📌 MAROKO133 Breaking startup: 🧩SaaS leader Mekari acquires Desty. 🏆Sea Ltd back on

Dear subscribers,

Indonesia ended the last week in horror as riots erupts across Indonesia driven by political demonstration that turned fatal. The whole weekend was a terrorizing one as riots spreads to smaller regions. Although most of the riots have died down, this week still starts in a rather fearful mood. We wish everyone safe and hope the situation improves soon for everyone

And now, this week’s highlights: funding (Pintarnya, Blitz, Kozystay), platform moves (Mekari, Amartha), and profitability signals (Wagely). Around the region, SeaLtd retakes the top spot by market cap, Atome scales profitably, and ZUZU raises to double-down on AI. Payment rails and rules continue to strengthen supporting Southeast Asia fintech’s march toward ~US$1.1T in 2025.

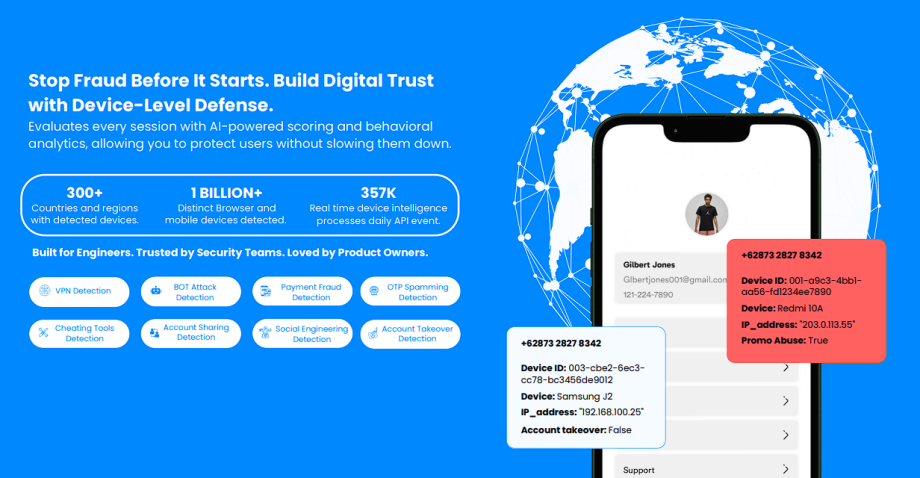

This week’s newsletter is sponsored by Keypaz, an advanced device-level fraud prevention system using fingerprinting, real-time monitoring, and AI risk scoring. Keypaz blocks high-risk devices across billions monitored globally, reducing operational costs, protecting brand reputation, and securing legitimate user experiences. [Try Now].

Keypaz, pioneer of proactive digital fraud defense!

Best regards,

The DailySocial Team

🚨 What’s New

-

Funding round-up (ID ecosystem):

-

Pintarnya, Indonesia’s jobs & worker-finance platform raised a US$16.7M Series A led by Square Peg, Vertex Ventures, and East Ventures to deepen its tech stack and expand worker financing. Traction to date: 10M+ job seekers, 40K+ employers, nearly 5× YoY revenue growth, breakeven targeted this year, and potential regional expansion. [Read more]

-

Blitz Electric Mobility, Indonesia-based EV logistics enabler closed Pre-Series A led by Vynn Capital with Iterative Capital and new investors including Balaji Srinivasan. In 2024: 3× revenue growth, 70% lower burn. Cumulative stats: 14M+ deliveries, 1,000+ e-motorbikes, 220M km traveled, operations in 30 cities. Indonesia’s courier market is projected to grow from US$7.86B (2025) to US$11.15B (2030). [Read more]

-

Kozystay acquires BaliSuperHost. Shortly after a Series A led by Integra Partners with Cercano Management and Intudo, Kozystay bought BaliSuperHost, the island’s largest premium villa operator. The combined group becomes Indonesia’s largest tech-enabled short-term rental manager with 1,000+ units across apartments, villas, and aparthotels. [Read more]

-

-

Mekari (Indonesia’s most valued SaaS startup) acquired Desty, an omnichannel commerce platform used by thousands of merchants. The move extends Mekari from back-office tools into integrated digital commerce—unifying inventory, orders, warehousing, products, finance, and customer comms in one system. Desty (founded 2021) adds landing pages, online stores, POS, and omnichannel orchestration. Expect faster merchant growth and stronger positioning as an end-to-end SME platform in Indonesia. [Read more]

-

Amartha becomes Amartha Financial Group (ID) to expand beyond micro-lending into payments and micro-investment to strengthen village-level economies (50,000 villages). With backers like IFC and Women’s World Banking, Amartha applies AI-based credit scoring from a decade of community data to deliver inclusive products distinct from urban-centric fintechs—while advancing financial literacy and inclusion for strategic segments such as women. [Read more]

