📌 MAROKO133 Hot crypto: Bitcoin Price Prediction: Jim Cramer Says the US Could Buy

I hate to be the one to bring it to you, but Jim Cramer might be bullish on Bitcoin.

Not exactly, but during CNBC’s Squawk Jim mentioned that he believe Trump might fill the US reserve if BTC price hit $60,000 again.

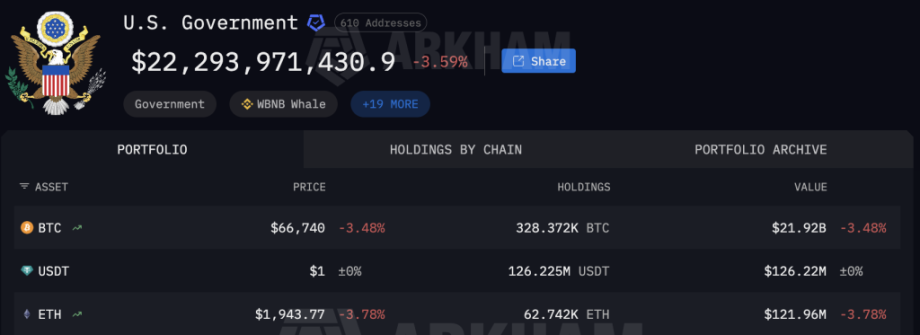

On-chain data shows the U.S. government already holds about 328,372 BTC (worth over $21 billion), but there hasn’t been any noticeable movement in the wallet recently.

No one knows if this actually happens, but according to Polymarket, there is roughly a 30% chance the U.S. government sets up a Strategic Bitcoin Reserve before 2027.

Long term, Bitcoin price prediction are mostly leaning bullish, and this catalyst only supports that view. Here is what the chart is saying right now.

Bitcoin Price Prediction: No, Don’t Tell Me We’re Heading $60,000 Again

BTC is still stuck inside a clean downtrend, but this is the part of the chart where things usually stop being boring.

Bitcoin Price is sitting around $66,000 while RSI says its oversold.

Below, $64,000 is the first floor to watch, and if that gives way, all eyes snap straight to $60,000.

Above us, $71,000 is the big boss level.

If Bitcoin can break and actually hold above it, the short term trend flips bullish fast and suddenly $80,000 is back in play, with $90,000 not sounding crazy anymore.

Until that happens, it is still technically a downtrend, but sellers are clearly losing energy.

If you are getting bored watching Bitcoin crawl sideways and do nothing for days, there is something new and shiny that might bring the excitement back. Even better, it is actually built on Bitcoin. Meet Bitcoin Hyper.

Bored of Bitcoin? Bitcoin Hyper Might Interest You

Bitcoin can sit oversold at $66,000 for weeks while narratives build and nothing actually changes on-chain. That is the problem. It is secure, but passive.

Bitcoin Hyper ($HYPER) is built for traders who want more than waiting.

This Bitcoin-focused Layer-2 uses Solana technology to make BTC faster, cheaper, and usable for payments, apps, and real on-chain activity, without touching Bitcoin’s core security.

While Bitcoin grinds in downtrends and headlines debate $60,000 or $90,000, Bitcoin Hyper is already moving.

The presale has raised over $31 million so far.

$HYPER is priced at $0.0136751 before the next increase, plus staking rewards up to 37%.

If Bitcoin feels boring again, Bitcoin Hyper is designed to fix that.

Visit the Official Bitcoin Hyper Website Here

The post Bitcoin Price Prediction: Jim Cramer Says the US Could Buy at $60K – Is a Government Bitcoin Buy Coming? appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Hot crypto: MicroStrategy Plans to Issue More Perpetual Preferred Stoc

Strategy, formerly known as MicroStrategy, plans to issue additional perpetual preferred stock in a bid to ease investor concerns over the volatility of its common shares, according to its chief executive officer.

The announcement comes as Strategy’s stock, trading under the ticker MSTR, has fallen nearly 17% year to date.

CEO Says Preferred Shares Could Become Major Funding Tool for Strategy

In a recent interview with Bloomberg, Strategy CEO Phong Le addressed Bitcoin’s price swings. He attributed its volatility to its digital characteristics. When BTC rises, Strategy’s digital asset treasury plan drives outsized gains in its common stock.

Conversely, during downturns, the shares tend to decline more sharply. He noted that Digital Asset Treasuries (DATs), including Strategy, are engineered to follow the leading cryptocurrency.

To address this dynamic, the company is promoting its perpetual preferred shares, branded “Stretch.”

“We’ve engineered something to protect investors who want access to digital capital without that volatility and that’s Stretch,” Le told Bloomberg.” To me, the story of the day is Stretch closes at $100 exactly how it was engineered to perform.”

The preferred shares offer a variable dividend, currently set at 11.25%, with the rate reset monthly to encourage trading near the $100 par value.

It’s worth noting that preferred stock has so far represented only a small portion of Strategy’s capital-raising activity. The company sold approximately $370 million in common stock and about $7 million in perpetual preferred shares to fund its previous three weekly Bitcoin purchases.

However, Le said, Strategy is actively educating investors about what preferred shares can do.

“It takes some seasoning. It takes some marketing,” he said. “This year, we have seen extremely high liquidity with our preferreds, about 150 times other preferreds, and as we go throughout the course of this year, we expect Stretch to be a big product for us. We will start to transition from equity capital to preferred capital.”

MicroStrategy’s Bitcoin Bet Under Pressure With Shares Trading Below Net Asset Value

The shift could prove important as Strategy’s traditional funding model faces pressure. Strategy continues to expand its Bitcoin holdings, purchasing more than 1,000 BTC earlier this week. As of the latest data, the firm holds 714,644 BTC.

However, the recent decline in Bitcoin’s price has weighed heavily on the company’s balance sheet. At current market prices of around $67,422 per coin, Bitcoin is trading well below Strategy’s average purchase price of approximately $76,056. As a result, the company’s holdings reflect an unrealized loss of roughly $6.1 billion.

The company’s common stock has mirrored that decline, falling 5% on Wednesday alone. MSTR is roughly down 17% so far this year. In comparison, Bitcoin has fallen more than 22% over the same period.

As mentioned before, Strategy’s Bitcoin accumulation strategy has relied more on equity issuance. A key metric in this model is its multiple to net asset value, or mNAV, which measures how the company’s stock trades relative to the value of its Bitcoin per share.

According to SaylorTracker data, Strategy’s diluted mNAV was approximately 0.95x, indicating the stock traded at a discount to the Bitcoin backing each share.

That discount complicates the company’s approach. When shares trade above net asset value, Strategy can issue stock, purchase additional Bitcoin, and potentially create accretive value for shareholders. When shares trade below net asset value, new issuance risks diluting shareholders instead.

By increasing its reliance on perpetual preferred stock, Strategy appears to be adjusting its capital structure to sustain its Bitcoin acquisition strategy while attempting to address investor concerns over volatility and valuation pressure.

For MSTR shareholders, the shift toward perpetual preferred stock could reduce dilution risk. By relying less on common equity issuance, Strategy may preserve Bitcoin per share and limit pressure from discounted share sales.

However, the move also introduces higher fixed dividend obligations, increasing financial commitments that could weigh on the company if Bitcoin remains under pressure. Ultimately, the plan reshapes the risk profile rather than eliminating the underlying volatility tied to its Bitcoin treasury.

The post MicroStrategy Plans to Issue More Perpetual Preferred Stock: What It Means for MSTR appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!