📌 MAROKO133 Eksklusif crypto: Shiba Inu Price Prediction: 9,000% Liquidation Imbal

After chasing a bottom, a sharp 8,972% liquidation imbalance may have just sent bulls packing as a death cross points to more than just a brief disruption to bullish Shiba Inu price predictions.

Even after the tenth-largest crypto liquidation event on record, bulls still have it rough as the meme coin struggles to find its footing.

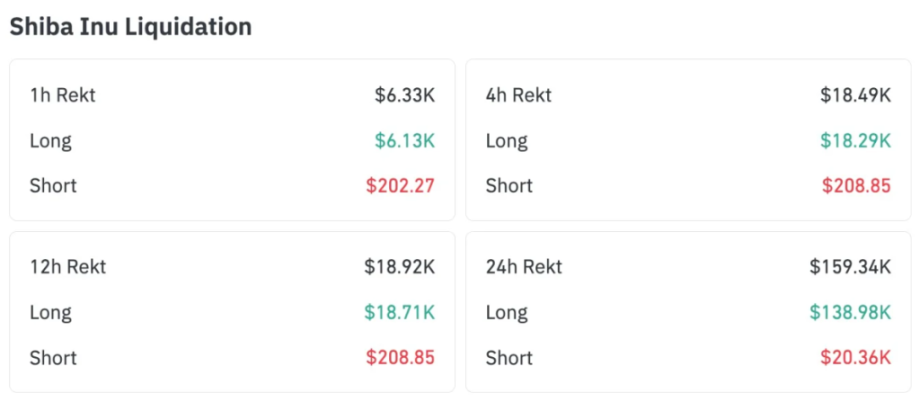

Of the $4.96 million in early Wednesday afternoon liquidations, roughly $18,710 came from longs while shorts lost just $208 as traders misplaced hopes of a buy-the-dip event.

Those who positioned themselves for a bounce missed one key trend indicator: the short-term trend of the 20-day SMA now underperforms the mid-term 50-day SMA, confirming a downtrend.

While liquidation events often reset the market by clearing excess leverage and creating a firmer footing, this setup points to deterioration rather than renewal. Structural breakdowns of this kind tend to invite further downside, not relief rallies.

That weakness exposes Shiba Inu’s core vulnerability: adoption. With no meaningful use case to anchor demand, SHIB remains almost entirely reliant on speculative flows

Without a fundamental backbone to absorb sustained selling pressure, Shiba Inu lacks a clear means to fend off a collapse.

Shiba Inu Price Prediction: Is This the Moment SHIB Collapses?

While there has been a clear breakdown of trend, the Shiba Inu price has yet to lose a key bull market proving ground, all-time lows at $0.000006.

This level has consistently marked pivots into bullish phases across previous market cycles, and momentum indicators suggest it may still carry the same historical significance.

The RSI’s breach far below the 30 oversold threshold suggests capitulation may be setting in, often an indicator of seller exhaustion and a prelude to a reversal.

The MACD reads similarly. It continues to close in on a golden cross above the signal line, painting the liquidation event as a short-term setback.

A bounce here could put a year-long falling wedge pattern back on track, eying a potential 450% return to $0.000033 highs if its key breakout threshold at $0.00001 can be reclaimed as support.

Still, the breakdown scenario remains. With limited historical support to cushion further downside, a break below all-time lows could see a 60% pattern breakdown to $0.0000025.

Maxi Doge: Shiba Inu Might Not Be the Right Play

Those who jump to legacy Doge tokens may be playing the game all wrong. When the bull market hits, capital almost always concentrates on one new Doge meme token.

The pattern is clear. Dogecoin ran first, Shiba Inu was next in 2021, followed by Floki, Bonk, Dogwifhat, and Neiro. Every bull cycle eventually crowns a new Doge-inspired frontrunner.

This time around, Maxi Doge ($MAXI) is tapping into those early Dogecoin vibes with a community built around sharing early alpha, trading ideas, and competitive engagement.

Participation is at its core. Weekly Maxi Ripped and Maxi Pump competitions reward top performers with leaderboard recognition, incentives, and bragging rights.

The hype is already showing in the numbers. The $MAXI presale has raised almost $4.6 million, while early backers are earning up to 68% APY through staking rewards.

For those who missed the Doge wave before, Maxi Doge could be the next chance to catch a meme coin before it enters the mainstream.

Visit the Official Maxi Doge Website Here

The post Shiba Inu Price Prediction: 9,000% Liquidation Imbalance Hits After Death Cross – Is SHIB About to Collapse? appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Eksklusif crypto: Bitcoin Crashed JPMorgan Sees Long-Term Upside vs Go

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in — the market’s been on a rollercoaster lately. Bitcoin is moving, stocks are shifting, and headlines are coming fast. While some investors are hitting pause, others are watching closely, trying to read the signals beneath the noise.

Crypto News of the Day: Bitcoin Slides Below $68,000 Amid Forced Deleveraging

Bitcoin fell below $70,000 on Thursday, before extending a leg down to levels below $68,000, an area last tested on October 28, 2024. The move came as intensified selling swept across crypto markets.

The decline marks roughly a 45% drop from October highs, fueled by ETF outflows, fading demand, and a “forced deleveraging” phase in futures markets.

“…with demand fading, ETF inflows drying up, and futures markets entering a “forced deleveraging” phase. Analysts say weak volumes and sustained selling are prompting investors to exit at a loss, despite technical indicators signaling oversold conditions,” wrote Walter Deaton.

Weak volumes and sustained selling pressure have prompted many investors to exit positions at a loss, even as technical indicators signal oversold conditions.

Despite the short-term turbulence, JPMorgan is increasingly bullish on Bitcoin’s long-term potential relative to gold.

The bank highlighted that BTC is now trading well below its estimated production cost of $87,000, a level historically considered a soft floor, and that its volatility relative to gold has dropped to record lows.

“…large outperformance of gold vs. Bitcoin since last October, coupled with the sharp rise in gold volatility, has left Bitcoin looking even more attractive compared to gold over the long term,” MarketWatch reported, citing JPMorgan’s quantitative strategist Nikolaos Panigirtzoglou.

According to the bank, this improved risk-adjusted profile suggests significant upside for investors willing to hold over a multi-year horizon.

Market stress metrics highlight the fragility of the current environment. Glassnode data shows that Bitcoin’s capitulation metric has recorded its second-largest spike in two years. This reflects sharp forced selling and accelerated de-risking by market participants.

Meanwhile, it is worth noting that Bitcoin has erased all gains since Donald Trump won the election, wiping out a 78% post-election rally and highlighting ongoing volatility.

Crypto Stocks Tumble Amid Bitcoin Sell-Off and Rising Economic Uncertainty

Crypto equities mirror the broader weakness in Bitcoin. Shares of Coinbase, Riot, Marathon, and Strategy fell between 5% and 7% premarket after the drop below $70,000, with ETF holdings also down more than 5%.

The crypto downturn comes amid broader macroeconomic headwinds. US January layoffs surged 205% year-over-year to 108,435, the highest January total since 2009, according to Challenger, Gray & Christmas.

Job cuts were concentrated in transportation — led by UPS — and tech, with Amazon announcing 16,000 layoffs. Healthcare also saw notable reductions.

Meanwhile, federal job protections were overhauled, with the Trump administration finalizing reforms affecting 50,000 civil service workers. Continuing claims remain elevated at 1.84 million, highlighting ongoing economic uncertainty.

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!