📌 MAROKO133 Hot crypto: America.Fun Wants To Fix the Pump.Fun Problem — But Will I

America.Fun is a new Solana-based launchpad advised by World Liberty Financial’s Ogle. It claims to offer a safer alternative to the meme-coin chaos typified by Pump.Fun.

The platform’s stated goal is to reduce spam tokens and improve user protection. However, questions remain about its sustainability, token performance, and transparency.

A Response to a Market Gone Wild

In an interview with BeInCrypto, Ogle said the project’s design responds directly to issues seen across permissionless meme coin platforms.

“Whenever you have catastrophic drops or scams, it’s usually a combination of many factors,” he said. “We wanted to build a safer, more legitimate place for people who are not as gambling.”

The platform requires creators to pay a small fee — about $20 worth of AOL tokens — to launch a token. According to Ogle, that friction discourages mass bot deployments and copycat scams.

“Right now it’s free to deploy in every other launchpad. I don’t think that’s a good thing,” he said. “When it costs a little, you think before you spam.”

America.Fun also restricts duplicate tickers. Each token name can only exist once, addressing a core issue of Pump.Fun, where dozens of imitations often appear within minutes of a trending launch.

“You don’t know which one’s real on other platforms,” Ogle explained. “Here, there can only be one.”

Building a “Walled Garden”

Last month, BeInCrypto published an exclusive report on how racist and offensive tokens were surging like wildfire on Pump.Fun.

According to Ogle, America.Fun is working to directly address this issue that plagues most launchpads.

The platform’s frontend is curated. Offensive or scam tokens may still exist on-chain, but they won’t appear on the platform’s interface or trending lists.

Ogle compared it to early America Online moderation:

“There were safeguards in place to stop racism and abuse. That’s why it worked. We’re doing the same — a walled garden where people feel safe.”

This semi-permissioned model positions the launchpad between hyper-open ecosystems like Pump.Fun and fully regulated venues like ICM.

According to Ogle, the team wants to strike a “middle ground” between creativity and compliance.

But is it enough to gain traction in an extremely crowded space?

A Crowded and Competitive Space

America.Fun enters a saturated launchpad market dominated by Pump.Fun and LetsBonk.Fun, both of which have massive user bases and trading volumes.

Ogle acknowledged the challenge but said the platform’s strategy is “reputation and curation.”

He also disclosed that America.Fun operates as a strategic arm of the USD1 partnership, connecting World Liberty Financial’s USD1 stablecoin with Radium and Bonk.

However, he declined to comment on any formal stake or revenue-sharing structure.

The decision to pair all new tokens initially against USD1 — instead of the more widely used USDC — could limit accessibility.

Ogle argued that this is intentional. He said trading through DEX routers like Jupiter automatically converts USDC to USD1, keeping user experience seamless while supporting USD1’s liquidity.

Token and Performance Data

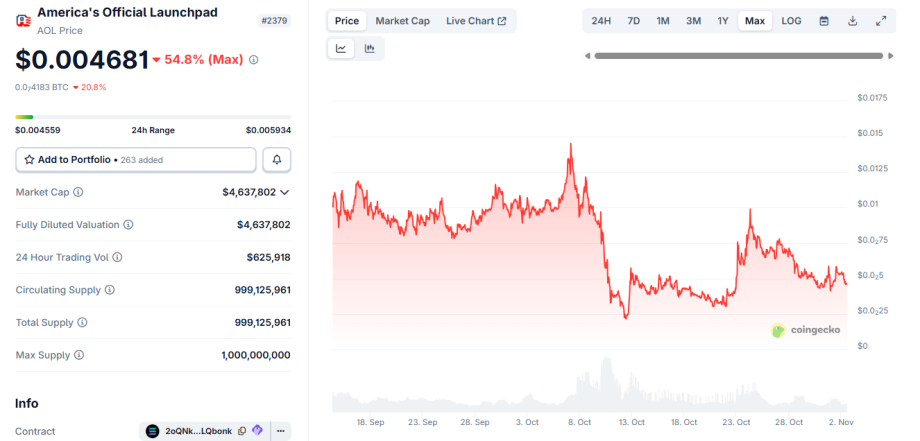

The platform’s native token, AOL (America’s Official Launchpad), launched in early September.

