📌 MAROKO133 Update crypto: Buy-the-Dip Sentiment Is Returning — How Far Can the Cr

After falling to nearly $2.0 trillion last Friday, the total crypto market capitalization has rebounded to above $2.3 trillion. Investors appear to be spotting opportunities, and buy-the-dip sentiment is resurfacing.

The key question is whether this rebound is strong enough to form a classic V-shaped recovery. Several market signals offer insight.

Signs of Buy-the-Dip Behavior After the Panic Sell-Off

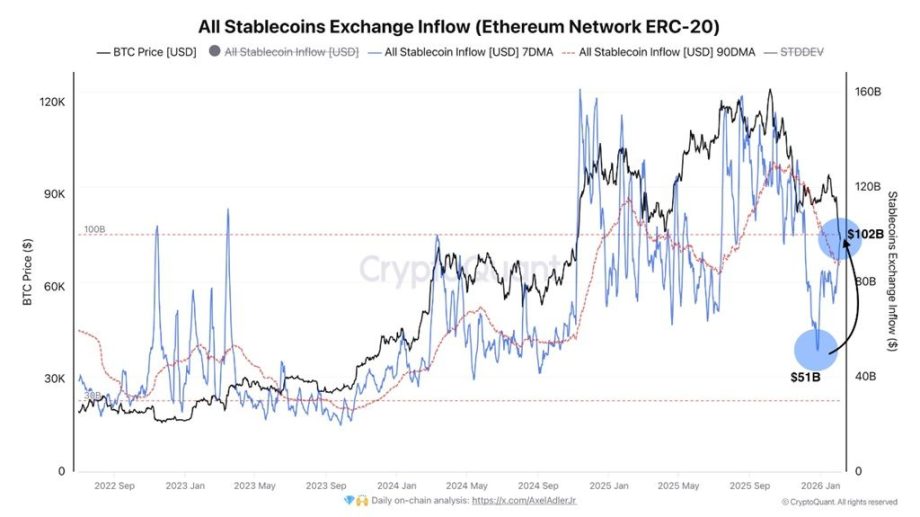

One of the earliest and most notable signals is the renewed inflow of stablecoins into centralized exchanges. This trend reversed after months of decline, even though selling pressure remains elevated.

Rising stablecoin balances on exchanges reflect investors’ readiness to deploy capital. This signal is particularly relevant to retail traders, who primarily trade on exchanges.

Data from CryptoQuant shows that the 7-day average value of ERC-20 stablecoins flowing into exchanges on Ethereum increased from $51 billion in late December 2025 to $102 billion as of now.

The $102 billion figure also exceeds the 90-day average of $89 billion. This suggests that capital deployment has accelerated over the past few weeks.

Although selling pressure remains significant, the growth in stablecoin inflows indicates renewed investor interest. Some market participants may already be accumulating positions at perceived market bottoms.

Additionally, the Accumulation Trend Score from Glassnode provides further confirmation. Wallets of all sizes, from small holders to large entities, are shifting toward stronger accumulation.

This indicator measures changes in balance across wallet cohorts and assigns a score between 0 and 1. Higher values indicate more aggressive accumulation behavior.

Glassnode’s chart shows the score moving from yellow and red zones (below 0.5) over the past two months to blue zones (above 0.5) across multiple wallet categories. Wallets holding 10–100 BTC stand out as the most aggressive buyers, with the indicator turning dark blue and approaching 1.

Observations from Lookonchain, an account that tracks notable on-chain activity, further support this data. The account has repeatedly reported whale accumulation in recent periods, not only in Bitcoin but also in Ethereum.

Overall, these signals suggest that buy-the-dip sentiment is returning among both retail investors, as reflected in rising stablecoin inflows, and whales, as reflected in on-chain accumulation. However, a sustainable recovery still depends on the market’s ability to hold key levels in total capitalization.

