behaves around support.

The post Polygon Price Rallies 50% Amid On-Chain Demand, But Will it Last? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Hot crypto: UN Taps Tether to Battle Crypto Scams and Human Traffickin

Tether has partnered with the United Nations Office on Drugs and Crime to strengthen cybersecurity and combat digital asset fraud across Africa, Papua New Guinea, and other vulnerable regions.

The collaboration, announced on Friday, will fund victim protection programs, youth education initiatives, and blockchain-based solutions to reduce exploitation and build community resilience against organized crime.

According to Chainalysis, Africa has emerged as the third-fastest-growing crypto region with over $205 billion in transaction volume between July 2024 and June 2025, while simultaneously becoming a prime target for scams and trafficking operations.

A recent Interpol investigation referenced by Tether uncovered $260 million in illicit crypto and fiat flows across the continent.

Protecting Victims While Educating Future Innovators

The partnership will support UNODC’s Strategic Vision for Africa 2030, focusing on three core initiatives across multiple countries.

In Senegal, Tether will fund a multi-phase cybersecurity education program for youth, including bootcamp sessions led by the Plan B Foundation (a joint project between Tether and the City of Lugano), followed by coaching, mentorship, and micro-grants to help participants develop their ideas.

Across six African nations, including Nigeria, DRC, Malawi, Ethiopia, and Uganda, the initiative will fund civil society organizations providing direct assistance to human trafficking victims.

In Papua New Guinea, Tether will work with local universities to raise awareness about financial inclusion and digital asset fraud prevention through student competitions focused on blockchain solutions for crime prevention.

Tether CEO Paolo Ardoino said the partnership combines innovation and education to create safer opportunities for vulnerable communities.

“Through our collaboration with the United Nations Office on Drugs and Crime, we’re backing initiatives that combine innovation and education to empower communities and help create safer, more inclusive opportunities for those who need them most,” Ardoino said.

UNODC Regional Representative for West and Central Africa Sylvie Bertrand described the collaboration as a tripartite effort “bringing together the United Nations, the private sector, and Senegalese authorities, to support the vision behind Senegal’s Digital New Deal,” while promoting secure digital ecosystems and preventing organized crime.

From Enforcement Partner to Development Ally

The partnership marks a shift in Tether’s relationship with UN agencies, moving from primarily enforcement-focused coordination to proactive development work.

Between 2023 and 2025, Tether froze $3.3 billion across 7,268 wallet addresses while working with over 275 law enforcement agencies in 59 jurisdictions, according to blockchain forensics firm AMLBot.

The company’s enforcement model included burning seized tokens and reissuing clean replacements to victims, processing up to $2.7 billion in stolen funds.

Major actions included freezing $130 million in July 2024, with $30 million linked to Cambodia’s Huione Group, a platform that processed over $24 billion in suspected criminal crypto flows since 2021 and operated unlicensed exchanges, identity fraud services, and its own stablecoin.

The UN has previously warned that organized crime groups increasingly use stablecoins, particularly USDT on low-cost networks like Tron, to fund terrorism, human trafficking, and fraud operations across Southeast Asia and beyond.

A 2024 UNODC report estimated scams originating from East and Southeast Asia generated losses between $18 billion and $37 billion in 2023 alone, with much of that activity denominated in USDT.

Criminal networks have exploited the cryptocurrency’s liquidity and global reach to facilitate illicit online gambling, identity theft operations, and sophisticated pig butchering scams that manipulate victims through false romantic connections before extracting large sums.

The new partnership also comes as broader crypto security threats persist, with December seeing $76 million in losses from hacks and exploits, down 60% from November’s $194 million.

A single address poisoning scam accounted for $50 million of December’s losses, while social engineering attacks continue targeting users across major platforms, including recent incidents at Betterment and widespread wallet drains across Ethereum Virtual Machine-compatible networks.

While the new partnership focuses on prevention and education rather than enforcement, it builds on Tether’s infrastructure developments, including the recent launch of Rumble Wallet (a self-custodial crypto wallet supporting USDT, Bitcoin, and Tether Gold) and its $8 million investment in Speed, a Bitcoin Lightning Network payments company.

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!