📌 MAROKO133 Update crypto: Russia Quietly Blocks Several Crypto Media Sites Edisi

The Russian Federal Service for Supervision of Communications, Information Technology and Mass Media (Roskomnadzor) appears to have intensified what increasingly looks like a technology-driven crackdown on crypto media.

Across the country, users reported disrupted access to several crypto news outlets, with no official explanation.

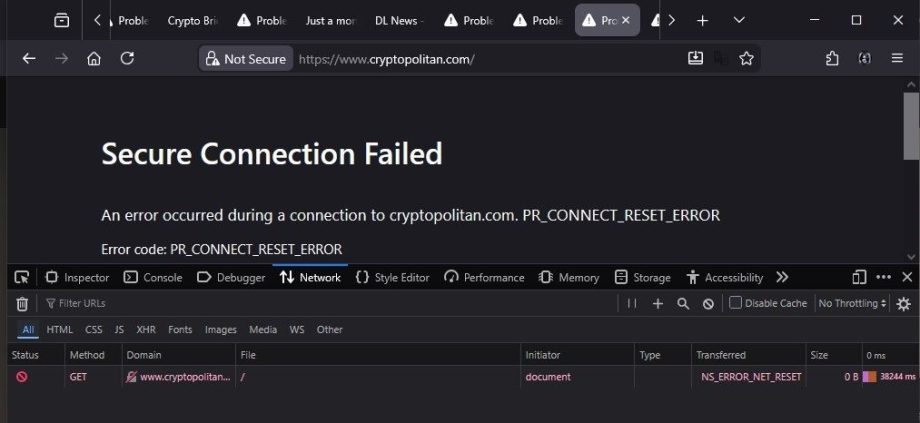

To determine whether the disruptions followed a broader pattern, we tested access to multiple crypto media websites from different locations and ran network-level diagnostics.

Several outlets failed to load on devices connected to domestic Wi-Fi networks. However, the same sites loaded normally when accessed through alternative connections.

As a result, the issue did not come from website outages or server failures. Instead, the findings point to network-level interference.

Blocking Patterns Point to ISP-level Enforcement

At the same time, Russia’s crypto regulation continues to evolve, including steps to ease restrictions on personal crypto trading.

Against that backdrop, testing conducted by the Outset PR analyst team shows that access to several international crypto media outlets is restricted at the network level.

For this analysis, we selected a representative group of crypto and financial media outlets to reflect differences in language, geography, and editorial focus.

The list included Benzinga, Coinness, FastBull, FXEmpire, CoinGeek, Criptonoticias, Cointelegraph, CoinEdition, The Coin Republic, AMBCrypto, and Nada News. This is not an exhaustive list.

According to estimates cited by industry analysts, access restrictions may affect as many as one in four crypto and financial publications.

Notably, BeInCrypto did not experience the same access disruptions during testing. This provided a neutral comparison point when assessing whether the restrictions were selective or network-wide.

Network-level blocking is not new in Russia. Authorities already use it to restrict access to social media platforms, messaging apps, and online gaming services.

After confirming that the affected domains failed to load on domestic Wi-Fi networks, we conducted further technical checks to identify the likely enforcement method.

The tests focused on whether Deep Packet Inspection (DPI) was involved, a technique that allows telecom providers to inspect and selectively restrict internet traffic.

When we enabled a DPI circumvention tool, the previously inaccessible websites loaded without issue. This shift strongly suggests the restrictions rely on DPI-based filtering rather than DNS manipulation, server-side issues, or website outages.

To assess whether access varied by internet provider, we asked 10 crypto users across different regions to open the same websites using domestic Wi-Fi networks, without VPNs or other tools. Only two reported little to no difficulty. For the remaining participants, none of the selected sites loaded.

This pattern does not resemble a centralized shutdown. Instead, it aligns with a distributed enforcement model, where providers apply restrictions using their own technical systems and timelines.

As a result, some networks blocked access entirely, while others allowed intermittent or consistent access.

Despite these local differences, the blocking behavior was strikingly similar. Users encountered the same connection-reset errors across regions and providers.

