📌 MAROKO133 Eksklusif crypto: Avantis (AVNT) Coils in a Tight Range as Mega Whales

Avantis’ (AVNT) price is up over 4% today, but it remains down about 18% over the past month. The decentralized derivatives project has garnered new attention following its recent listing on Robinhood. Even with the buzz, the market structure shows a split setup.

AVNT is stuck inside a tight range, and both bullish and bearish pressures are visible at the same time.

Whales Sell as TVL Drops and Volume Support Softens

The data first shows some mild bearish pressure.

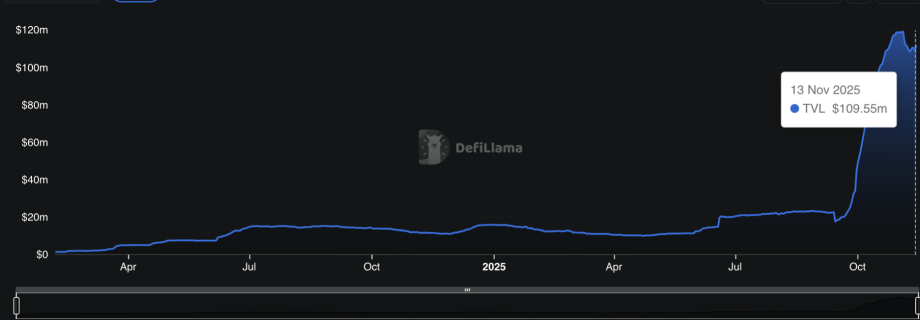

Avantis’ total value locked has slipped from $119.42 million on November 4 to $109.55 million on November 13. That is a drop of 8.26% in ten days. A TVL drop often signals lighter on-chain activity, and some whales reacted to this pullback.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Whales have reduced their holdings by 17.19% over the past week, bringing their balance down to 365,439 AVNT. They sold about 75,761 AVNT during the TVL fall. It is not a large amount compared to the broader market flows, but it still reflects some hesitation from mid-sized holders.

This hesitation may also be linked to the volume trend. The On-Balance Volume line is sitting right on its rising trendline. If OBV breaks below it, it would signal early weakness in volume support behind the AVNT price.

This aligns with the small whale outflows, which could mark the onset of OBV weakening.

Mega Whales Buy as a Reversal Setup Emerges

The bullish side of Avantis crypto is much stronger. The largest holders, or mega whales, have increased their balances by 0.67% this week. That means mega whales added roughly 6.6 million AVNT, worth around $3.3 million at the current price. This is significantly larger than the whale selling and shows clear confidence from the biggest players.

The Robinhood listing may also be feeding into this shift, giving mega whales a reason to position early before any breakout attempt.

Exchange balances back this up. They have dropped 9.57% over the past week. When tokens leave exchanges, it often means retail traders and smaller holders are shifting tokens into private wallets. It supports the idea that dip-buying exists across Avantis.

Momentum also points toward a possible trend reversal. Between November 6 and November 12, the AVNT crypto price made a lower low, but the Relative Strength Index made a higher low.

RSI measures the speed of price movement, and this pattern is a standard bullish divergence. It typically occurs when a downtrend is losing its momentum. The 18% month-on-month downtrend, to be precise.

Avantis Price Still Trades in a Tight Range — But Bulls Look Slightly Stronger

The Avantis price now trades inside a narrow band between $0.63 at the top and $0.47. Today’s price, near $0.51, sits right in the middle. This tight structure means the next move can be sharp.

If buyers take control, the first major resistance is $0.72, the level that rejected the rally on November 1. A clean daily close above it can trigger a stronger recovery and confirm the bullish divergence strength.

If sellers take control, the key level to watch is $0.47, which is only 7.62% away. A breakdown would expose AVNT price to new lows, especially if OBV fails and whales extend their selling.

