📌 MAROKO133 Hot crypto: XRP Price Prediction: First U.S. Spot XRP ETF Launches Wit

XRP price prediction has taken center stage this week after the first U.S. Spot XRP ETF officially went live, opening for trade under Canary Capital’s XRPC ticker and drawing strong early demand from investors.

According to Bloomberg ETF analyst Eric Balchunas, the fund recorded $26 million in trading volume within its first 30 minutes, marking one of the most active ETF debuts of the year.

Balchunas said the XRPC “has a good shot at beating $BSOL’s $57 million as the biggest Day One volume of any ETF launched this year,” hinting at the growing appetite for regulated exposure to XRP among institutional traders.

XRPC ETF Brings Institutional Access to XRP Ledger

In a November 13 post, Canary Capital described the XRPC as a product designed to provide exposure to XRP, the native token of the XRP Ledger, reflecting the network’s performance across payment and liquidity protocols.

Following the announcement, XRP jumped 3% to reach $2.40, with daily trading volume climbing to $6.24 billion, a 34% increase since the ETF opened for trade.

Bitwise CIO Matt Hougan applauded the launch, calling it a bold step for crypto ETFs and a sign of how sentiment is evolving.

“The median opinion of a crypto asset does not determine an ETF’s success,” he said. “You’d rather have 20% of people love an asset than 80% of people kinda vaguely like it.”

His comment explains XRP’s polarized reputation, often criticized by segments of the crypto community yet consistently supported by a loyal base of investors and developers.

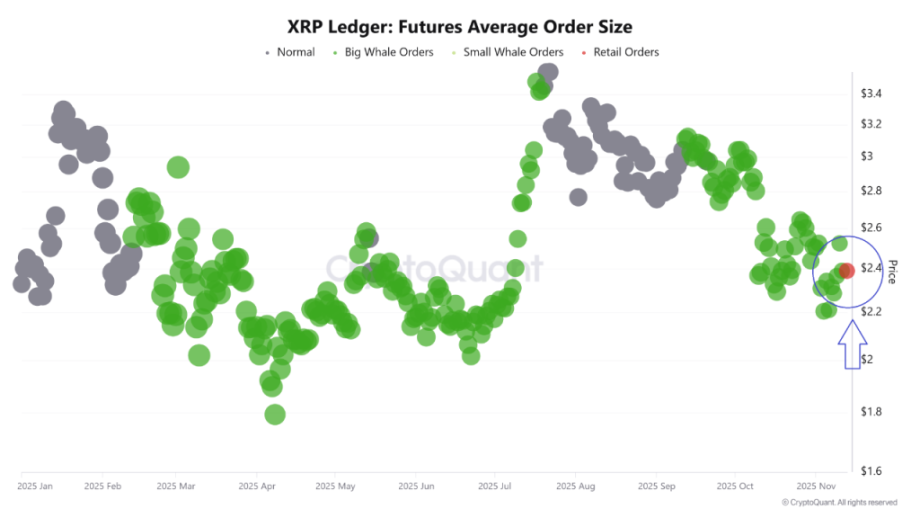

Meanwhile, CryptoQuant data shows that large investors and whales were already positioning ahead of the ETF announcement.

“Before the XRP Spot ETF news, futures data showed a clear rise in whale-sized orders while prices were still compressed,” analysts at the firm observed.

This “whales-first, retail-last” pattern is a familiar sight in crypto markets and often signals a shift toward more aggressive price action.

“Once retail enters late, the market typically becomes more volatile and sentiment-driven,” CryptoQuant noted.

XRP Price Prediction: Elliott Wave Setup Points to $5 Breakout

Multiple market analysts now predict XRP could finish 2025 above $3.50, with potential to reach $5 by 2026 if institutional inflows sustain momentum.

The XRP/USD chart displays an Elliott Wave analysis projecting a dramatic bullish scenario.

The chart shows that XRP has completed a five-wave impulse structure from 2013 to 2018 (Wave 1), followed by a prolonged corrective Wave 2 that bottomed around 2023.

The analysis indicates XRP is now in the early stages of Wave 3, historically the most powerful impulse wave.

The projection shows a potential rally toward the $5-6 range, representing over 150% gain from current levels around $2.40

Key Fibonacci extension levels are marked, with the 0.786 extension around $2.20 (already achieved) and the 1.00 extension near $3.5 serving as the next target before the 1.618 extension near $5.5

Maxi Doge (MAXI) Draws $4M as Investors Hunt High-Yield Meme Plays

As institutional money floods into ETFs, retail traders are turning to presale projects that offer better entry points and strong staking incentives.

One standout is Maxi Doge (MAXI), a meme coin with muscle that’s already raised over $4 million in its ongoing presale.

Unlike typical dog-themed tokens, Maxi Doge pairs meme culture with real staking utility.

The presale runs in staged rounds, with the current price at $0.000268 and small increments between stages, giving early buyers a clear advantage ahead of its DEX listing.

Investors can buy $MAXI using ETH, BNB, USDT, USDC, or a bank card, with no minimum investment, and can stake it immediately for an estimated 78% annual yield.

Visit the Official Website Here

The post XRP Price Prediction: First U.S. Spot XRP ETF Launches With $26M Volume in 30 Minutes appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Eksklusif crypto: HBAR Heads Toward a Crash Site — One Level Stands Be

HBAR price is down almost 1% today and has traded flat over the past month. It is up 5.7% in the last seven days, but that bounce does not change the bigger picture.

The chart is close to forming a bearish structure that points to a deeper drop unless one level holds.

Bearish Pattern Forms as Two Risks Amplify

HBAR is close to completing a head-and-shoulders pattern on the daily chart. If price slips below the neckline, the setup signals a potential 28% decline. This pattern is not confirmed yet, but it sits near completion — and the next moves depend heavily on volume behavior.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That brings the focus to On-Balance Volume (OBV), a tool that tracks whether volume is flowing into or out of the asset. OBV has been rising slowly along an ascending trendline since 23 October, but this is not a strong signal.

Each time OBV drifts toward the lower edge of this trendline, HBAR price pulls back, showing that buyers are barely holding momentum. OBV is now back at the edge again, which increases the risk of a breakdown. If OBV slips under this line, the head-and-shoulders setup gains momentum.

A second risk comes from the leverage map. Over the past seven days on Bitget alone:

- Long liquidations: 17.95 million

- Short liquidations: 14.34 million

Longs outweigh shorts by almost 25%, which leaves the market exposed. If price reaches the neckline, led by weak OBV, a long squeeze could kick in, accelerating the downside.

Key Levels Now Decide Whether HBAR Price Drops or Escapes

HBAR now comes down to two paths:

Bearish path (likely if the neckline breaks): The neckline of the head-and-shoulders pattern sits near $0.160. A clean drop below it completes the structure and exposes a 28% fall, with the HBAR price chart pointing toward $0.113 and even $0.100 if long liquidations cascade.

Bullish path (only if reclaimed): A recovery starts only if HBAR reclaims $0.199 with strength. A full invalidation happens at $0.219, which erases the pattern and shifts momentum back to buyers.

For any bullish scenario to hold, OBV must stay above its ascending trendline. If OBV fails, the neckline breaks faster — and the long squeeze risk increases sharply. For now, the HBAR price is heading toward a crash site, with one level ($0.160) still standing between the price and the fall.

The post HBAR Heads Toward a Crash Site — One Level Stands Between Price and the Fall appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!