📌 MAROKO133 Update ai: Adobe Research Unlocking Long-Term Memory in Video World Mo

Video world models, which predict future frames conditioned on actions, hold immense promise for artificial intelligence, enabling agents to plan and reason in dynamic environments. Recent advancements, particularly with video diffusion models, have shown impressive capabilities in generating realistic future sequences. However, a significant bottleneck remains: maintaining long-term memory. Current models struggle to remember events and states from far in the past due to the high computational cost associated with processing extended sequences using traditional attention layers. This limits their ability to perform complex tasks requiring sustained understanding of a scene.

A new paper, “Long-Context State-Space Video World Models” by researchers from Stanford University, Princeton University, and Adobe Research, proposes an innovative solution to this challenge. They introduce a novel architecture that leverages State-Space Models (SSMs) to extend temporal memory without sacrificing computational efficiency.

The core problem lies in the quadratic computational complexity of attention mechanisms with respect to sequence length. As the video context grows, the resources required for attention layers explode, making long-term memory impractical for real-world applications. This means that after a certain number of frames, the model effectively “forgets” earlier events, hindering its performance on tasks that demand long-range coherence or reasoning over extended periods.

The authors’ key insight is to leverage the inherent strengths of State-Space Models (SSMs) for causal sequence modeling. Unlike previous attempts that retrofitted SSMs for non-causal vision tasks, this work fully exploits their advantages in processing sequences efficiently.

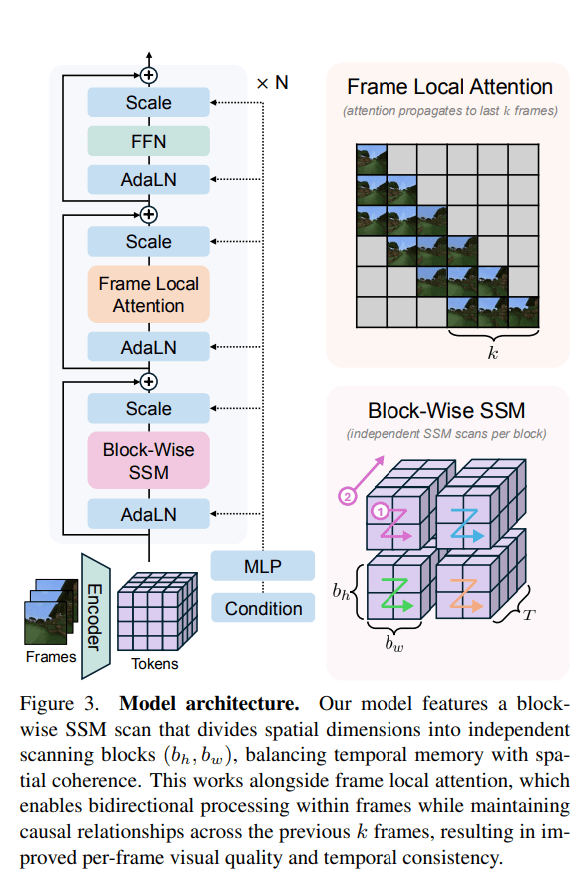

The proposed Long-Context State-Space Video World Model (LSSVWM) incorporates several crucial design choices:

- Block-wise SSM Scanning Scheme: This is central to their design. Instead of processing the entire video sequence with a single SSM scan, they employ a block-wise scheme. This strategically trades off some spatial consistency (within a block) for significantly extended temporal memory. By breaking down the long sequence into manageable blocks, they can maintain a compressed “state” that carries information across blocks, effectively extending the model’s memory horizon.

- Dense Local Attention: To compensate for the potential loss of spatial coherence introduced by the block-wise SSM scanning, the model incorporates dense local attention. This ensures that consecutive frames within and across blocks maintain strong relationships, preserving the fine-grained details and consistency necessary for realistic video generation. This dual approach of global (SSM) and local (attention) processing allows them to achieve both long-term memory and local fidelity.

The paper also introduces two key training strategies to further improve long-context performance:

- Diffusion Forcing: This technique encourages the model to generate frames conditioned on a prefix of the input, effectively forcing it to learn to maintain consistency over longer durations. By sometimes not sampling a prefix and keeping all tokens noised, the training becomes equivalent to diffusion forcing, which is highlighted as a special case of long-context training where the prefix length is zero. This pushes the model to generate coherent sequences even from minimal initial context.

