📌 MAROKO133 Eksklusif crypto: Digital Asset ETPs Record $716M Weekly Inflows as Au

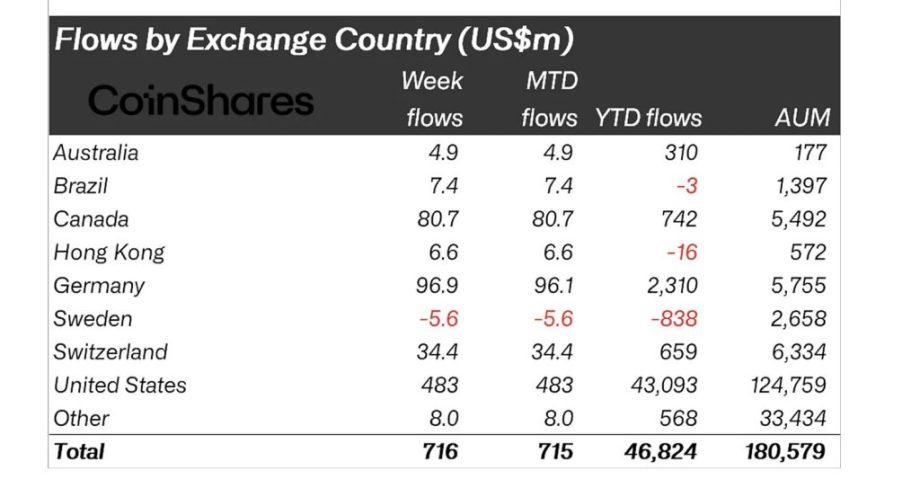

Digital asset investment products recorded a second consecutive week of inflows, totalling $716M, showing improving sentiment across institutional and retail investors after a volatile period in crypto markets, according to the latest report from CoinShares.

CoinShares reports total assets under management rose 7.9% from their November lows to $180B, though this figure remains below the all-time high of $264B. Daily flow data indicated minor outflows toward the end of the week, which analysts believe reflected macroeconomic uncertainty and market reactions to U.S. inflation-related data.

Despite those short-term jitters, the week’s net performance highlights renewed confidence in digital asset exposure through exchange-traded products.

A notable trend was the geographic spread of inflows, suggesting renewed interest globally rather than activity concentrated in a single region. The United States led with $483M in inflows, followed by Germany at $96.9M and Canada at $80.7M, demonstrating that institutional re-engagement with crypto markets is widening across regulated investment platforms.

Bitcoin Leads Inflows While Short Products Reverse

Bitcoin remained the primary focus for investors, recording $352M in inflows last week, contributing to year-to-date (YTD) inflows of $27.1B. This remains below the record $41.6B seen in 2024; however, continued inflows suggest persistent appetite for exposure despite reduced volatility and slower price momentum compared to previous cycles.

In contrast, short-Bitcoin investment products saw outflows of $18.7M — the largest since March 2025. Analysts note that the previous occurrence coincided with price lows and later recovery, hinting that current negative sentiment may have exhausted itself, with investors positioning for a more favourable outlook.

The reversal in short-Bitcoin demand could be interpreted as a tactical shift, where investors are less confident in prolonged downside risk and increasingly reassessing the potential for stabilization or upside in digital asset markets.

XRP Sees Strong Momentum as Institutional Interest Accelerates

XRP continued to draw attention, with $245M flowing into ETPs last week, bringing YTD inflows to $3.1B — a dramatic increase compared to $608M in 2024. The surge reflects heightened institutional engagement following greater clarity around its legal and regulatory landscape, which has broadened access and improved sentiment.

The continued rise in XRP ETP demand marks one of the strongest comparative growth stories in the digital asset space this year, suggesting that investors may now be reassessing exposure beyond Bitcoin and Ethereum as the market diversifies.

Chainlink Records Largest Inflows on Record

Chainlink registered $52.8M in weekly inflows, representing over 54% of its total assets under management — the largest on record for the token. The surge highlights growing institutional and developer interest in the tokenized asset and oracle infrastructure ecosystem that Chainlink underpins.

As tokenization of real-world assets expands and demand for reliable data connectivity increases across blockchains, Chainlink’s growth may indicate a long-term thematic trend rather than short-term speculation.

The post Digital Asset ETPs Record $716M Weekly Inflows as AuM Reaches $180B: CoinShares appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Hot crypto: Argentina Weighs Allowing Traditional Banks To Trade Crypt

Argentina’s central bank is reportedly weighing a move that could redraw the country’s crypto landscape, drafting rules that would let traditional banks offer trading and custody services for digital assets after years of leaving that business to exchanges and fintech platforms.

Local outlet La Nacion reported Friday that the officials are working on a regulation that would open the door for lenders to handle cryptocurrencies directly, although they have not committed to a timetable or disclosed key details.

One exchange operating in the country believes the measure could win approval around April 2026, signalling a relatively near-term shift if the process stays on track.

The idea has circulated quietly for months among exchanges, people close to regulators and a handful of bankers. It fits with a broader push inside government circles to ease restrictions on crypto use and bring part of the activity that already happens at scale into the formal financial system.

Crypto Demand Surges As Argentines Seek Stability Amid Inflation

For Argentina, the stakes are higher than in most markets. Years of inflation and currency controls have pushed savers toward dollars and digital assets, and crypto has become a parallel store of value for many households.

By one estimate, Argentines are now six times more likely to use crypto on a daily basis than residents of the average Latin American country.

Allowing banks to trade and hold crypto on behalf of clients could give that demand a new channel. Analysts say regulated lenders can offer familiar on-ramps, clearer disclosures and more robust compliance checks, which together may make digital assets feel less like a grey market product and more like a standard investment option.

The real impact, they caution, will depend on how the central bank draws the lines on issues such as custody standards, capital treatment and which tokens qualify.

Libra Scandal Casts A Long Shadow Over Argentina’s Crypto Debate

The debate is unfolding in the long shadow of the Libra meme coin scandal, a blow that shook confidence in Argentina’s crypto scene and raised uncomfortable questions about political promotion of speculative tokens.

That episode erupted in Feb. 2025 when President Javier Milei, known for his libertarian economic agenda and enthusiasm for digital assets, posted on X endorsing the Solana-based Libra token as a tool for “market-driven innovation” and economic liberation from the peso.

The coin’s price raced from fractions of a cent to more than $4.50 within hours of his post, lifting its fully diluted valuation to around $4.6b before collapsing more than 96% in what investigators described as a classic rug pull by its creators at Kelsier Ventures.

Thousands of investors, many of them everyday Argentines who took the president’s message as a green light, were left holding the bag, with losses estimated between $100m and $251m.

Argentina’s central bank has swung between tolerance and crackdowns in the past, at one point barring unregulated crypto services in the banking system, and any turn toward openness would mark a significant change in stance.

For now, officials appear to be testing whether they can bring a fast growing market into the tent without importing too much of its volatility into the traditional financial system.

The post Argentina Weighs Allowing Traditional Banks To Trade Cryptocurrencies appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!