📌 MAROKO133 Hot crypto: DeFi Passes Real-World Stress Test As Major Exchanges Buck

A wave of heavy market activity on October 10 sent shockwaves through both traditional and digital markets, exposing the limits of major centralized crypto exchanges.

The turbulence began moments after US President Donald Trump announced a 100% tariff on Chinese imports. The policy surprise spooked global investors, triggering a sell-off that spread from equities to digital assets within minutes.

Trump’s Tariff Shock Exposes Cracks in Major Crypto Exchanges

Following the announcement, crypto traders responded in two distinct ways. Some rushed to cut their losses, while others scrambled to “buy the dip.”

The simultaneous surge in orders overloaded several exchanges, including Binance, Coinbase, Gemini, Kraken, and Robinhood.

As a result, several social-media users reported frozen dashboards, mismatched prices, and failed trades as trading engines struggled to keep up with demand.

However, Binance and Coinbase later said the disruptions were caused by extreme user activity rather than security breaches.

Although most platforms restored normal service within hours, the episode raised debate over whether centralized exchanges could scale fast enough during major volatility events.

While centralized platforms struggled to stay online, decentralized finance (DeFi) protocols largely operated without interruption.

Aave founder Stani Kulechov described the market crash as “the largest stress test in DeFi history.” During the period, the lending platform liquidated roughly $180 million in collateral within an hour without downtime or transaction errors.

Chainlink’s community liaison, Zach Rynes, attributed that performance to reliable on-chain price feeds that allowed automated liquidations to execute in real time.

Similarly, Hyperliquid, a top decentralized derivatives exchange, reported zero latency despite record traffic volumes. It credited its HyperBFT consensus system for maintaining throughput and solvency.

On Ethereum, Uniswap processed an estimated $9 billion in daily trading volume—significantly above its norm—without notable slowdowns.

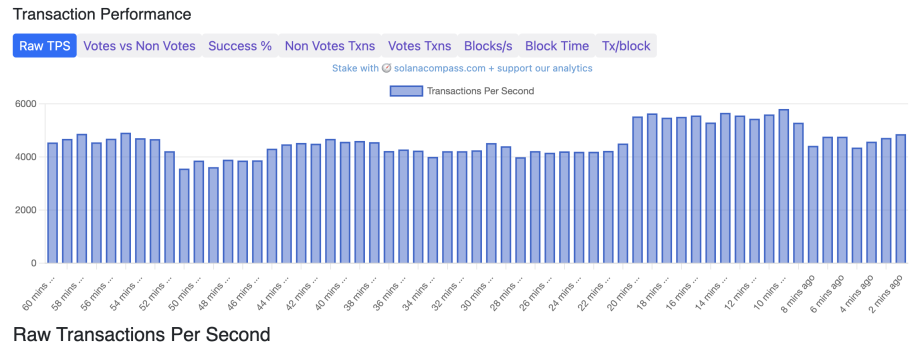

Meanwhile, the resilience extended to Solana’s ecosystem, where Kamino Finance confirmed zero bad debt while the network itself handled up to 10,000 transactions per second.

Speaking about these DeFi protocols’ strong performance, Paul Frambot, CEO of Morpho Labs, said DeFi’s resilience highlights why open, programmable financial infrastructure may eventually outlast traditional intermediaries.

Antonio Garcia Martinez, an executive at Coinbase’s Base network, echoed similar views, while adding that:

“The fact you have financial infrastructure managing billions that runs as literal code in a decentralized way across machines owned by strangers who don’t trust each other is one of the great tech miracles of our time. There are cathedrals everywhere for those with eyes to see.”

The post DeFi Passes Real-World Stress Test As Major Exchanges Buckle Under Trump’s Tariff Shock appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Hot crypto: Bitcoin Could Rebound 21% This Week as October Trends Favo

Bitcoin may be primed for a sharp rebound after last week’s steep sell-off, according to economist Timothy Peterson, who believes the world’s largest cryptocurrency could climb as much as 21% in the next seven days if October’s historical patterns hold.

Key Takeaways:

- Economist Timothy Peterson predicts Bitcoin could rebound up to 21% this week.

- Since 2013, October has averaged 20.1% gains, making it Bitcoin’s second-best month behind November.

- Despite a brief plunge to $102,000 after Trump’s tariff announcement, analysts remain bullish.

“Drops of more than 5% in October are exceedingly rare,” Peterson wrote on X Friday, noting it has only happened four times in the past decade, in 2017, 2018, 2019, and 2021.

In three of those years, Bitcoin rallied immediately afterward, gaining 16%, 4%, and 21%, respectively, while only 2021 saw a minor decline of 3%.

October Lives Up to ‘Uptober’ Hype as Bitcoin’s Second-Best Month on Record

October’s reputation as “Uptober” continues to strengthen. Since 2013, it has been Bitcoin’s second-best performing month, delivering an average return of 20.1%, behind only November’s 46% average.

Peterson’s comments followed a dramatic market correction on Friday when Bitcoin briefly dipped below $102,000 after US President Donald Trump confirmed plans for a 100% tariff on Chinese imports.

The market has since stabilized, with Bitcoin trading near $111,700, recovering from an earlier high of $125,100 set on Monday, according to CoinMarketCap.

If Bitcoin mirrors its strongest October rebound, the 21% surge seen in 2019, a similar move from Friday’s low would push the price back to around $124,000, just shy of its recent record.

Despite last week’s turbulence, many Bitcoin advocates remain bullish. Samson Mow, founder of Jan3, reminded traders that “there are still 21 days left in Uptober.”

Meanwhile, Michael van de Poppe, founder of MN Trading Capital, called the latest dip “the bottom of the current cycle.”

Others have taken a broader view. The Bitcoin Libertarian argued that massive liquidation events are part of the asset’s natural evolution, predicting that even when Bitcoin trades near $1 million, similar volatility will persist.

Analyst Warns Bitcoin Faces Decisive 100-Day Window

Bitcoin may be nearing a critical turning point, according to trader Tony “The Bull” Severino, who believes the next 100 days could determine whether the cryptocurrency enters a parabolic rally or ends its current bull cycle.

Severino pointed to the Bollinger Bands indicator on Bitcoin’s weekly chart, which has tightened to levels unseen before, often a precursor to sharp price moves in either direction.

Severino cautioned that “head fakes,” or false breakouts, are common during such setups. He noted Bitcoin recently failed to break above the upper band with strength after briefly touching $126,000, suggesting a potential dip before any sustained rally.

Currently, BTC trades around $122,700, hovering below its record highs as volatility compresses further.

While some analysts fear a looming breakdown, others argue that Bitcoin’s cycles are getting longer, hinting at more room for growth.

The post Bitcoin Could Rebound 21% This Week as October Trends Favor Recovery, Economist Says appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!