📌 MAROKO133 Eksklusif crypto: Solana Price Faces Crash Risk Despite 8 Million New

Solana price continues to trend higher overall, but near-term risks are building. SOL has formed an ascending wedge since the start of the month, a pattern that often precedes a pullback.

Despite strong investor participation, the setup suggests a potential dip that could undermine recent bullish efforts.

Solana Holders Counter Each Other

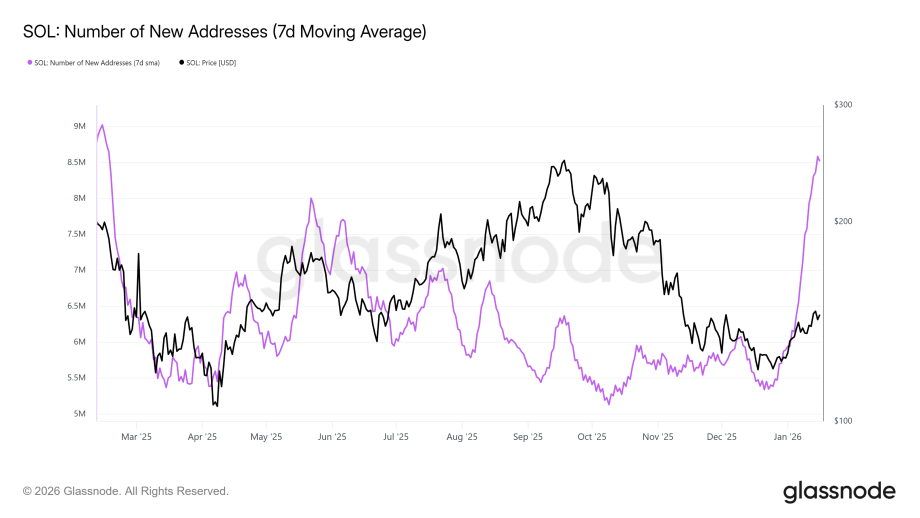

On-chain activity shows strong network growth. Since the beginning of the month, the number of addresses conducting transactions on Solana has surged sharply. At its peak, more than 8 million new addresses joined the network within a single 24-hour period.

This increase signals substantial demand for SOL. New addresses typically bring fresh capital, boosting liquidity and network usage. Such growth reflects Solana’s expanding ecosystem appeal, driven by DeFi activity, memecoins, and high-throughput applications attracting new participants.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Despite rising network adoption, macro momentum tells a different story. Exchange position change data indicates existing holders are exerting a stronger influence on price action. Buying pressure from long-term participants has weakened, offsetting the impact of new capital inflows.

As buying momentum fades, selling pressure is beginning to dominate. This shift suggests that established SOL holders are reducing exposure or preparing to sell. When legacy supply outweighs new demand, price weakness often follows, increasing the probability of a breakdown from the current structure.

SOL Price Is Looking at a Correction

Solana price trades near $144 at the time of writing, moving within an ascending wedge formed over recent days. This bearish continuation pattern projects a potential 9.5% decline, placing the downside target near $129 if the structure resolves lower.

The projected drop aligns with weakening momentum indicators. A confirmed breakdown would likely push SOL toward $136 initially. Losing that support would expose the $130 level, where buyers may attempt to stabilize the price amid broader market caution.

Still, the bearish scenario is not guaranteed. If investor sentiment improves and selling pressure eases, SOL could rebound from the wedge’s lower trend line. A move above $146 would signal renewed strength. Further upside could carry Solana toward $151, invalidating the bearish outlook.

The post Solana Price Faces Crash Risk Despite 8 Million New Investors appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: Why Is The Crypto Market Down Today? Edisi Jam 15:49

The total crypto market cap (TOTAL) and Bitcoin (BTC) maintained their bearish stance as the weekend failed to show any improvement. Altcoins shared this outlook as well, with Dash (DASH) falling by 12% in the last 24 hours.

In the news today:-

- Steak ’n Shake purchased $10 million in Bitcoin as part of its effort to build a corporate crypto treasury. The move expands the company’s “Bitcoin-to-Burger” strategy, converting fast-food revenue into digital assets.

- Solana Labs CEO Anatoly Yakovenko said Solana must continuously evolve to survive, rejecting the idea of a static, self-sustaining blockchain. His comments contrast with Ethereum co-founder Vitalik Buterin’s view that Ethereum should eventually operate independently of active developer influence.

The Crypto Market Stays In Red

The total crypto market cap declined by $8.8 billion over the past 24 hours, holding near $3.19 trillion. TOTAL remains just above the $3.18 trillion support zone. This level is critical for short-term stability as traders assess risk following recent volatility across major digital assets.

Market conditions remain relatively calm during the weekend, with limited volatility and balanced trading activity. The absence of strong selling pressure suggests consolidation. If the coming week opens with positive sentiment, TOTAL could rebound toward $3.21 trillion, reclaiming a key resistance level and restoring near-term confidence.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, continued weakness would shift the outlook bearish. A decisive break below $3.18 trillion would signal renewed selling pressure. Such a move could drag TOTAL toward $3.14 trillion or lower, reflecting broader risk aversion and reduced capital inflows into the cryptocurrency market.

Bitcoin Is Maintaining Its Support

Bitcoin price trades near $95,109 at the time of writing, holding above the key $95,000 support level. The asset recently failed to clear uptrend resistance, slowing recovery momentum. Maintaining this support is critical, as it continues to anchor short-term market structure amid cautious investor sentiment.

If BTC successfully bounces from the $95,000 zone, upside potential remains intact. A rebound could push Bitcoin toward $98,000, where resistance remains firm. Clearing that level would open the path to $100,000, provided bullish sentiment and buying pressure persist into the week.

Failure to defend $95,000 would weaken the bullish outlook. A breakdown could send Bitcoin to $93,471, with deeper losses possible. Extended selling pressure may drag BTC toward $91,298, signaling broader risk aversion and invalidating the near-term bullish thesis.

Dash Slides To $75

DASH price trades near $75, down 12% over the past 24 hours after failing to breach the $85 resistance. The altcoin is holding above the $73 support level, which remains critical for short-term stability. Price action reflects heightened volatility following a sharp rejection.

The privacy coin narrative remains strong, supporting the underlying interest in DASH. However, if capital inflows weaken, downside risk increases. A loss of the $73 support would likely trigger a decline toward $63, reflecting reduced buying pressure and broader caution among short-term traders.

Conversely, renewed investor interest could stabilize price action. Fresh capital inflows would help DASH defend $73 and regain momentum. A sustained push above $85 would signal strength, opening the path toward $100 and restoring bullish confidence in the privacy-focused cryptocurrency.

The post Why Is The Crypto Market Down Today? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!