📌 MAROKO133 Hot crypto: Bitcoin’s Failed Breakout Was Expected — and So Might Be I

Bitcoin (BTC) spent most of October moving sideways, gaining barely 1.5% across the month. Over the past week, though, the Bitcoin price has climbed nearly 5%, bringing the focus back to a possible bullish reversal.

Earlier this week, Bitcoin briefly crossed $113,200 before getting rejected near $115,000 — a zone that now defines the line between hesitation and renewed strength. The rejection looked sudden, but the data shows it was expected. And if one key level gives way, the recovery could be, too.

Why The Breakout Failed

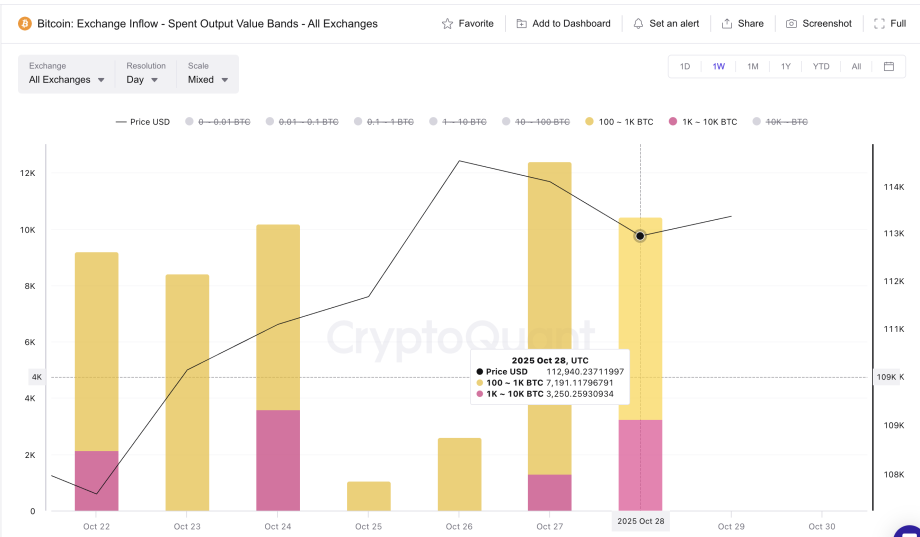

The first signal came from on-chain behavior rather than the charts. CryptoQuant’s Spent Output Value Bands, which track how much Bitcoin each holder group moves to exchanges, showed a sharp rise in selling pressure between October 25 and 28.

The 100–1,000 BTC group (sharks) raised their exchange transfers from 1,046 BTC to 7,191 BTC, while the 1,000–10,000 BTC group (whales) added around 3,250 BTC during the same time.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Such inflows often mean profit-taking or short-term hedging. Together, these moves flooded exchanges with supply right as Bitcoin tested $115,000, capping the Bitcoin price move and stopping what could have been a clean continuation.

This wave of large-holder activity explains why the breakout attempt stalled despite strong retail optimism.

Why The Setup Still Holds

Even after that sell pressure, Bitcoin’s foundation looks steady. Glassnode’s Holder Accumulation Ratio (HAR), which tracks how many wallets add to their BTC balance, remains firm at 60.2%.

Any reading above 50% means the market is in net accumulation, showing that long-term holders are still quietly buying. While it’s slightly below the recent three-month high near 63%, the data confirms the broader buying trend hasn’t broken.

This behavior matters because it offsets short-term selling from whales.

As long-term holders absorb the coins moving to exchanges, it prevents deeper pullbacks and keeps the structure stable. That’s what keeps the door open for a renewed push if momentum returns.

Bitcoin Price Structure And Why The Recovery Is Expected

Bitcoin’s current setup still follows a clear technical structure, an inverse head and shoulders pattern, which often signals a shift from selling to buying momentum. The formation remains valid as long as BTC holds above $106,600, which acts as the base of the pattern.

The Relative Strength Index (RSI), an indicator that measures how strong buying or selling momentum is, first flashed a hidden bearish divergence between October 13 and 26, right around the time the breakout attempt formed.

During that period, the Bitcoin price made a lower high, while RSI made a higher high, signaling that momentum was weakening even as traders pushed the price up.

That imbalance was the reason many expected a possible breakout failure near $115,000. And that’s exactly what followed — a rejection and short-term correction.

Now, the divergence has flattened out, meaning RSI and the Bitcoin price are moving in sync again. This stabilization shows that sellers are losing steam and that the setup for recovery is building strength. However, $115,000 remains the key test. It’s the level that capped the last breakout and will decide whether this pattern continues to evolve higher.

If Bitcoin closes decisively above it, the neckline breakout could open the path toward $117,300 and $125,900 (near BTC’s peak). That would be an 11% gain from the current zone. If the BTC price fails and slips below $106,600, that would invalidate the bullish setup. It could even send BTC toward $103,500.

The post Bitcoin’s Failed Breakout Was Expected — and So Might Be Its Recovery If $115,000 Breaks appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Hot crypto: Australia Detains Blockchain Global Director Pending Corpo

Australia’s corporate regulator has barred Blockchain Global director Ryan Xu from leaving the country while it investigates the collapse of a crypto exchange operated by the company.

The Australian Securities and Investments Commission (ASIC) said on Wednesday that the Federal Court granted interim travel restraint orders against Xu, also known as Zijing Xu, on Oct. 20. The orders prohibit him from leaving or attempting to leave Australia until Dec. 20.

ASIC sought the restrictions on an ex parte basis, meaning Xu has not yet had the opportunity to respond in court. The matter will return for an inter partes hearing, where all parties can be heard, on October 30.

ASIC Probe Targets Blockchain Global’s Failed Exchange and Missing Funds

The investigation centers on Blockchain Global’s role in operating the ACX Exchange, a now-defunct crypto platform that allowed customers to buy, sell and store digital assets. The exchange collapsed in late 2019 after users began reporting difficulties accessing their funds.

Blockchain Global entered liquidation in Feb. 2022. Liquidators later told ASIC that the firm owed around A$58m ($37.3m) to unsecured creditors as of Oct. 2023. The regulator launched a formal probe into the company and its directors in early 2024.

ASIC said it applied for the travel ban over concerns Xu could leave the country while the investigation is ongoing.

ASIC Targets Troubled Crypto Firms to Restore Market Credibility

The case marks another move by Australian authorities to tighten oversight of failed crypto ventures and recover funds for affected investors. ASIC has previously pursued actions against multiple digital asset firms that collapsed during the sector’s 2019–2022 downturn.

Blockchain Global, once a high-profile player in Australia’s blockchain scene, operated several crypto businesses and positioned itself as a bridge between traditional finance and emerging digital markets. Its collapse, however, left creditors and customers facing millions in potential losses.

Court Order Keeps Xu in Australia as ASIC Reviews Potential Law Breaches

Court documents show that ASIC’s investigation is examining whether company directors breached corporate or financial laws in managing customer funds and maintaining solvency.

Xu, a co-founder of Blockchain Global, was one of several executives associated with the exchange. He has not been charged with any criminal offenses, and the court’s current order is a civil measure to ensure his availability for ongoing proceedings.

The Federal Court will reassess the restraint order at the next hearing on Oct. 30, where both ASIC and Xu’s representatives are expected to present their positions.

The post Australia Detains Blockchain Global Director Pending Corporate Misconduct Probe appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!