📌 MAROKO133 Hot crypto: Bonk Price Prediction as BONK Approaches 6-Month Support L

The downturn that started last week now puts a 6-month support trendline under pressure, putting BONK price predictions at a crossroads.

The meme coin faces a decisive moment that could spark a deeper correction or mark a buy-the-dip opportunity.

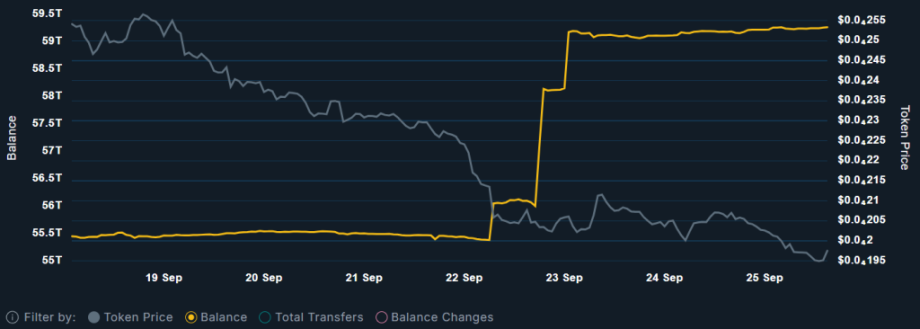

Whales appear to be betting on the latter. Over the past week, the top 100 BONK wallets have deepened their holdings by 3.80 trillion tokens, according to Nansen data.

This show of conviction comes as market narratives continue to favor a Q4 bull run.

Rex-Osprey, the issuer behind the first Dogecoin spot ETF, may have a clear shot at a first Bonk spot ETF under new SEC generic listing standards to fast-track crypto ETP approvals.

And with U.S. inflation nearing the Fed’s 2% target, hopes for further interest rate cuts are strengthening, fuelling risk-on sentiment and capital rotation into more speculative plays like Bonk.

Bonk Price Prediction: Can Bonk Hold the Support?

The current retest of psychological support at $0.000019 marks the final barrier to a breakdown of Bonk’s 6-month support trendline and a wider ascending broadening wedge pattern.

Momentum indicators lean toward a bounce. The RSI is approaching the oversold threshold at 30, a level that often marks local bottoms as sellers reach exhaustion.

The MACD histogram shows a similar shift, reversing toward the signal line in what could be the early stages of a golden cross, signaling a potential new uptrend.

If the wedge’s lower boundary holds as a launchpad, the next upward move could target a retest of its upper resistance.

That would put the $0.0001 level back in focus, a potential 425% gain from current levels.

Still, resistance levels like the $0.00004075 July high and Bonk’s $0.000062 all-time high stand as critical hurdles.

To flip them to support, fresh demand catalysts such as U.S. rate cuts and spot ETF approvals will likely be necessary to sustain the rally into 2026.

History Says This Bull Run Could Deliver Bonk’s Successor – the Market Has Already Spoken

With this breakout setup, Bonk continues to demonstrate a trend: the strongest social momentum lies with Doge-branded tokens.

It all started with Dogecoin in 2021, then Floki, Bonk, Dogwifhat, Neiro, and most recently Dowge. Every bull run eventually delivers its own parabolic Doge-themed runner.

Now, early momentum is pointing to Maxi Doge ($MAXI) as the next in line.

Maxi Doge blends a no-utility ethos with gym-culture satire and trader degeneracy, positioning itself as more than just a meme coin—it’s a lifestyle asset.

The hype is already translating into numbers. The $MAXI presale has already pulled in close to $2.5 million in its initial weeks, with early backers locking in a massive 134% APY through staking rewards.

You can take part in the Maxi Doge ($MAXI) presale now on the official website.

With exchange listings coming soon, now could be the best opportunity to get involved early.

More info: Maxi Doge on X (formerly Twitter) and Telegram.

Visit the Official Website Here

The post Bonk Price Prediction as BONK Approaches 6-Month Support Level – Next Move Could Decide Everything appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Eksklusif crypto: US Regulators Examine Trading Patterns Before Firms

US regulators are investigating sharp swings in stock prices before companies revealed plans to raise funds for crypto treasury purchases, the Wall Street Journal reported on Thursday.

The Securities and Exchange Commission and the Financial Industry Regulatory Authority have contacted some of the more than 200 firms that announced crypto treasury strategies this year, sources told the Journal.

Officials warned companies about possible breaches of rules against selectively sharing material non-public information.

The scrutiny comes amid a wave of companies adopting crypto treasury strategies. Inspired by the success of Strategy, formerly known as MicroStrategy, dozens of firms outside the crypto sector have announced plans to raise capital specifically for Bitcoin purchases.

Crypto Treasury Craze Fuels $20 Billion Fundraising Wave

The trend accelerated in early 2025 after a Trump administration executive order established a national strategic Bitcoin reserve. Since then, more than 60 companies, from software and gaming to biotech and energy, have unveiled plans to put portions of their balance sheets into crypto.

Together, they have targeted over $20b in fundraising through stock offerings, convertible debt and private placements. The aim has been to hedge against inflation, attract younger investors and mirror the outsized gains seen by early movers.

However, stock prices often soared in the days before announcements, sometimes doubling or tripling. These unexplained moves have raised questions about whether insiders leaked details or tipped investors, prompting regulators to act.

Corporate Crypto Buys Spur Stock Surges, Draw SEC And FINRA Attention

Trump Media and Technology Group is among the most high-profile cases. Ahead of its May 27 disclosure that it planned to raise $2.5b for a Bitcoin treasury, its shares posted a week of unusual volatility.

The announcement pushed the firm into the ranks of the largest corporate Bitcoin holders, alongside Strategy and Marathon Digital Holdings, but regulators quickly flagged suspicious trading.

GameStop followed a similar path. The retailer revealed a $500m Bitcoin buy on May 28, but its shares had already surged 40% in the three trading sessions before the news. SEC officials are examining clustered buy orders tied to company vendors, while FINRA is reviewing broker communications.

Biotech firm MEI Pharma also drew attention in July when it announced plans to allocate a quarter of its cash reserves to Litecoin. Its stock nearly doubled in four days leading up to the filing, with unusually heavy call option activity. Investigators are reviewing whether investor briefings breached disclosure rules.

Debt-Funded Buybacks Signal Strain On Firms Chasing Crypto Gains

SharpLink Gaming, a small-cap marketing firm specializing in sports betting and iGaming affiliates, made a major shift into an Ethereum treasury strategy in mid-2025. On May 28, its shares spiked roughly 433% during intraday trading, market data showed.

The craze for crypto treasuries that swept through small and mid-cap firms is already showing cracks. Several companies that only months ago trumpeted crypto holdings are now launching share buybacks, often using debt, to counter sliding stock prices.

In some cases, market values have fallen below the worth of the Bitcoin on their balance sheets. That gap signals rising investor doubt about whether crypto treasury strategies can deliver long-term value.

The post US Regulators Examine Trading Patterns Before Firms Announced Crypto Treasury Holdings: Report appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!