📌 MAROKO133 Update crypto: 3 Altcoins That Could Trigger Major Liquidations in the

At the start of the third week of January, total market-wide liquidations reached nearly $900 million. Negative volatility driven by Trump’s tariff impact on the EU caused the spike. The figure could rise further as several altcoins show warning signs.

XRP, Axie Infinity (AXS), and Dusk (DUSK) are attracting capital and leveraging this week for different reasons. However, they could become traps for investors without strict risk management plans.

1. XRP

On January 19, XRP dropped to $1.85 before rebounding to $1.95. The decline erased most of the recovery effort since the start of the year.

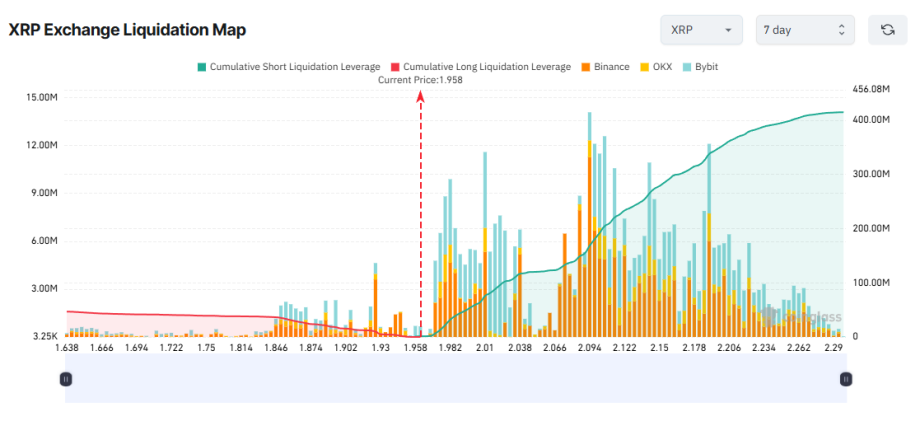

Short-term traders appear increasingly bearish. Many are betting on further downside. The 7-day liquidation map shows potential Short liquidations outweighing Long positions.

Liquidation data indicates that if XRP rebounds to $2.29 this week, Short positions could face more than $600 million in liquidations.

This scenario could unfold if concerns over Trump’s new tariffs fade quickly. Strong buying demand around the $1.8 level would also support a rebound.

Another key metric is XRP’s spot average order size. CryptoQuant data shows that when XRP trades below $2.4, large whale orders appear frequently. This pattern reflects strong whale demand at lower price levels.

“Whale interest is at a 2026 high. Large orders are dominating the tapes, suggesting the “Smart Money” is front-running the next leg up.” – An analyst from CryptoQuant commented.

If whale accumulation surpasses the market’s temporary fears, XRP could recover swiftly. Such a move would compel short traders into liquidation.

2. Axie Infinity (AXS)

Axie Infinity (AXS) unexpectedly returned to the top trending list in the third week of January. The token has gained more than 120% year-to-date.

The January rally is driven by the Axie founders’ plan to convert rewards into a new utility token called bAXS. This change is part of a broader tokenomics overhaul scheduled for 2026.

The 7-day liquidation map for AXS shows a similar potential liquidation volume of around $12 million. However, the price range needed to liquidate Long positions is narrower than for Shorts. This suggests many traders still expect further upside in the short term.

On the other hand, data shows that AXS’s January rally coincides with a sharp increase in exchange deposits. The 7-day average number of deposit transactions has reached a three-year high.

This trend indicates that many investors are looking to exit as prices recover, potentially leading to selling pressure at any time. Such a development could put long positions at risk.

3. Dusk (DUSK)

Dusk has emerged as a new standout in the growing interest in privacy coins. The rally reflects capital rotation from large-cap privacy coins to smaller-cap alternatives.

Despite a nearly sixfold increase since the start of the year, DUSK has already triggered significant Short liquidations over the past four days. Short-term traders continue to add capital and leverage to bullish bets.

DUSK’s liquidation map shows that potential Long liquidations dominate. If the price corrects this week, Long positions would face serious risk.

