📌 MAROKO133 Hot crypto: What to Expect From XRP Price in February 2026 Wajib Baca

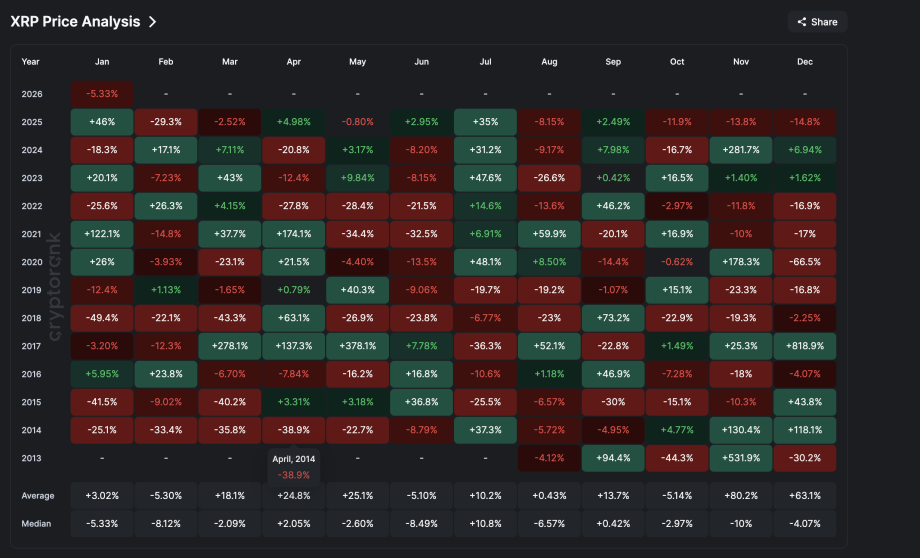

XRP is entering February under pressure. The token is down nearly 7% in the past 24 hours and about 5% over the past month, reflecting growing weakness across the market. Historically, February has been a difficult month for the XRP price. Data shows its median February return stands at −8.12%, with an average decline of −5%. In 2025, the token fell by almost 29% during the same period.

This year, technical and on-chain signals suggest similar risks are building. At the same time, selective accumulation and early momentum indicators hint that recovery is still possible. Here is what the data shows.

Why the Price Pullback Was Expected

XRP continues to trade inside a long-term descending channel on the two-day chart. A falling channel is a bearish structure where price makes lower highs and lower lows within parallel trendlines.

Since mid-2025, this pattern has kept rallies capped and pushed prices steadily lower. As historically weak February approaches, XRP is drifting closer to the channel’s lower boundary, increasing downside risk.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Vasily Shilov, Chief Business Development Officer at SwapSpace, said seasonal patterns still matter but are no longer decisive on their own.

“ETF flows are currently more reliable directional drivers,” he explained.

“Range-bound movement is the most likely outcome if macro clarity does not emerge,” he also added.

This technical weakness was not sudden, though.

Between October 2 and January 5, XRP formed a lower high in price, while the Relative Strength Index (RSI) made a higher high. RSI measures momentum, showing whether buying or selling pressure is strengthening.

This mismatch is called hidden bearish divergence. It often signals that upside strength is fading before a correction begins. That signal flashed in early January and was followed by a nearly 30% decline.

Now, a new setup is forming.

Between October 10 and January 29, the XRP price printed a lower low (active at press time) while RSI is attempting to form a higher low. This creates the basis for a bullish divergence, which can signal trend exhaustion.

For this signal to confirm:

- The next 2-day XRP price candle must form above $1.71, confirming the lower low price setup

- RSI must remain above 32.83

If both conditions are met, downside momentum weakens and rebound potential improves. If they fail, the bearish channel remains in control.

Money Flow And Whale Activity Show Mixed Signals

While the XRP price trends lower, capital flow data paints a more complex picture.

The Chaikin Money Flow (CMF), which tracks institutional and large-wallet buying pressure, has been rising between January 5 and January 25, even as the price fell. This forms a bullish divergence.

It suggests that larger, possibly institutional players have been accumulating XRP quietly during the pullback.

ETF flow data supports this trend. Although January’s overall ETF flows remain net negative due to heavy outflows on January 21, net inflows have improved steadily toward the month-end. Recent green bars show renewed interest from institutional channels.

Shilov said that January’s ETF volatility reflects broader macro caution rather than structural weakness in XRP demand.

He explained that while macro pressures pushed investors toward safer assets like gold and silver, XRP spot ETFs have still attracted more than $1.3 billion in total inflows since launch and have not recorded a month of net redemptions.

“The scale and persistence of inflows suggest a trend reversal is unlikely for now,” he mentioned

However, this optimism is being challenged by exchange data.

