📌 MAROKO133 Breaking crypto: Bittensor Jumps 10% After Grayscale Officially Unveil

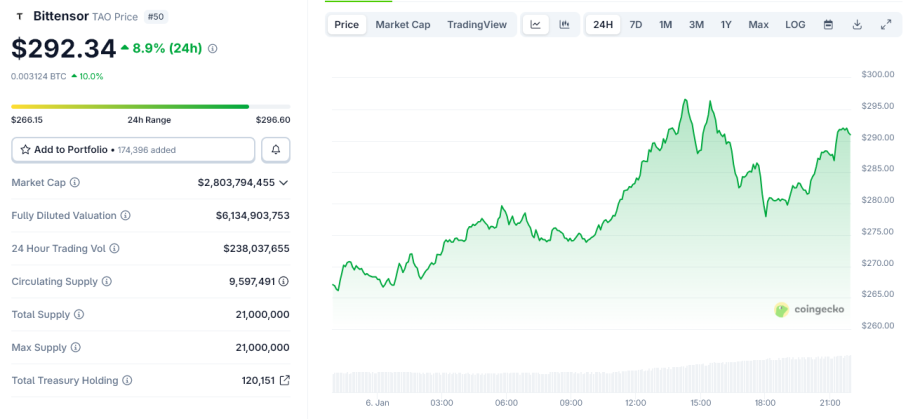

Bittensor (TAO) surged nearly 10% on Tuesday, climbing above $290, after Grayscale formally unveiled the Grayscale Bittensor Trust (GTAO). This marks one of the first regulated investment vehicles offering exposure to the decentralized AI network.

The rally pushed TAO to its highest level in weeks, with 24-hour trading volume topping $230 million. The move comes as investors react to growing institutional interest in AI-linked crypto assets, particularly those with reduced supply growth.

Grayscale Launch Opens Regulated Access to TAO

Grayscale said the Trust allows investors to gain exposure to Bittensor’s native token TAO through a traditional security structure, without the need to directly buy or custody the asset.

Shares of the Trust trade on OTC Markets under the ticker Grayscale Bittensor Trust (GTAO).

According to Grayscale, GTAO aims to track TAO’s market price using the Coin Metrics Real-Time Bittensor Reference Rate, minus fees and expenses.

As of January 5, the Trust reported a total expense ratio of 2.5% and a net asset value of $7.96 per share.

The launch follows a series of structural changes within the Bittensor ecosystem. In mid-December, the network completed its first halving event, cutting daily TAO emissions by roughly 50%.

The move reduced inflation and introduced tighter supply dynamics. This made Bittensor’s structure comparable to Bitcoin’s scarcity model.

Separately, Grayscale has already filed paperwork with US regulators to convert its Bittensor Trust into a spot ETF. This is part of a broader push by Grayscale Investments to expand regulated crypto exposure beyond Bitcoin and Ethereum.

While approval timelines remain uncertain, the filing has strengthened the narrative around TAO’s institutional accessibility.

Bittensor operates as a decentralized marketplace for machine intelligence, where contributors earn TAO by providing compute and AI services to the network.

The protocol has gained attention as investors look for blockchain-based alternatives to centralized AI infrastructure.

With reduced issuance, rising staking activity, and new regulated access points, TAO’s recent price action suggests markets are reassessing the asset’s long-term positioning.

The post Bittensor Jumps 10% After Grayscale Officially Unveils TAO Trust appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Eksklusif crypto: Can Trump Seize Venezuela’s $60 Billion Bitcoin Rese

Speculation around Venezuela’s alleged Bitcoin holdings surged after US forces captured President Nicolás Maduro and brought him to the United States.

Some claims suggest the US could now seize a massive, hidden Bitcoin reserve—often estimated at 600,000 BTC, worth roughly $60 billion at current prices. But legal reality and on-chain data tell a far more restrained story.

Venezuela’s Secret 600,000 Bitcoin Stash: Fact or Fiction?

The rumor centers on the idea that Venezuela quietly accumulated Bitcoin over several years to bypass sanctions.

Supporters point to informal oil trades, gold sales, and crypto usage inside the country as evidence of a large “shadow reserve.”

However, there is no on-chain proof to support claims of hundreds of thousands of Bitcoin held by the Venezuelan state.

No wallets have been identified, nor have custodians been named. There is no verifiable on-chain evidence for this claim.

In short, the $60 billion figure remains speculation, not evidence.

What Venezuela Actually Holds

The only amount that appears consistently in public trackers and analyst estimates is around 240 BTC. Even that figure is debated and modest by global standards.

Crucially, this small amount is not clearly linked to wallets that the US can access. It may sit in cold storage, third-party custody, or structures outside US jurisdiction.

Ownership also matters. State-held assets face much higher legal barriers than personal property.

Can the US Legally Seize Maduro’s Bitcoin Stash?

Under US law, the answer is likely yes. Once Nicolás Maduro is physically in the United States and indicted, federal courts generally assert jurisdiction.

The long-standing Ker–Frisbie doctrine allows prosecutions even if a defendant is brought in through irregular means.

The US also does not recognize Maduro as Venezuela’s legitimate leader. That weakens any claim to head-of-state immunity in US courts.

But personal custody is not the same as asset control.

Seizing Bitcoin requires two things – legal authority and physical access.

First, prosecutors must prove the Bitcoin is directly linked to criminal activity charged in court. Estimates, intelligence claims, or geopolitical narratives are not enough.

Second, authorities must be able to access the assets. That means private keys, compliant custodians, or exchanges within US reach. Without keys or cooperation, Bitcoin cannot be seized—no matter who is in custody.

This applies to both the rumored reserve and the smaller 240 BTC figure.

What is Realistic Going Forward

The US may freeze assets if it identifies them. It may pressure intermediaries or monitor suspected wallets. It may also use forfeiture threats as leverage during legal proceedings.

But outright seizure of a $60 billion Bitcoin reserve remains legally and practically implausible.

Arresting Donald Trump’s most high-profile adversary does not unlock Venezuela’s Bitcoin, real or rumored.

Without proof, jurisdiction, and keys, even the boldest claims stay out of reach.

The post Can Trump Seize Venezuela’s $60 Billion Bitcoin Reserve, If It Exists? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!