📌 MAROKO133 Hot crypto: Trump’s Crypto Retirement Order Just Went Federal — GOP Mo

A US Republican lawmaker has introduced legislation to permanently embed President Donald Trump’s executive order on retirement investments.

This move could expand Americans’ access to crypto-exposed products in 401(k) plans. The bill aims to transform a temporary policy directive into a binding federal law.

Republican House Pushes to Codify Executive Order

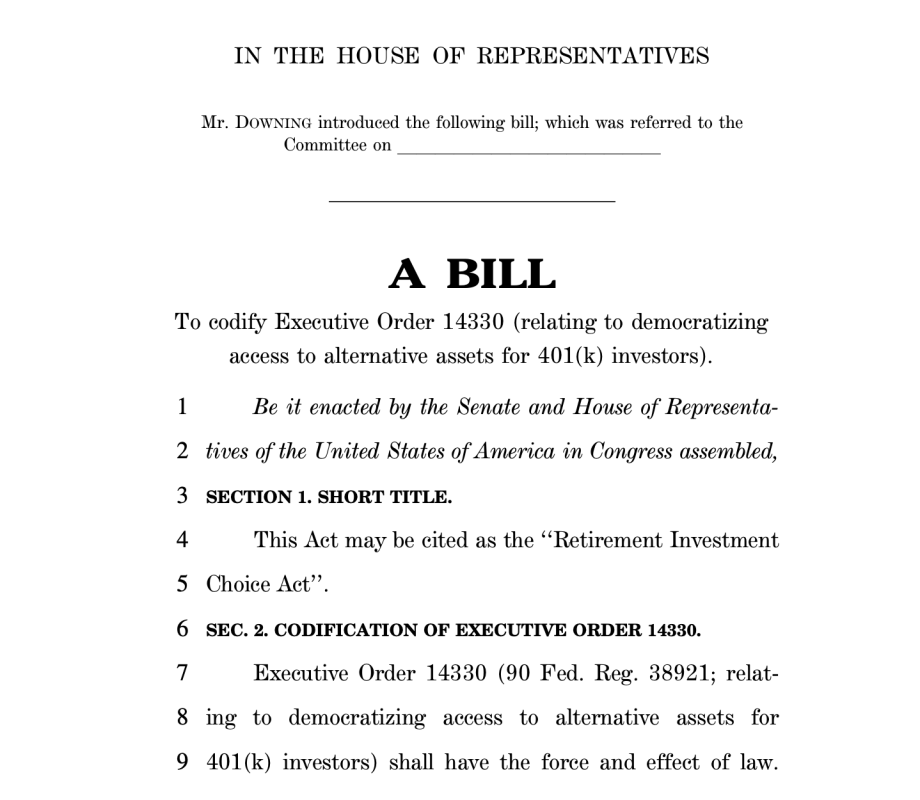

On Tuesday, Representative Troy Downing (R-Mont.) introduced the Retirement Investment Choice Act. The one-page bill grants Executive Order 14330—Trump’s directive allowing crypto in retirement accounts—“the force and effect of law.”

The initiative follows Trump’s August executive order instructing the Labor Department to permit “alternative assets,” including digital assets, when deemed appropriate by plan fiduciaries. The proposal could reshape the $25 trillion US retirement market by opening a new channel for Bitcoin-linked investment vehicles if enacted.

Executive orders can guide policy but lack statutory permanence. Future administrations or courts can reverse them. Downing’s bill aims to fix that gap by legally binding the directive.

“Alternative investments hold the transformative potential to supercharge Americans’ financial security,” Downing said. “I applaud President Trump for his leadership to democratize finance.”

Meanwhile, the Department of Labor has 180 days to propose rule changes enabling plan sponsors to include such assets. However, the ongoing government shutdown could delay progress.

About a month after Trump’s order in September, nine lawmakers urged SEC Chair Paul Atkins to accelerate implementation. They argued that 90 million Americans excluded from alternative assets deserve a stable, dignified retirement.

Industry groups, including the American Retirement Association, back the bill. They say fiduciaries—not regulators—should decide suitable investment options.

New Flows Could Reshape Crypto Markets

If the bill becomes law, 401(k) providers may offer crypto funds in addition to traditional assets. This could become Washington’s most consequential move for digital-asset markets seeking long-term capital. Analysts estimate that even a 1% allocation from US accounts could add tens of billions of dollars to crypto markets.