XRP’s exchange flow balance has flipped sharply higher since January 17, moving from −7.64 million to +3.78 million. More concerning is the pattern.

Three consecutive inflow peaks appeared on January 25, 27, and 29. A similar structure formed earlier this month on January 4, 8, and 13. After that, XRP fell from $2.10 to $1.73, a drop of about 18%. This makes the current inflow structure a clear risk signal despite ETF optimism.

Shilov added that ETF demand alone is still not strong enough to fully isolate XRP from broader market forces. Based on SwapSpace trading data, he said XRP’s short-term moves continue to track Bitcoin’s trend and macro risk sentiment when ETF flows turn unstable.

“BTC’s direction, macro stress, and derivatives positioning are likely to dictate risk appetite in the near term,” he noted.

XRP Whales Present An Interesting Perspective

Whale behavior adds another…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Eksklusif crypto: What to Expect From XRP Price in February 2026 Wajib

XRP is entering February under pressure. The token is down nearly 7% in the past 24 hours and about 5% over the past month, reflecting growing weakness across the market. Historically, February has been a difficult month for the XRP price. Data shows its median February return stands at −8.12%, with an average decline of −5%. In 2025, the token fell by almost 29% during the same period.

This year, technical and on-chain signals suggest similar risks are building. At the same time, selective accumulation and early momentum indicators hint that recovery is still possible. Here is what the data shows.

Why the Price Pullback Was Expected

XRP continues to trade inside a long-term descending channel on the two-day chart. A falling channel is a bearish structure where price makes lower highs and lower lows within parallel trendlines.

Since mid-2025, this pattern has kept rallies capped and pushed prices steadily lower. As historically weak February approaches, XRP is drifting closer to the channel’s lower boundary, increasing downside risk.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Vasily Shilov, Chief Business Development Officer at SwapSpace, said seasonal patterns still matter but are no longer decisive on their own.

“ETF flows are currently more reliable directional drivers,” he explained.

“Range-bound movement is the most likely outcome if macro clarity does not emerge,” he also added.

This technical weakness was not sudden, though.

Between October 2 and January 5, XRP formed a lower high in price, while the Relative Strength Index (RSI) made a higher high. RSI measures momentum, showing whether buying or selling pressure is strengthening.

This mismatch is called hidden bearish divergence. It often signals that upside strength is fading before a correction begins. That signal flashed in early January and was followed by a nearly 30% decline.

Now, a new setup is forming.

Between October 10 and January 29, the XRP price printed a lower low (active at press time) while RSI is attempting to form a higher low. This creates the basis for a bullish divergence, which can signal trend exhaustion.

For this signal to confirm:

- The next 2-day XRP price candle must form above $1.71, confirming the lower low price setup

- RSI must remain above 32.83

If both conditions are met, downside momentum weakens and rebound potential improves. If they fail, the bearish channel remains in control.

Money Flow And Whale Activity Show Mixed Signals

While the XRP price trends lower, capital flow data paints a more complex picture.

The Chaikin Money Flow (CMF), which tracks institutional and large-wallet buying pressure, has been rising between January 5 and January 25, even as the price fell. This forms a bullish divergence.

It suggests that larger, possibly institutional players have been accumulating XRP quietly during the pullback.

ETF flow data supports this trend. Although January’s overall ETF flows remain net negative due to heavy outflows on January 21, net inflows have improved steadily toward the month-end. Recent green bars show renewed interest from institutional channels.

Shilov said that January’s ETF volatility reflects broader macro caution rather than structural weakness in XRP demand.

He explained that while macro pressures pushed investors toward safer assets like gold and silver, XRP spot ETFs have still attracted more than $1.3 billion in total inflows since launch and have not recorded a month of net redemptions.

“The scale and persistence of inflows suggest a trend reversal is unlikely for now,” he mentioned

However, this optimism is being challenged by exchange data.

XRP’s exchange flow balance has flipped sharply higher since January 17, moving from −7.64 million to +3.78 million. More concerning is the pattern.

Three consecutive inflow peaks appeared on January 25, 27, and 29. A similar structure formed earlier this month on January 4, 8, and 13. After that, XRP fell from $2.10 to $1.73, a drop of about 18%. This makes the current inflow structure a clear risk signal despite ETF optimism.

Shilov added that ETF demand alone is still not strong enough to fully isolate XRP from broader market forces. Based on SwapSpace trading data, he said XRP’s short-term moves continue to track Bitcoin’s trend and macro risk sentiment when ETF flows turn unstable.

“BTC’s direction, macro stress, and derivatives positioning are likely to dictate risk appetite in the near term,” he noted.

XRP Whales Present An Interesting Perspective

Whale behavior adds another…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!