-

Earned wage access platform Wagely reports full profitability, with US$120M+ disbursed across 3.5M transactions and loss rates <0.5%. With 200+ employers (incl. Adira Finance, BAT), Wagely serves 1M+ workers in Indonesia, positioning EWA as an employee benefit (not a loan) to drive recurring revenue. Beyond EWA, Wagely added savings and budgeting, and expanded in Bangladesh. Wagely sees room to apply generative AI for efficiency and worker financial literacy. [Read more]

👏 What’s Exciting

-

Sea Ltd. back at #1 by market cap (SEA)

Sea reclaimed the title of Southeast Asia’s most valuable public company at ~US$111B, edging past DBS (~US$110.3B) after a 300% rally fueled by Shopee outperformance. Cost discipline drove profitability; SPX Express logistics and digital finance are long-term levers. DBS also rallied ~65% on lending and wealth management strength but ceded the top spot. -

Atome Financial delivers profitable scale

2024 operating income: US$236M (+63% YoY); <a href="https://www.atome.id/news/atome-financial-posts-record-us236m-operating-income-marks-full-year-profi…Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

📌 MAROKO133 Hot startup: Bali mandates tourist app 📲, BI adjusts burden-sharing 💵,

Dear subscribers,

This week’s update highlights major developments shaping Indonesia’s digital and economic landscape. Bali has introduced a mandatory tourist app to support sustainable travel, VinFast announced a landmark EV factory investment, and Venturi Partners has closed fresh funding for its second vehicle targeting consumer brands across Asia. On the innovation front, QRIS adoption continues to accelerate, driving SME participation in the digital economy. Meanwhile, governance challenges resurfaced with ongoing updates in the Tanihub case and the recent detention of Gojek founder and ex-Minister of Education, Nadiem Makarim—reminders of the importance of transparency and accountability in sustaining ecosystem growth.

Best regards,

The DailySocial Team

🚨 What’s New

-

VinFast commits IDR 185 trillion EV plant in Subang, West Java 🚗⚡

Vietnamese EV maker VinFast announced plans to invest IDR 185 trillion (approx. USD 11.2 billion) to build an electric vehicle factory in Subang, around 2 hours from Jakarta. The facility is expected to become one of the largest EV plants in Southeast Asia, producing both cars and batteries for domestic and export markets. This investment marks a major win for Indonesia’s strategy to position itself as a regional EV hub, leveraging its nickel reserves and supportive policies. -

Bali mandates new app for tourists 📲

Starting early September this week, international visitors to Bali are required to download the “Love Bali” app before entry. The app is designed to track tourist activities, promote sustainable travel, and ensure compliance with local regulations. Authorities say the platform will also function as a digital guide, providing travelers with verified information about destinations, cultural etiquette, and environmental conservation. -

Ex-minister & Gojek co-founder Nadiem detained on graft charges ⚖️

Indonesia’s Corruption Eradication Commission (KPK) has detained Nadiem Makarim, former Minister of Education and founder of Gojek, as a suspect in a corruption investigation linked to state-funded education projects. According to the KPK, the case involves procurement irregularities and potential misuse of public funds through $563 million Google Chromebook laptop procurement project. Meanwhile, GoTo clarified that Nadiem has no formal role or involvement in the company, emphasizing its operations remain unaffected. The case underscores rising scrutiny of governance standards and could shape perceptions of Indonesia’s broader innovation ecosystem. -

Tanihub scandal deepens 🌾

South Jakarta prosecutors have officially detained three new suspects, including former executives from state-owned venture capital firms, in the ongoing corruption and money-laundering case related to Tanihub’s investment funds. Former executives from state-owned investment firms have been charged with enabling unlawful investments worth millions, allegedly funneled into agritech startup Tanihub before being diverted. The scandal deepens concerns over governance and accountability in Indonesia’s venture capital–backed startup ecosystem.

✨ What’s Exciting

-

Venturi Partners raises $150M for consumer brands 🌐

Singapore-based private equity firm Venturi Partners has closed $150 million in funding for its second vehicle focused on high-growth consumer brands in Asia. The firm, known for backing companies like Livspace and Country Delight, said the fund will target businesses in food, health, personal care, and lifestyle. This reflects increasing investor appetite for consumer-facing businesses that can scale with Asia’s expanding middle class. Venturi Partners emphasized its hands-on approach, supporting portfolio companies with operational expertise, digital transformation, and regional expansion strategies.

🔮 What’s Next

-

QRIS drives digitalization for SMEs 📊

Indonesia’s digital economy continues to gain momentum through QRIS adoption. By H1 2025, QRIS recorded 57 million users and 39.3 million merchants, of which 93.16% are SMEs. Transaction volumes hit 6.05 billion with a total value of Rp 579 trillion—clear evidence that SMEs are not just present in the digital ecosystem but also thriving through digital transactions -

QRIS Tap adoption accelerates 🚀

Bank Indonesia rolled out QRIS Tap (NFC-based) in March 2025, allowing users to make payments by simply tapping their phone. By June 2025, 47.8 million users and 648,000+ merchants had adopted the service, particularly …Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

-

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!