According to Bitwise, a 1% allocation of US 401(k) assets would channel $122 billion into crypto, while a 3% share could drive nearly $360 billion. Global crypto ETFs confirm the demand: by Oct. 4, 2025, funds saw record inflows of $5.95 billion, with the US making up $5 billion.

Bitcoin and Ethereum ETFs have already been approved, and several altcoin-based ETFs now await SEC review. While the bill’s passage remains uncertain, its arrival shows clear political momentum to normalize crypto within retirement portfolios.

The post Trump’s Crypto Retirement Order Just Went Federal — GOP Moves to Lock It In appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: BlackRock Hits $13.4T AUM — Larry Fink Says Digital W

BlackRock’s assets under management surged to $13.46 trillion in the third quarter of 2025, up from $11.48 trillion a year earlier, reflecting how rapidly traditional finance is merging with digital-asset strategies.

Larry Fink, CEO of BlackRock, noted that roughly $4.1 trillion is now held in digital wallets worldwide — much of it outside the United States.

BlackRock Bets on Crypto Boom

Fink argued that if products like ETFs could be tokenized and digitized, it would allow new crypto-market investors to transition toward traditional long-term investment products, creating “the next wave of opportunity” for BlackRock.

The comment coincided with the world’s largest asset manager reporting record assets under management of $13.46 trillion for the quarter, underscoring how fast traditional finance converges with digital assets.

Fink’s outlook places tokenized markets near the center of BlackRock’s growth thesis. He said that crypto now plays a role similar to gold — an alternative store of value — and pointed to expanding institutional demand through regulated channels. Company data show digital-asset exposure in its funds has roughly tripled since 2024. Analysts say the trend reflects surging demand for Bitcoin ETFs and growing industry interest in tokenization initiatives. BlackRock’s Aladdin technology supports these initiatives.

BlackRock’s assets climbed from $11.48 trillion a year earlier, with long-term net inflows of $171 billion. Revenue rose to $6.5 billion on an 8% rise in organic base fees, while total expenses increased to $4.6 billion. Private-market inflows reached $13.2 billion, and retail inflows rose to $9.7 billion. GIP, Preqin, and HPS Acquisitions bolstered data and infrastructure capabilities supporting its digital-asset pipeline.

Technology revenue jumped 28% to $515 million, led by Aladdin — a system increasingly used for managing tokenized portfolios and integrating blockchain analytics. Fink described BlackRock’s model as a “unified public-private platform,” linking traditional ETFs, private credit, and digital assets under one architecture.

Bitcoin ETFs Anchor Institutional Shift

The firm’s iShares Bitcoin Trust (IBIT) has become its top-earning ETF, generating $244.5 million annually from a 0.25% fee. IBIT’s assets have reached nearly $100 billion in under 450 days — faster than any ETF in history. Across US markets, Bitcoin ETFs are on pace to attract $30 billion this quarter, a report found, reflecting Wall Street’s tightening control over crypto liquidity.

Fink’s optimism coincides with a broader institutional shift. JP Morgan’s head of markets confirmed the bank will buy and trade Bitcoin — a pivotal signal legitimizing digital assets within mainstream finance. Morgan Stanley dropped restrictions on which wealth clients can access crypto funds, extending exposure across all account types. This “wirehouse distribution” trend unlocks new ETF demand across retail and institutional channels.

Meanwhile, BlackRock’s own balance-sheet exposure has grown. Thomas Fahrer reported that the company purchased 522 Bitcoin, bringing total holdings to about 805,000 BTC — valued near $100 billion. Analysts interpret the move as a balance-sheet signal of conviction in digital reserves. Market observer Holger Zschaepitz noted that its growing crypto franchise partly drove total inflows of $205 billion in Q3.

The $4.5 trillion figure often cited by industry analysts illustrates the scale of digital wealth outside the banking system. For traditional asset managers, that capital represents both competition and opportunity. With its expanding ETF empire, tokenization initiatives, and institutional credibility, BlackRock appears positioned to intermediate the next wave of on-chain finance — one that could make digital wallets as central to investing as custodial accounts are today.

The post BlackRock Hits $13.4T AUM — Larry Fink Says Digital Wallets Hold the Next $4 Trillion Opportunity appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!