No Record in Official Blocking Registries

We also checked whether the affected websites had been formally restricted. However, none of the domains appeared in Roskomnadzor’s public blacklist.

This suggests the restrictions are not enforced through standard content takedown procedures. Roskomnadzor itself notes that certain access limitations do not require public disclosure:

“Access to internet resources may be restricted under Articles 65.1 and 65.2 of Russia’s Federal Law ‘On Communications.’ Information about such restrictions is not reflected in this public registry.”

Taken together, the findings show that access to multiple crypto and financial media websites was restricted on some domestic networks but not others. The blocking occurred at the provider level rather than through a centralized shutdown.

The affected sites were absent from Roskomnadzor’s public registry, and the connection behavior remained consistent wherever restrictions appeared.

Overall, the evidence points to unevenly applied network-level access controls across Russian internet service providers.

The post Russia Quietly Blocks Several Crypto Media Sites appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Update crypto: Korea’s Financial Regulator Weighs Ownership Caps for C

South Korea’s top financial regulator is pressing ahead with plans to limit the ownership stakes of major shareholders in domestic crypto exchanges, signaling a tougher approach to governance as the industry’s role in the financial system expands.

Key Takeaways:

- South Korea’s financial regulator is pushing to cap major shareholders’ stakes in crypto exchanges at 15%–20%.

- The proposal would be included in the planned Digital Asset Basic Act as part of stricter governance rules.

- Regulators say ownership limits are needed as exchanges move toward licensed status similar to public financial infrastructure.

Financial Services Commission (FSC) Chairman Lee Eog-weon said Wednesday that imposing ownership caps is necessary to bring governance standards in line with the growing public importance of virtual asset exchanges, according to a report by the Korea Times.

His remarks suggest the regulator intends to move forward despite pushback from industry players and concerns raised within the ruling Democratic Party of Korea.

Korea Regulator Reviews 15–20% Ownership Cap for Crypto Exchanges

The FSC is reviewing a proposal to cap controlling shareholders’ stakes at around 15% to 20%, per the report.

The provision is expected to be included in the planned Digital Asset Basic Act, often described as the second phase of South Korea’s virtual asset legislation.

Lee said existing laws, including those governing anti-money laundering and investor protection, are limited in scope and do not address broader governance issues.

The new bill, by contrast, is designed to establish a comprehensive legal framework covering the full digital asset ecosystem, from service providers to market participants.

“Under the current system, virtual asset exchanges operate under a notification system that requires renewal every three years,” Lee said at a media briefing.

“The proposed shift to an authorization system would effectively grant exchanges permanent operating status.”

Once licensed under such a system, exchanges would no longer be treated purely as private businesses, Lee added, but would take on characteristics closer to public financial infrastructure.

He warned that excessive concentration of ownership could heighten conflicts of interest and weaken market integrity.

“Securities exchanges and alternative trading systems are already subject to ownership limits, making it reasonable to apply similar standards to virtual asset platforms,” Lee said.

Korean Crypto Exchanges Push Back Against Proposed Ownership Caps

The proposal has drawn sharp criticism from the industry.

A joint council representing major domestic exchanges, including Upbit, Bithumb and Coinone, said earlier that ownership caps could undermine the development of South Korea’s digital asset sector.

At Dunamu, the operator of Upbit, Chair Song Chi-hyung and related parties control more than 28% of the company. Coinone founder Cha Myung-hoon holds roughly 53%.

If the proposed cap is enacted, both would be required to divest significant portions of their stakes.

The ruling party has also voiced reservations, arguing that similar ownership limits are rare internationally and could leave South Korea out of step with global regulatory trends.

Lee acknowledged the concerns and said discussions with lawmakers are ongoing.

Last month, South Korea revealed that it is preparing one of its most aggressive crackdowns on cryptocurrency-related financial crime by expanding its travel rule requirements.

The new threshold covers transactions under 1 million won ($680), which until now allowed users to bypass identity checks by breaking transfers into smaller amounts.

The post Korea’s Financial Regulator Weighs Ownership Caps for Crypto Exchanges appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!