A recent BeInCrypto report highlights rising DUSK inflows to exchanges. This trend reflects potential profit-taking selling pressure. In addition, DUSK is rallying amid a return of market fear over Trump’s new tariffs on Europe. These factors threaten the sustainability of the uptrend.

In October last year, DASH surged sixfold after capital rotated from ZEC to lower-cap privacy coins. DASH then fell by 60% the following week. DUSK faces the risk of a similar outcome.

If DUSK’s FOMO fades and the price drops below $0.13, total Long liquidations could reach $12 million.

These three altcoins reflect very different, and even opposing, expectations among short-term traders. This complexity stems from geopolitical pressures clashing with internal market dynamics. Without strict stop-loss strategies, liquidation losses could hit both Long and Short positions.

The post 3 Altcoins That Could Trigger Major Liquidations in the Third Week of January appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: Bitcoin Price Slides for Fifth Day as Risk-Off Sentim

Bitcoin has fallen for a fifth straight session, pulling back from its highest levels since November as it struggles to hold above the $92,000 mark.

Key Takeaways:

- Bitcoin has slid for a fifth straight day on profit-taking and rising political and macro uncertainty.

- The pullback remains orderly, with low liquidations, falling leverage, and renewed spot ETF and whale demand.

- Ongoing concerns over Federal Reserve independence are reinforcing risk-off sentiment.

According to Samer Hasn, senior market analyst at XS.com, the decline reflects a mix of profit-taking and a broader shift toward risk aversion driven by political and macro uncertainty.

In a note shared with Cryptonews.com, Hasn said traders are responding to a sudden spike in US political risk alongside rising geopolitical and trade tensions.

Bitcoin Sell-Off Shows Limited Stress as Spot Demand Strengthens

Despite the pullback, Hasn noted that market damage remains limited. Futures liquidations have stayed relatively low, suggesting the sell-off lacks the hallmarks of panic and may point instead to a period of consolidation.

Signs of underlying demand have also emerged. Data from SoSoValue shows US spot Bitcoin exchange-traded funds posted their strongest week of net inflows since October, following a $20 billion futures liquidation event earlier in the month.

On-chain metrics echo that trend, with addresses holding between 1,000 and 10,000 BTC increasing by 28 over the past week, according to BGeometrics.

Meanwhile, CoinGlass data shows crypto futures open interest has dropped by about $9 billion from January highs, indicating reduced leverage and a greater reliance on spot buying.

Even so, Hasn said renewed “risk-off” forces are capping Bitcoin’s rebound. A key concern is political turmoil surrounding the US Federal Reserve.

Reports of a criminal investigation involving Fed Chair Jerome Powell have complicated leadership succession and raised questions about the central bank’s independence.

“This institutional friction has immediate consequences for market sentiment, as uncertainty regarding the Fed’s autonomy typically triggers a flight from dollar-denominated assets,” he said.

The situation has reignited debate over the future of the dollar’s role as a global safe haven. Analysts warn that perceived erosion of Fed autonomy could weaken confidence in US assets, potentially accelerating diversification toward alternatives.

“If investors lose faith in US government debt and the Fed’s autonomy, decentralized assets like Bitcoin and ‘hard’ assets like gold, which has already seen skyrocketing prices, become the logical hedge against institutional decay,” he said.

Arthur Hayes Says Bitcoin’s Next Rally Hinges on Dollar Liquidity in 2026

Arthur Hayes says Bitcoin could reach new all-time highs in 2026, arguing that its underperformance relative to gold and tech stocks in 2025 was driven by tight dollar liquidity rather than weakening fundamentals.

According to Hayes, Bitcoin needs an expanding supply of dollars to outperform, and without that monetary fuel, even strong adoption trends are not enough to push prices higher.

Optimism among long-term bulls also remains strong. Venture capitalist Tim Draper reiterated this week that 2026 would be a breakout year, repeating his long-standing $250,000 Bitcoin price target.

Meanwhile, Abra CEO Bill Barhydt believes Bitcoin could benefit in 2026 as easing monetary policy injects fresh liquidity into global markets, reviving risk appetite after a prolonged period of tight financial conditions.

The post Bitcoin Price Slides for Fifth Day as Risk-Off Sentiment Weighs on Prices: Analyst appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!