📌 MAROKO133 Breaking crypto: Bitcoin Rally Flashes Red Flags: New Highs, But Fewer

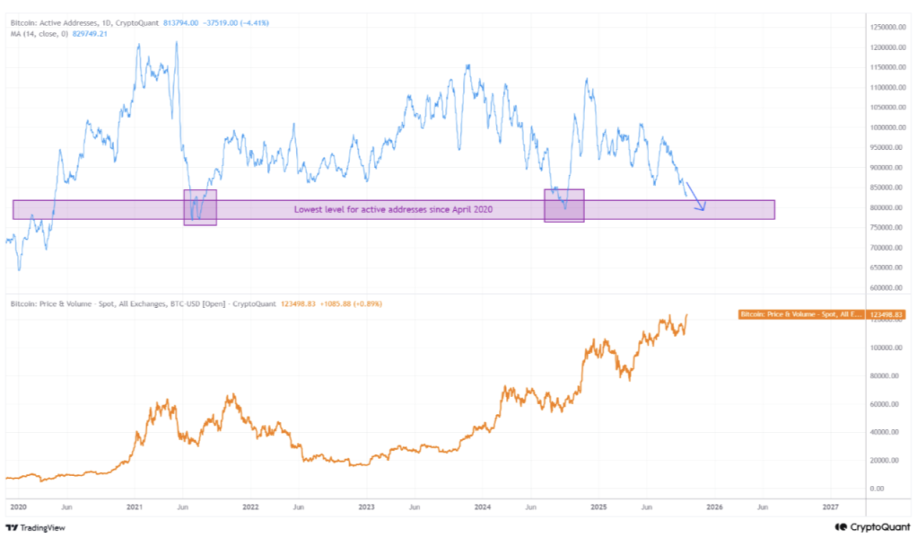

Bitcoin’s recent climb to new all-time highs might not be as strong as it looks. A new report has revealed that while BTC’s price has surged, the number of active addresses on its network has dropped. This signals a negative divergence between the coin’s market price and on-chain activity.

The weak participation puts a potential decline back to the $120,000 price region on the table.

Bitcoin Runs, But Network Activity Signals Trouble Ahead

In a new report, pseudonymous CryptoQuant analyst CryptoOnchain notes that BTC’s rally to a new all-time high of $125,708 appears to be driven less by broad market enthusiasm and more by speculative trading activity.

The analyst examined user activity on the Bitcoin network and found a “negative divergence between the price and the number of active network addresses.”

According to the report, while the king coin’s price has climbed, the daily count of its active wallet addresses (14-day moving average) “is approaching its lowest level since April 2020.”

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here

Commenting on what this means for the coin, the analyst writes:

“Traditionally, a sustainable price increase should be accompanied by a rise in network activity, as it indicates the influx of new users and organic demand. A decline in this metric while the price is rising could suggest that the recent rally is driven more by derivatives trading, financial leverage, and the activity of a small group of large players, rather than widespread public participation.”

This means that while BTC prices are breaking new highs, fewer unique users are actually transacting on-chain, a sign of an unstable bull run. The current trend increases the risk of a sharp pullback if market sentiment shifts.

High Leverage in Bitcoin Futures Sparks Concerns

The uptick in BTC’s futures open interest also confirms this bearish outlook. According to Coinglass, this currently sits at a year-to-date high of $92.14 billion, climbing 10% since October 1.

Open interest refers to the total number of outstanding futures or options contracts that have not yet been settled or closed.

Historically, a rapid increase in futures open interest during a price rally has been linked to overheated markets. When too many traders enter with high leverage, even minor liquidations can trigger steep corrections, putting BTC at risk of a pullback.

Strong Rally, But Will $120,000 Hold?

According to CryptoOnchain, this current trend is a “warning.”

“If network activity fails to grow in tandem with the price, it is likely that the price lacks strong fundamental support to maintain its current levels, and the risk of a local price correction increases,” the analyst added.

In this scenario, the coin could revisit $120,090 if the underlying demand continues to fall.

However, an uptick in user participation on the Bitcoin network would invalidate this bearish projection. If new buyers enter the market, they could push BTC to revisit its all-time high and attempt a break above it.

The post Bitcoin Rally Flashes Red Flags: New Highs, But Fewer Hands Are Holding the Rally appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Eksklusif crypto: EU Plans to Give ESMA Greater Powers Over Crypto and

The European Commission is preparing sweeping changes that could hand over direct supervisory authority of stock exchanges, cryptocurrency firms, and clearing houses to the EU’s markets watchdog, the European Securities and Markets Authority (ESMA).

Key Takeaways:

- The European Commission plans to shift oversight of stock exchanges, crypto firms, and clearing houses to ESMA.

- ESMA argues that fragmented supervision under MiCA creates inefficiencies and weakens consumer protection.

- Smaller EU nations oppose the move, warning that centralizing power at ESMA could harm their local financial sectors.

Verena Ross, chair of ESMA, told the Financial Times that the proposed changes aim to resolve persistent fragmentation across the EU’s financial sector and create a more unified capital market.

“This would provide a key impetus towards having a capital market in Europe that is more integrated and globally competitive,” she said.

EU Proposes Shifting Financial Market Oversight from National Regulators to ESMA

Under the proposals, regulation of several financial market sectors currently overseen by national authorities would shift to ESMA.

This includes crypto asset service providers, such as exchanges and custodians, who are currently regulated under the EU’s landmark Markets in Crypto-Assets (MiCA) framework. The initial plan was to grant ESMA central oversight, but concerns about capacity led to supervision remaining with individual member states.

Ross said this decentralization has resulted in inefficiencies and inconsistent application of MiCA. “It clearly takes a lot of effort from us and the national supervisors to achieve alignment,” she noted.

“Specific new resources had to be built up 27 times, once in each member state, which could have been done more efficiently at a European level.”

In July, ESMA criticized Malta’s licensing process for pan-EU crypto companies, warning that certain risk areas had not been adequately assessed.

The agency argues that fragmented supervision undermines consumer protections and investor confidence.

The initiative is already drawing resistance from smaller EU countries like Luxembourg, Ireland, and Malta.

Claude Marx, head of Luxembourg’s financial regulator, recently warned that centralizing powers at ESMA could create a regulatory “monster.”

Still, the European Commission is moving forward. Maria Luís Albuquerque, EU Commissioner for Financial Services, confirmed in a recent speech that the bloc is evaluating a formal proposal to transfer oversight of cross-border entities, including stock exchanges and crypto platforms, to ESMA.

The Paris-based authority is already set to supervise consolidated equity and bond price tapes and ESG ratings starting in 2026.

Ross emphasized the need for capital markets to support the EU’s long-term goals, including defense, green energy, and digital infrastructure.

“The demand for breaking down barriers has gone up a level, not just at the EU level but within member states too,” she said.

ESMA Flags Gaps in Malta’s Crypto Licensing

In July, ESMA raised concerns about Malta’s crypto licensing process, following a peer review of the Malta Financial Services Authority (MFSA).

While acknowledging that the MFSA has adequate staffing and sector expertise, the review found that Malta only “partially met expectations” in its authorization of a crypto asset service provider (CASP), with several material issues left unaddressed during the approval stage.

The review, initiated in April 2025 by ESMA’s Peer Review Committee, focused on the MFSA’s supervisory setup, authorization procedures, and oversight tools.

ESMA emphasized that consistency across EU member states is essential under the MiCA regulatory framework, which seeks to standardize how crypto firms are licensed and supervised throughout the bloc.

The post EU Plans to Give ESMA Greater Powers Over Crypto and Stock Market Supervision appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!