As of November 2, it trades at $0.0046, down 54% from its peak, with a $4.6 million market cap and $625,000 daily volume.

This decline mirrors the wider post-October 10 crash downturn, but also suggests that community enthusiasm has yet to translate into sustainable demand.

Ogle recently claimed the project gained 39,000 active users in the past 30 days and 222,000 page views, with Singapore, China, and Ukraine leading in traffic.

These metrics are unverified, but they indicate early traction in Asia rather than the US market.

Critical View: Promise Meets Practical Limits

America.Fun’s selective moderation and launch fees address real problems in the meme coin ecosystem — spam, scams, and offensive content.

Yet, the model introduces its own risks. Curated access can slow growth, and limiting pairs to USD1 could restrict liquidity in a market that favors flexibility.

The AOL token’s steep price drop also ra…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Hot crypto: SOL Outflows Drop 83%, But One Factor Keeps Solana Price i

Solana (SOL) entered November still struggling to find a clear direction. The token is down 4% over the past seven days and nearly 19% this month, despite a brief bounce attempt amid Halloween. Solana price now trades near $186, trapped in a range between $178 and $209.

While outflows from holders have slowed, one group of traders might be keeping the SOL price in check.

Big Money Still Missing From the Move

The Chaikin Money Flow (CMF), which tracks whether large investors are adding or exiting positions, has failed to cross back above zero.

Between October 27 and October 31, CMF made a short-lived attempt to turn positive but then turned lower again, showing that large traders continue to move money out of Solana rather than into it.

Until CMF climbs decisively above zero, inflows from big players remain missing, keeping Solana’s upside capped.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The newly launched Bitwise Solana Staking ETF (BSOL) drew $132 million in inflows this week, but since most of its exposure is possibly created in-kind (from existing SOL reserves) and managed through staking, those flows haven’t yet translated into real spot market demand.

This could explain why Solana’s Chaikin Money Flow (CMF) remains below zero

Despite the ETF launch and broader media buzz, Solana’s price is still down about 4% this week, proving that passive inflows alone haven’t helped the token recover.

Interestingly, Solana’s Holder Net Position Change — which measures whether long-term wallets are accumulating or selling — shows a different tone.

On October 3, net outflows peaked near –11.43 million SOL, one of the steepest levels this month. By October 31, that figure had improved to –1.91 million SOL, an 83% reduction in net outflows.

This means while holders are still selling, they’re doing it at a much slower pace — a small but positive shift for Solana’s long-term structure.

Solana Price Chart Setup Still Leans Bearish

Despite the slowdown in holder selling, the Solana price chart setup remains fragile. The daily chart shows SOL trading within a broadening rising wedge pattern, which typically signals exhaustion and a possible breakdown.

The lower trendline — tested more than five times since August — has been under heavy pressure since mid-October.

Between October 13 and October 26, Solana’s price made a lower high, while the Relative Strength Index (RSI) — which measures buying momentum — made a higher high.

This forms a hidden bearish divergence, a pattern that typically suggests the larger Solana price downtrend could continue.

To regain strength, Solana must first reclaim $198, then close above $209. That would open a path toward $237. However, if $178 fails (a mere 4.53% dip), a slide to $155 is likely — a drop of around 14%. That would provide more strength to the bearish hypothesis.

To invalidate weakness, the CMF needs to move above zero, and the investors should circle back to net buying. That kind of spot money flow could help the SOL price cross at least $198 in the short term.

The post SOL Outflows Drop 83%, But One Factor Keeps Solana Price in Check appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!