- Frame Local Attention: For faster training and sampling, the authors implemented a “frame local attention” mechanism. This utilizes FlexAttention to achieve significant speedups compared to a fully causal mask. By grouping frames into chunks (e.g., chunks of 5 with a frame window size of 10), frames within a chunk maintain bidirectionality while also attending to frames in the previous chunk. This allows for an effective receptive field while optimizing computational load.

The researchers evaluated their LSSVWM on challenging datasets, including Memory Maze and Minecraft, which are specifically designed to test long-term memory capabilities through spatial retrieval and reasoning tasks.

The experiments demonstrate that their approach substantially surpasses baselines in preserving long-range memory. Qualitative results, as shown in supplementary figures (e.g., S1, S2, S3), illustrate that LSSVWM can generate more coherent and accurate sequences over extended periods compared to models relying solely on causal attention or even Mamba2 without frame local attention. For instance, on reasoning tasks for the maze dataset, their model maintains better consistency and accuracy over long horizons. Similarly, for retrieval tasks, LSSVWM shows improved ability to recall and utilize information from distant past frames. Crucially, these improvements are achieved while maintaining practical inference speeds, making the models suitable for interactive applications.

The Paper Long-Context State-Space Video World Models is on arXiv

The post Adobe Research Unlocking Long-Term Memory in Video World Models with State-Space Models first appeared on Synced.

🔗 Sumber: syncedreview.com

📌 MAROKO133 Hot ai: If Bitcoin Keeps Tanking, It Could Cause a “Death Spiral” for

The major cryptocurrency Bitcoin has had an absolutely horrible start to the year. The digital token has plummeted almost 14 percent so far in 2026, and almost 40 percent since hitting all-time highs of well over $120,000 in October — its longest losing streak since 2018. It’s down almost three percent today alone.

It’s a wakeup call to anyone who made major investments in crypto betting on a more lenient and light-on-regulation market during president Donald Trump’s second term. The White House established its own “Strategic Bitcoin Reserve,” a stockpile made up of Bitcoin holdings mainly from seized assets, and Trump has enriched himself enormously with a series of crypto-related business moves.

To Michael Burry, the man who famously shorted the US housing market before its collapse in 2008, it could be a sign of an impending disaster. In a Substack post this week, Burry warned that further losses for Bitcoin could put a major strain on the balance sheets of investors that overindexed on crypto, leading to further selloffs and a “death spiral” that could be difficult to recover from.

Recent corrections in gold and silver prices after their year-long rallies could be connected to Bitcoin’s woes, Burry argued, since metals futures aren’t backed by physical assets, not unlike crypto tokens.

“Sickening scenarios have now come within reach,” Burry wrote, fretting that another ten percent drop in Bitcoin could prove disastrous for the world’s largest crypto treasury, Strategy Inc., pushing some who are mining the token closer to bankruptcy.

Burry’s warning comes amid turbulent times on Wall Street. The US dollar reached a four-year low earlier this year as investors look abroad for safer bets. The Trump administration’s shaky monetary policy has made foreign investments, particularly in Europe, far more tempting.

All of that uncertainty has caused the value of gold to make major leaps, hitting an all-time high of over $5,500 per ounce last week. Cryptocurrencies, meanwhile, are quickly losing their appeal, dropping below $73,000 last week.

“There is no organic use case reason for Bitcoin to slow or stop its descent,” Burry wrote in his Substack post.

In case the nosediving cryptocurrency were to drop below $70,000, Burry warned that the financial industry could incur heavy losses. Below $50,000, and miners could be forced to close up shop, accompanied by a catastrophic sell-off for precious metals like gold.

“Tokenized metals futures would collapse into a black hole with no buyer,” he wrote. “Physical metals may break from the trend on safe haven demand.”

Whether Burry’s bearish stance on the matter will end up accurately predicting a major “death spiral”-like collapse remains to be seen. He has a long track record of criticizing cryptocurrencies for being worthless and comparing them to the tulip crisis of the 1600s.

His track record is shaky, though. Following his famous shorting of the 2008 housing crisis, the hedge fund manager has also made plenty of wrong calls over the years.

But given the massive investments well over 150 public companies have made in Bitcoin, the token’s recent downturn could indeed foreshadow difficult days ahead as investors desperately try to cut their losses.

More on Bitcoin: The Streets Are Saying Bitcoin Is Gonna Fall to $30,000

The post If Bitcoin Keeps Tanking, It Could Cause a “Death Spiral” for the Entire Economy appeared first on Futurism.

🔗 Sumber: futurism.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!