📌 MAROKO133 Eksklusif crypto: $30M Stolen as Step Finance Treasury Wallets Comprom

Step Finance, a major Solana DeFi platform, confirmed multiple treasury and fee wallets were compromised by a sophisticated attacker during Asian Pacific trading hours, resulting in the theft of approximately 261,854 SOL tokens worth roughly $30 million.

The breach sent shockwaves through the Solana ecosystem as blockchain security firm CertiK flagged that the stolen SOL “has been withdrawn after stake authorization had been transferred” to an unknown wallet address.

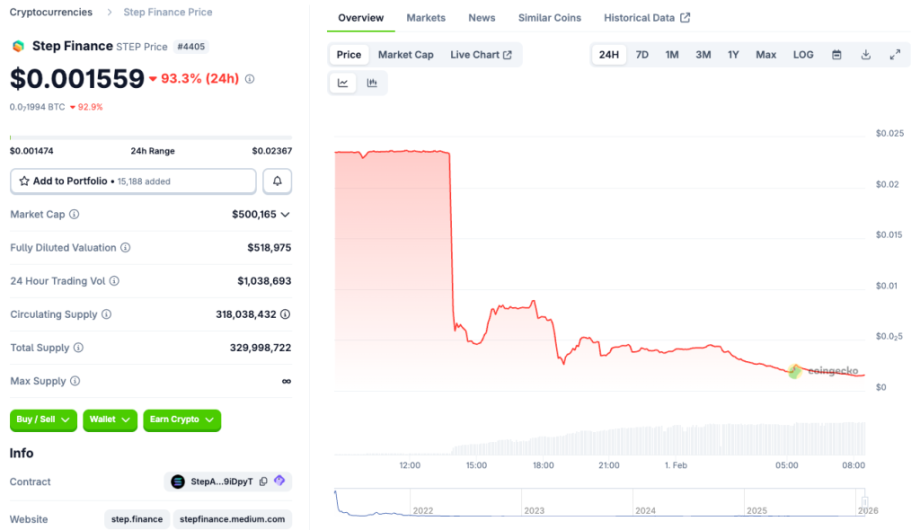

The incident triggered immediate market panic, with the platform’s native STEP token plummeting over 90% within 24 hours.

While the team insists user funds remained unaffected, questions swirl over whether the breach represents a genuine security failure or a disguised exit scam, particularly given that the attacker appeared to have direct wallet access rather than exploiting smart contract vulnerabilities.

Emergency Response and Damage Control

Step Finance disclosed the security breach through a series of urgent social media posts, stating “several of our treasury and fee wallets were compromised by a sophisticated actor” and confirming the attack leveraged “a well known attack vector.“

The platform immediately activated emergency protocols and reached out to cybersecurity firms for assistance.

Solana media firm Solana Floor reported that on-chain data showed the stolen 261,854 SOL was “unstaked and moved during the incident,” suggesting the attacker had obtained authorization to control staking operations.

The team emphasized it had “notified the relevant authorities” and implemented immediate remediation steps while working with top security professionals around the clock.

Ripple Effects Across Linked Protocols

The breach extended beyond Step Finance’s own operations, impacting connected platforms including Remora Markets.

The protocol disclosed that as “majority LP, Step Finance experienced a hack of treasury wallets earlier today” with some affected assets including Remora rStocks.

Remora assured users that despite the incident, “Remora assets remain held 1:1 in our brokerage account” while constructing a process for handling redemptions.

The market’s swift verdict on Step Finance came through brutal price action, with the STEP token losing most of its value as traders fled amid uncertainty about the platform’s future viability and the legitimacy of the breach.

January’s Relentless Wave of DeFi Exploits

The Step Finance hack marks the latest in what security firms describe as a devastating month for cryptocurrency security.

According to CertiK’s comprehensive January 2026 security report, “combining all the incidents in January, we’ve confirmed ~$370.3M lost to exploits” across multiple attack vectors.

Major January incidents included Truebit’s $26.6 million smart contract exploit, SwapNet’s $13.3 million breach affecting Matcha Meta users, Saga’s $6.2 million exploit that forced the Layer-1 protocol to pause its SagaEVM chain, and Makina Finance’s $4.2 million loss through flash loan manipulation.

CertiK’s analysis revealed that phishing incidents accounted for $311.3 million of January’s losses, while code vulnerability attacks totaled $51.5 million.

Notably, the Step Finance breach continues a troubling pattern affecting Solana-based protocols.

Swiss crypto platform SwissBorg lost $41.5 million worth of SOL tokens in September 2025 after hackers compromised partner API provider Kiln, while South Korea’s Upbit exchange suffered a $36 million Solana exploit in November 2025, exactly six years after its 2019 hack attributed to North Korean actors.

Beyond individual protocol failures, January als…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Update crypto: Gold and Silver Erased $7 Trillion From Global Markets,

A historic liquidation event swept through gold and silver markets over the past 48 hours, erasing roughly $7 trillion in value from precious metals. Meanwhile, Bitcoin fell 7% but remained surprisingly resilient amid the broader sell-off.

Bitcoin analyst Joe Consorti noted that the decline in the precious metals market cap was roughly four times Bitcoin’s entire capitalization.

BTC Avoids Liquidation Cascade That Crushed Gold and Silver Prices

Data from blockchain analytics firm Santiment highlighted the rarity of the event. The firm noted that Bitcoin and altcoin prices remained flat, while gold dropped by more than 8% and silver by over 25%.

Notably, gold’s price had collapsed from a high of $5,600 an ounce to trade around $4,700, while silver plummeted from $121 to $77.

Market observers linked the sell-off in precious metals to President Donald Trump’s nomination of Kevin Warsh to replace Jerome Powell as Federal Reserve chairman.

Warsh is widely regarded as an inflation hawk committed to defending the U.S. dollar. This stance upends the depreciation narrative that drove the recent surge in metals prices.

Notably, traders had piled into leveraged bets, assuming the administration would pursue aggressive rate cuts.

However, the Warsh nomination signaled a pivot toward tighter monetary policy, which triggered a violent unwinding of trades.

“The violent move in the metals is a symptom of a lot of hot money chasing price recently which now are being stopped out, leverage being unwound, and profit taking among many players,” Bob Coleman, CEO of Idaho Armored Vaults, explained.

Meanwhile, some market experts noted that the gold market was due for a correction, having become overheated amid soaring public interest in precious metals.

“While parabolic moves often take asset prices higher than most investors would think possible, the out-of-this-world spikes tend to occur at the end of a cycle. In our view, the bubble today is not in AI, but in gold. An upturn in the dollar could pop that bubble, a la 1980 to 2000 when the gold price dropped more than 60%,”Cathie Wood, founder of Ark Invest, said.

What’s Next for Bitcoin?

The question now facing Bitcoin investors is whether the top crypto’s stability near $82,000 signals a decoupling from traditional commodities or a delayed reaction.

Unlike metals, Bitcoin did not participate in the final, euphoric leg of the “debasement trade.” This potentially leaves it with less speculative froth to shed and more room to rally.

Some analysts argue that as liquidity exits the crowded metals trade, capital may rotate into digital assets. These observers view Bitcoin’s scarcity as distinct from the industrial dynamics that are currently weighing on gold and silver.

However, if the Warsh nomination leads to sustained global liquidity tightening, risk assets, including cryptocurrencies, could face renewed pressure in the coming weeks.

The post Gold and Silver Erased $7 Trillion From Global Markets, Will Bitcoin Follow? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!