📌 MAROKO133 Eksklusif crypto: Meteora’s 3% TGE Allocation to JUP Stakers a Smart L

Meteora is stirring the Solana community with a controversial proposal: to allocate 3% of the TGE fund to JUP stakers, not in regular tokens but in Liquidity Position NFTs.

This novel approach promises to bootstrap deep liquidity for MET from day one, yet it raises questions about fairness and concentration risk. Will this be a savvy move to bridge the two communities, or will it ignite a prolonged debate?

3% Allocation for JUP Staker

As BeInCrypto reported, Meteora is preparing for a TGE in October. The platform floated one of the community’s most notable proposals ahead of MET’s TGE.

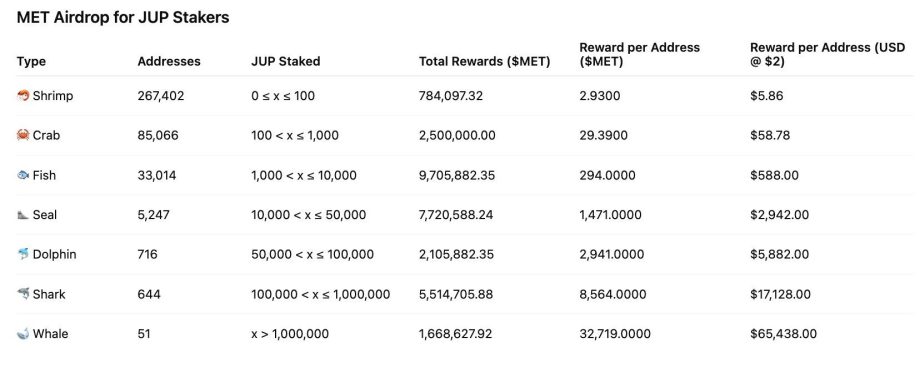

Under the plan, the project intends to allocate 3% of the TGE fund to Jupiter’s JUP stakers as Liquidity Position NFTs. Specifically, Meteora would use the 3% to seed MET liquidity in a Single-Sided DAMM V2 pool, then allocate positions to Jupiter stakers based on time-weighted staking, amount, and voting activity.

The objective is to create MET/USDC liquidity at listing without immediately adding more MET to the circulating supply. The proposal also emphasizes that “no additional tokens circulating will be added due to this proposal.” This is a “liquidity-first” approach rather than a direct token payout.

Meteora’s Co-Lead, Soju, published a public calculation to visualize scale. According to Soju, roughly 600 million JUP are currently staked. A 3% allocation would equal 30 million MET tokens. That works out to about 0.05 MET per staked JUP.

“I think its reasonable,” Soju shared.

A user on X ran some napkin math and produced a similar figure of ~0.05035 MET/JUP depending on FDV assumptions. The per-JUP reward is small but aggregated at scale, so it can serve as a meaningful incentive to convert users into MET liquidity providers.

Pros & Cons

Meteora’s proposal has clear upsides compared to other projects that reward users via airdrops. It explicitly recognizes Jupiter’s role in the Solana ecosystem, helps bootstrap MET/USDC liquidity at TGE, and reduces the immediate sell pressure because the initial reward is a liquidity position rather than freely tradable tokens. With careful engineering (time-weighted distribution, vesting attached to NFTs, withdrawal restrictions), this could be an effective bridge between the two communities.

However, significant risks remain. The community has raised fairness concerns: why should JUP stakers receive a large share? Could an “LP Army” or large wallets capture a disproportionate share of the rewards? What will the circulating supply be at TGE immediately? Earlier allocation drafts mentioned up to 25% reserved for liquidity/TGE reserve, so the total initial circulating supply remains a material transparency question.

“Difficult to debate on ‘fairness’ when JUP gave up 5% for Meteora (via mercurial stakeholders). LP army deserves more -> LP Army will capture a significant chunk of all future emissions (ongoing LM rewards), and still possess 20% (8% + 5% + 2% + 3% + 2%) of total supply at TGE,” Soju noted.

From past airdrop events, Meteora’s team must be transparent about tokenomics, clearly disclose the LP NFT redeem/vest mechanics, set per-address caps, and consider additional incentives for MET holders. If executed poorly, concentrated distribution and subsequent sell pressure could erode TGE’s value.

The post Meteora’s 3% TGE Allocation to JUP Stakers a Smart Liquidity Move? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Update crypto: Ethereum Price Retreats to 7-Week Low as Whales Balance

Ethereum (ETH) fell below $4,000 in early Asian trading today, hitting a nearly seven-week low. The sharp decline triggered notable liquidations, further denting traders’ portfolios.

Furthermore, in September, the second-largest cryptocurrency has displayed heightened volatility, with whale activity split between aggressive buying and selling.

Ethereum Price Drops Below $4,000

BeInCrypto Markets data showed that the altcoin reached a low of $3,965—its weakest level since early August. This drop came amid a broader downtrend that has dragged the asset down 12.4% over the past week.

By midday, the price had partially recovered to $4,032, reflecting a 2.93% daily decline.

The correction wasn’t totally unexpected, as previously analysts had anticipated a downward move below the $4,000 level. Still, ETH’s downward trajectory triggered significant liquidations across the market.

Coinglass data showed that over the past four hours, over $134 million in ETH long positions were liquidated, contributing to a total liquidation of $140 million.

Lookonchain, a blockchain analytics firm, reported that as ETH dipped below $4,000, a trader’s (0xa523) entire 9,152 ETH long position valued at $36.4 million was liquidated.

“His total losses now exceed $45.3 million, leaving him with less than $500,000 in his account,” the post read.

How Are Whales Trading Ethereum?

While retail traders suffered losses, whale activity revealed a more complex picture. Investor sentiment in September remained highly volatile, with whales adopting divergent strategies.

On the selling side, Grayscale transferred over $53.8 million in ETH to Coinbase yesterday.

“Big money isn’t buying Ethereum right now,” analyst Ted Pillows wrote.

Other whales followed suit, offloading tens of millions in ETH, including one sale of $12.53 million. BeInCrypto’s latest analysis indicated increased long-term holders’ sales, offsetting bullish inflows.

Conversely, accumulation efforts were also strong. Lookonchain noted that 10 wallets withdrew 210,452 ETH—valued at $862.85 million—from platforms including Kraken, Galaxy Digital OTC, BitGo, and FalconX. Another whale pulled 22,100 ETH valued at around $91.6 million from Kraken.

Nonetheless, an analyst noted that the contrasting pattern shows whales preparing for significant market shifts, either up or down. The analyst highlighted that Binance, the largest exchange for Ethereum flows, reflected this split sentiment.

Some days saw withdrawals of more than 8 million ETH, while other days showed deposits of up to 4 million ETH, hinting at potential selling. This constant push and pull highlighted the conflicting strategies of market participants.

Yet, much of the Ethereum parked on Binance remained untouched, with the utilization rate hovering near zero. This indicates that while large holders—or whales—were shifting funds, they were largely waiting on the sidelines.

“The market appears to have been preparing for a major move but has yet to trigger it. This type of behavior often precedes: An explosion in volume or a major price shift, either upward or downward. Continued low utilization despite rising deposits could indicate accumulation rather than selling pressure. A subsequent surge in utilization would signal an actual market entry, potentially pushing the price upward or triggering a sharp correction,” the analyst added.

What’s Next For Ethereum?

So, what will the next move be? Well, the majority of the analysts agree that ETH faces another downside risk. An analyst drew parallels to ETH’s performance in June, noting that the price could fall to $3,750 before rebounding to $7,000.

<blockquote class="…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!