📌 MAROKO133 Eksklusif crypto: Institutional Bets on ETH Grow, Analysts Eye $6,000

Major digital asset firms are stepping up their Ethereum (ETH) exposure as the cryptocurrency rebounds from recent lows.

BitMine Immersion Technology has grown its Ethereum treasury to over $11 billion, while Bit Digital plans to raise $100 million to expand its ETH reserves. The moves signal rising institutional confidence in the asset amid a broader market recovery.

ETH Bet Drives DAT Firms’ Stock Higher

In a recent press release, Bit Digital, the seventh largest corporate holder of ETH, revealed that it plans to raise $100 million through a public offering of convertible senior notes set to mature in 2030. The company also provided underwriters with a 30-day option to acquire up to an additional $15 million under the same terms.

“The Notes will be senior, unsecured obligations of the Company. The Notes will mature on October 1, 2030, unless earlier converted, redeemed, or repurchased. Holders may convert their Notes at their option prior to the close of business on the second scheduled trading day immediately preceding the maturity date,” the press release reads.

According to the firm, the capital raised will be directed primarily toward increasing Ethereum holdings. At the same time, there is also a provision to use the funds for potential acquisitions, investments, and other digital asset opportunities.

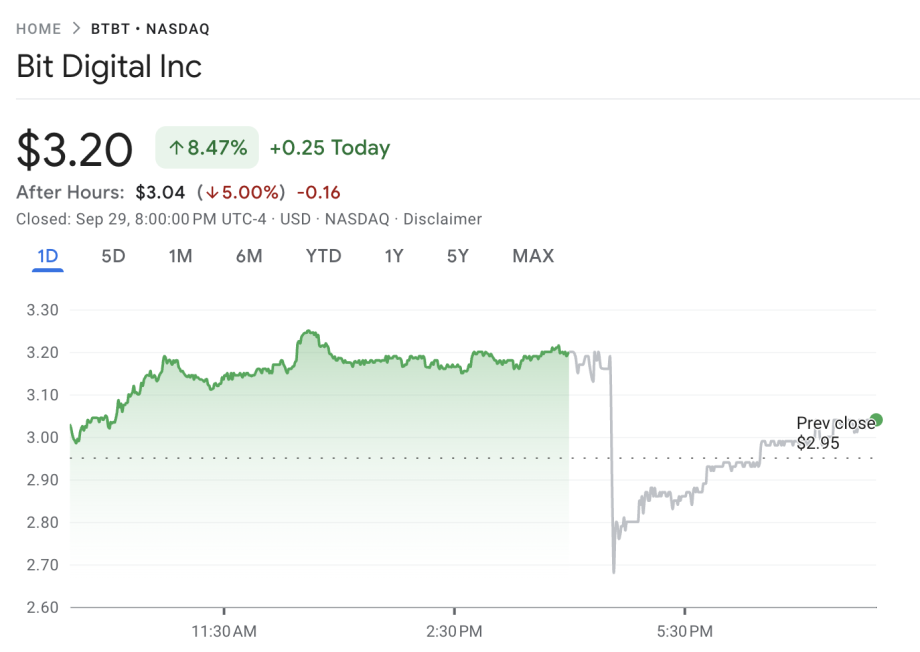

Notably, after the announcement, Bit Digital’s stock BTBT appreciated. Google Finance data showed that share prices rose to $3.2, up 8.47% at market close. However, in after-hours trading, BTBT dipped 5%.

Concurrently, BitMine Immersion Technologies (BMNR) announced that it has expanded its Ethereum treasury to 2.65 million coins valued at more than $11 billion at current market prices. On-chain analytics firm Lookonchain identified that the firm purchased 234,846 ETH, worth $963 million, to boost its holdings.

“As we enter the final months of 2025, the two Supercycle investing narratives remain AI and crypto. And both require neutral public blockchains. Naturally, Ethereum remains the premier choice given its high reliability and 100% uptime. These two powerful macro cycles will play out over decades. Since ETH’s price is a discount to the future, this bodes well for the token and is the reason BitMine’s primary treasury asset is ETH,” BitMine Chairman Tom Lee stated.

In addition to ETH, BitMine reported holding 192 Bitcoin valued at $21.6 million, a $157 million stake in Eightco Holdings, and $436 million in unencumbered cash, bringing its total crypto and cash assets to $11.6 billion.

Like BTBT, the company’s stock also saw an uptick, although more modestly. BMNR closed at $53.22, representing an increase of 5.39%. Moreover, in after-hours trading, the price slipped 0.49% to $52.96.

Furthermore, following the disclosure, BitMine appears to have continued its ETH accumulation. Today, Lookonchain reported that a wallet likely linked to BitMine received 25,369 ETH, valued at $106.74 million, from FalconX.

These moves align with a surge in corporate ETH treasuries. Data from the Strategic ETH Reserve showed that ETH treasuries have expanded from $2.3 billion in June 2025 to over $21 billion by late September.

Besides these institutional players, the ETH buying trend is persistent across the market. The analytics firm highlighted that another wallet, 0x6F9b, withdrew 4,985 ETH worth around $21 million from OKX.

“Address 0x1fc…FAEd5 has accumulated 21,048 ETH ($88.54 million) since 2025.06.18, with an average withdrawal price of $3,794 and unrealized profits of approximately $8.49 million. This address withdrew another 2,360 ETH from Binance, worth $9.92 million,” an on-chain analyst highlighted.

Will Ethereum Hit $6,000 In November?

Meanwhile, the institutional bets come as ETH started to rally again following its <a target="_blank" href="https://bein…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: SEC trading halt of crypto treasury firm QMMM is a Tr

Shares in QMMM Holdings will be off the market until Oct. 13 after the US securities regulator suspended trading to probe possible stock manipulation.

🔗 Sumber: www.cointelegraph.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!