📌 MAROKO133 Breaking crypto: Bank of Japan Rate Hike Could Trigger 20-30% Bitcoin

Markets are bracing for a potentially pivotal week for Bitcoin as the Bank of Japan (BOJ) heads into its December 18–19 policy meeting. Expectations point to a near-certain rate hike.

Prediction markets and macro analysts alike are converging on the same conclusion: Japan is poised to raise rates by 25 basis points. Such a move could reverberate far beyond its domestic bond market and into global risk assets, especially Bitcoin.

Bank of Japan Rate Hike Puts Bitcoin’s Liquidity Sensitivity Back in Focus

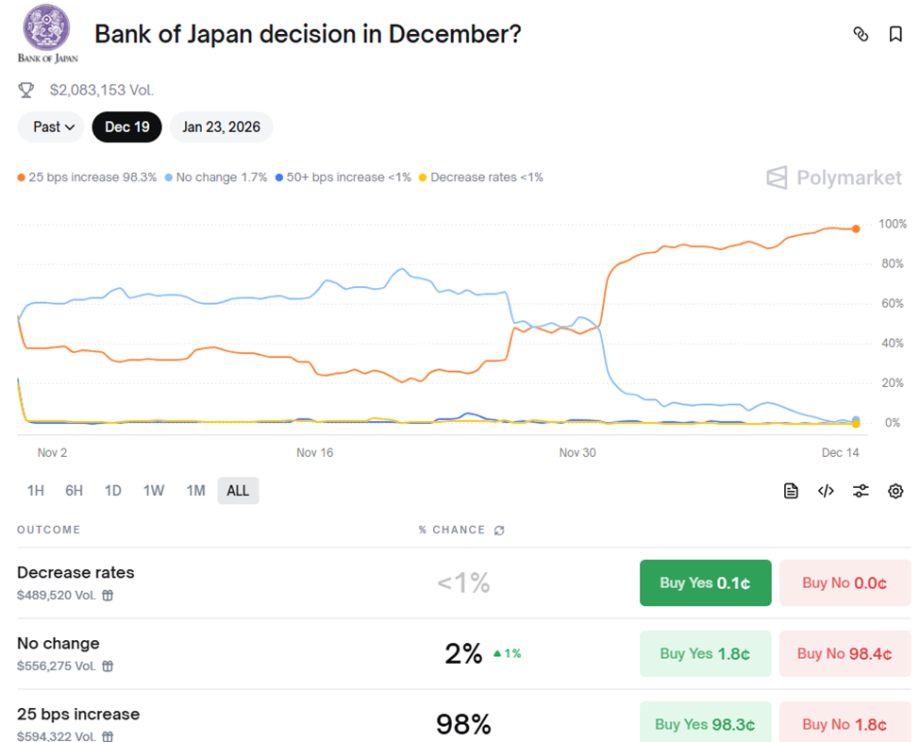

Polymarket is currently assigning a 98% probability of a BOJ hike, with a measly 2% wagering that policymakers will hold interest rates steady.

The general sentiment among crypto analysts is that this is not good for Bitcoin, with the pioneer crypto already trading below the $90,000 psychological level.

If implemented, the move would take Japan’s policy rate to 75 basis points, a level not seen in nearly two decades. While modest by global standards, the shift is significant because Japan has long been the world’s primary source of inexpensive leverage.

For decades, institutions borrowed yen at ultra-low rates and deployed that capital into global equities, bonds, and crypto, a strategy known as the yen carry trade. That trade is now under threat.

“For decades, the Yen has been the #1 currency people would borrow & convert into other currencies & assets… That carry trade is diminishing now, as Japanese bond yields are rising rapidly,” wrote analyst Mister Crypto.

If yields continue to climb, leveraged positions funded in yen may be unwound, forcing investors to sell risk assets to repay debt.

Liquidity Fears Grow Amid Bitcoin’s BOJ Track Record

The historical backdrop is fueling anxiety in crypto markets. Bitcoin is currently trading at $88,956, down 1.16% in the last 24 hours.

However, traders are focused less on the current price and more on what has happened after previous BOJ hikes.

- In March 2024, the price of Bitcoin fell by roughly 23%.

- In July 2024, it dropped around 25%.

- Following the January 2025 hike, BTC slid more than 30%.

Against this backdrop, several traders see a troubling pattern, urging investors to brace for volatility this week.

“Every time Japan hikes rates, Bitcoin dumps 20–25%. Next week, they will hike rates to 75 bps again. If the pattern holds, BTC will dump below $70,000 on December 19. Position accordingly,” cautioned analyst 0xNobler.

This week, therefore, analysts see the Bank of Japan as the biggest threat to the Bitcoin price, with a play to $70,000 now in the cards.

Similar projections have been echoed across crypto-focused accounts, with repeated references to a potential drop below $70,000 if history rhymes. Such a move would constitute a 20% drop below current levels.

Regime Shift or Liquidity Shock? Why Traders Are Split on the BOJ–Fed Policy Mix

Yet not everyone agrees that a BOJ hike spells inevitable downside. A competing macro narrative argues that Japan’s tightening, when paired with US Federal Reserve rate cuts, could ultimately be bullish for the crypto market.

Macro analyst Quantum Ascend framed the situation as a regime shift rather than a liquidity shock.

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!