📌 MAROKO133 Update crypto: If World War 3 Fears Spike, Does Bitcoin Crash or Becom

War scenarios do not reward clean narratives. Markets usually do two things at once. They sprint into safety, then they reprice the world after the first shock passes. Bitcoin sits right on that fault line.

That is why the “WW3 trade” is not a single bet. It is a sequence. In the first hours, Bitcoin often behaves like a high-beta risk asset. In the following weeks, it can start behaving like a portable, censorship-resistant asset, depending on what governments do next.

Are ‘World War 3’ Fears Real Right Now?

Given the current geopolitical escalations, the world world 3 conversation is more real than ever. Some might even say we are in the midst of a world war, but it’s functioning differently than it did 90 years ago.

Over the past few weeks, multiple flashpoints have tightened the margin for error.

Europe’s security debate has shifted from theory to operational planning. Officials have discussed post-war security guarantees around Ukraine, a topic that Russia has historically treated as a red line.

In the Indo-Pacific, China’s military drills around Taiwan have looked increasingly like blockade rehearsals. A blockade-style crisis does not need an invasion to break markets. It only needs shipping disruption and an incident at sea.

Add the United States’ broader posture. President Trump is basically ‘running Venezuela’ in his own comments after capturing its president from his home.

And now, the US government is talking about buying Greenland, a sovereign country that’s part of Denmark and the EU.

Then there’s Sanctions enforcement, higher-risk military signaling, and sharper geopolitical messaging. Add these, and you get a global environment where one mistake can trigger another.

This is exactly how crises become linked.

What “WW3” Means in this Model

This analysis treats “World War III” as a specific threshold.

- Direct, sustained conflict between nuclear powers, and

- Expansion beyond one theater (Europe plus the Indo-Pacific is the clearest route).

That definition matters because markets react differently to regional conflicts than to multi-theater confrontations.

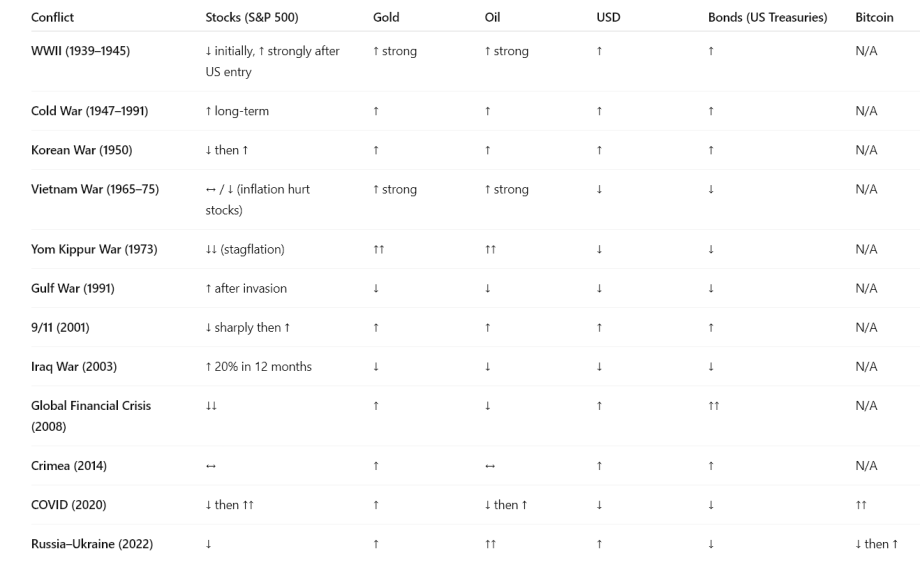

How Major Assets Behave Around War

The single most useful lesson from past conflicts is structural: Markets usually sell the uncertainty first, then trade the policy response.

Stocks

Equities often drop around the initial shock, then can recover once the path becomes clearer—even while war continues. Market studies of modern conflicts show that “clarity” can matter more than the conflict itself once investors stop guessing and start pricing.

The exception is when war triggers a lasting macro regime change: energy shocks, inflation persistence, rationing, or deep recession. Then equities struggle for longer.

Gold

Gold has a long record of rising into fear. It also has a record of giving back gains once a war premium fades and policy becomes predictable.

Gold’s edge is simple. it has no issuer risk. Its weakness is also simple: it competes with real yields. When real yields rise, gold often faces pressure.

Silver

Silver behaves like a hybrid. It can rally with gold as a fear hedge, then whipsaw because industrial demand matters. It is a volatility amplifier more than a pure safe haven.

Oil and Energy

When conflicts threat…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: Pi Coin Price Prediction: Apps Can Now Add Pi Payment

Pi Network apps can now integrate in-app PI payments in under 10 minutes, bolstering bullish PI coin price predictions with a fresh use case.

The feature is part of a new developer toolkit designed to reduce configuration work for common integrations, effectively fast-tracking DApps from prototype to launch.

This ultimately makes Pi Network a more attractive platform for building, supporting a broader ecosystem and wider demand for the atlcoin as the utility token powering real-world use cases like e-commerce.

This would go a long way to address Pi Network’s biggest pain point: Adoption. It lacks a meaningful use case to sustain long-term growth, leaving price action volatile.

Bridging liquidity issues, with short-term speculative trading compounds inflationary pressure as unlocks continue at an average rate of $900,000 in PI tokens per day.

The toolkit also marks renewed engagement from the Pi Core Team after months of relative inactivity, rekindling bullish social sentiment after key opinion leaders started to sideline the project.

PI Coin Price Prediction: Big Upgrade Sets Big Targets

Improving utility, adoption, social sentiment, and liquidity stand to give Pi network the fuel it needs to final realise a 3-month brewing symmetrical triangle pattern.

This comes as PI sees an unwind of recent momentum, with the RSI falling back below the neutral line as buy pressure fades.

Though it does still cling to an uptrend, with the MACD holding a narrow lead above the signal line. With the introduction of a catalyst like the toolkit, this could be a strong platform for growth.

The key breakout threshold sits around a past demand zone-turned-resistance at $0.265. With a higher and firmer footing here, a 95% breakout move to $0.40 could be in focus.

Over the long term, the introduction of fresh use cases with adoption from developers and users could put past resistance around $0.65 into focus for a 210% gain.

Maxi Doge: A Bull Market Play to Watch

With meme coins emerging as one of the foremost narratives this year so far, it seems attention is shifting back to more speculative plays.

When this happens, momentum always circles back to one thing: Doge.

History makes the pattern clear: Shiba Inu carried the torch from Dogecoin in 2021, then Floki, Bonk, Dogwifhat, and most recently, Neiro in 2024. Every bull run eventually delivers its own Doge-themed runner.

Now, speculators are increasingly eyeing Maxi Doge ($MAXI) as the next frontrunner.

The hype is already showing in the numbers. The $MAXI presale has raised almost $4.35 million, while early backers are earning up to 71% APY through staking rewards.

For those who missed the Doge wave before, Maxi Doge could be the next chance to catch a meme coin breakout before it takes off.

Visit the Official Maxi Doge Website Here

The post Pi Coin Price Prediction: Apps Can Now Add Pi Payments in 10 Minutes – Biggest Upgrade So Far? appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!