Right now, both sides are active. However, the bullish side appears slightly more impactful, as mega whales are accumulating millions of tokens, exchange balances are decreasing, and the RSI is signaling a potential Avantis price reversal.

The post Avantis (AVNT) Coils in a Tight Range as Mega Whales Quietly Accumulate appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Update crypto: Coinbase Slams Banks for Trying to Ban Stablecoin Rewar

Coinbase has mounted a fierce defense of stablecoin reward programs, accusing banking associations of attempting to expand Congress’s interest prohibition beyond its statutory limits illegally.

The crypto exchange’s pushback targets efforts by bank lobbyists to classify merchant discounts and third-party benefits as prohibited “indirect interest” under the GENIUS Act.

Chief Policy Officer Faryar Shirzad argued that banking associations are misinterpreting congressional intent by claiming merchant rewards tied to stablecoin payments constitute illegal interest.

“Congress was clear that the GENIUS Act only prohibits interest/yield paid by the issuer, and nothing else,” Shirzad stated on X, warning that expanding the ban to third-party benefits would create “unprecedented, far-reaching and unpredictable” implications.

Banking Groups Push Expansive Interest Ban

The American Bankers Association and 52 state banking associations submitted letters to the Treasury urging strict implementation of the GENIUS Act’s interest prohibition.

Their November 4 filing proposes defining “interest or yield” broadly to encompass any economic benefit, preventing evasion through affiliates, and treating indirect payments as if they were issuer payments.

Brooke Ybarra, ABA’s senior vice president of innovation and strategy, told the organization’s annual convention that “a detriment would be allowing Coinbase or Kraken to pay interest on payment stablecoins.”

Jess Sharp, ABA senior vice president, acknowledged the challenge ahead.

“This is not an easy fight, it’s a very well resourced group on the other side,” Sharp said. “Banks take deposits and convert them into loans, that’s what we do, and fewer deposits means fewer loans.”

The associations warned that community banks face particular vulnerability to deposit outflows, citing analysis showing disintermediation could eliminate approximately $1.5 trillion in lending capacity and shrink small business and farm credit by $110 billion and $62 billion, respectively.

Coinbase Argues Consumer Harm

Coinbase Institute’s argument shows an analysis that U.S. merchants paid over $180 billion in card fees in 2024, costs that stablecoins could help reduce.

The company’s November 4 Treasury submission emphasized that the GENIUS Act prohibits only permitted payment stablecoin issuers from paying interest “solely in connection with the holding, use, or retention” of stablecoins.

“The statute addresses payments by issuers only—nowhere does the text reference ‘indirect’ interest, affiliates, or third-party benefits,” Coinbase wrote, adding that “treating third-party rewards or loyalty programs as prohibited interest would rewrite Congress’s carefully-drawn lines.”

The exchange warned that broad interest bans would hurt consumers by eliminating market-based incentives that lower payment costs and spur merchant acceptance.

Coinbase cited scenarios where small businesses offering discounts for stablecoin payments could face prohibition if they maintain any relationship with issuers, even routine API integrations.

UK Expansion Amid Similar Regulatory Pressure

This new response comes as Coinbase recently launched a 3.75% AER savings account for UK users through ClearBank, offering FSCS protection of up to £85,000, effective November 11.

The move positions the exchange to compete with traditional British banks, where major institutions like HSBC and NatWest pay between 1.15% and 3.5%.

Keith Grose, CEO of Coinbase UK, framed the offering as building “the UK’s number 1 financial app.“

The launch coincides with the Bank of England proposing a £20,000 cap on individual stablecoin holdings.

Coinbase vice president Tom Duff Gordon called the restrictions “bad for UK savers, bad for the City and bad for sterling.”

Notably, Shirzad also published a Telegraph commentary criticizing the Bank’s excessive caution, arguing these constraints risk “deterring adoption and innovation, making GBP stablecoins unusable for wholesale markets, and undermining the UK’s global competitiveness.“

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!