According to well-known analyst Daan Crypto Trades, TOTAL swept the April 2025 lows, which were associated with tariff-related news, and then closed back above them. He argues that the market must hold above $2.3 trillion in the coming days to justify expectations of a recovery toward $2.8 trillion.

“I think this is an important area for the market to hold if it wants to sustain a further relief bounce,” Daan Crypto Trades said.

He also noted that after several weeks of heightened volatility, market volatility could begin to decline. Price action may then stabilize within a defined range, allowing investors to reassess conditions and search for new opportunities.

A recent analysis from BeInCrypto also highlighted the importance of the $71,000 level for Bitcoin. Only if the price stabilizes above this support level can the market reasonably expect a broader, more extended recovery.

The post Buy-the-Dip Sentiment Is Returning — How Far Can the Crypto Market Recover? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Eksklusif crypto: Investors Pour $258M Into Crypto Startups Despite $2

Venture funding is continuing to flow into digital asset companies even as the broader crypto market struggles with heavy losses.

Key Takeaways:

- Crypto startups raised $258M in one week despite a $2T market downturn.

- Funding focused on infrastructure, compliance and institutional services, led by Anchorage Digital’s $100M round.

- Venture firms continue betting on long-term growth in AI and blockchain innovation.

Roughly $258 million was invested in crypto firms during the first week of February, according to data from DeFiLlama, underscoring that investors are still backing infrastructure and services tied to blockchain networks despite a market drawdown estimated at about $2 trillion.

Decentralized finance projects led activity with four deals, followed by payments startups with three.

Anchorage Digital Raises $100M in Tether-Led Funding Round

The largest raise came from Anchorage Digital, which secured $100 million in strategic financing led by stablecoin issuer Tether.

The federally chartered crypto bank offers custody, trading and crypto-native banking services to institutions and plans to use the funding to expand its operational infrastructure as demand from asset managers and corporations grows.

Tether said the investment reflects efforts to align stablecoins with regulated financial systems and deepen ties with institutional partners exploring tokenized payments and settlement.

Blockchain analytics provider TRM Labs raised $70 million in a Series C round led by Blockchain Capital, reaching a $1 billion valuation.

The company develops software used by exchanges, banks and government agencies to monitor blockchain transactions, detect fraud and track illicit activity.

The fresh capital will support expansion into new markets and enhance investigative tools, highlighting the growing role compliance technology plays as regulators increase scrutiny of crypto markets.

Meanwhile, Solana-based decentralized exchange aggregator Jupiter completed a $35 million strategic round backed by ParaFi Capital.

The investment was settled using JupUSD, the project’s stablecoin, with ParaFi purchasing JUP tokens and agreeing to a long-term lockup.

Jupiter also announced that prediction market platform Polymarket will integrate with its ecosystem on Solana, signaling continued development across trading applications even during weak market conditions.

Andreessen Horowitz Raises $15B to Back AI and Crypto Innovation

Last month, Andreessen Horowitz secured more than $15 billion in fresh capital, strengthening its standing as one of the most powerful venture capital firms in the US tech sector.

The funds span multiple strategies, including infrastructure, applications, healthcare, growth investments and its “American Dynamism” initiative.

In 2025 alone, the firm represented over 18% of total venture capital deployed in the United States.

Co-founder Ben Horowitz said the fundraising reflects the firm’s core philosophy that venture capital exists to give people opportunities to build companies and create value.

He framed startups as engines of social mobility, arguing that innovation ecosystems work best when individuals are free to pursue success and experimentation.

Horowitz also linked the firm’s mission to broader geopolitical competition. He warned that US leadership in technology is not guaranteed and could weaken if the country falls behind in foundational innovations.

According to the firm, technological leadership carries economic, military and cultural consequences globally.

The new capital will focus heavily on artificial intelligence and crypto, which the firm views as defining technologies of the next era.

The post Investors Pour $258M Into Crypto Startups Despite $2T Market Wipeout appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!