📌 MAROKO133 Hot crypto: Ether.fi Moves Crypto Card Product to OP Mainnet From Scro

Ether.fi is migrating its payments rail, Ether.fi Cash, to OP Mainnet, moving roughly 70,000 active cards and 300,000 accounts away from the Scroll Layer 2 network, according to a recent blog post.

The transition, announced Wednesday, involves shifting millions in Total Value Locked (TVL) over the coming months to integrate with Optimism’s broader Superchain ecosystem.

This strategic pivot underscores the fierce competition among Layer 2 solutions for high-volume consumer applications, with Ether.fi citing access to a larger DeFi ecosystem as a primary driver.

Key Takeaways

- Mass Migration: Approximately 70,000 active cards and 300,000 accounts are moving to Optimism.

- Volume Impact: Ether.fi Cash processes roughly $2 million in daily spend volume.

- Incentives: Gas fees for card transactions will be fully absorbed by Ether.fi during and after the transition.

Why Is Network Choice Critical?

Ether.fi initially built its reputation on asset restaking but successfully pivoted to consumer payments with Ether.fi Cash in 2024.

The product allows users to spend stablecoins or borrow against staked assets like eETH to fund real-world Visa purchases.

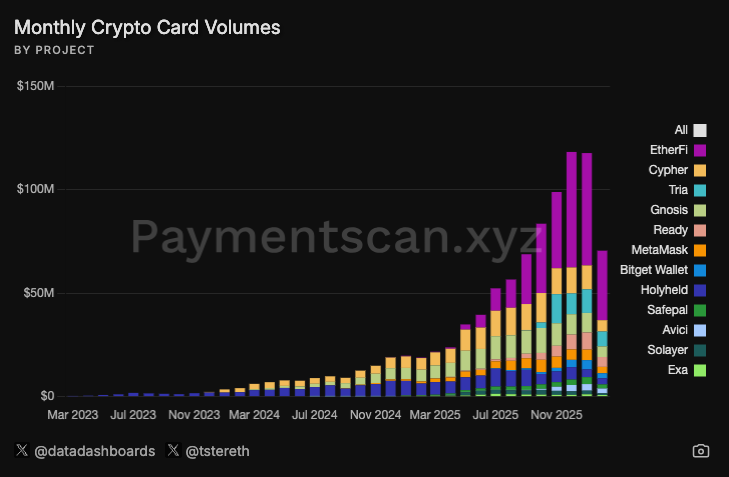

According to Paymentscan, these cards now facilitate nearly half of all crypto-native card transactions.

The choice of underlying network defines transaction speed and liquidity depth.

Operational stability is paramount for consumer products; just look at what happened to what happened to Moonwell this week.

Payment providers must mitigate infrastructure risks by selecting mature execution layers. Ether.fi’s move signals that liquidity depth on OP Mainnet currently outweighs the ZK-rollup advantages offered by Scroll for this specific use case.

Discover: The best crypto presales right now

Breaking Down the Migration

The migration utilizes an OP Enterprise partnership, providing Ether.fi with dedicated support and shared codebase tooling.

Transaction costs for card usage will be absorbed by the protocol, ensuring users experience no friction during the switch. This is critical as Ether.fi Cash currently processes roughly 2,000 internal swaps and 28,000 spend transactions daily, metrics that have reportedly doubled every two months.

Capital efficiency is the core technical driver here. Much like how new frameworks are introducing unified liquidity and staking solutions, Ether.fi expects deeper liquidity for swaps on OP Mainnet compared to its previous deployment.

Optimized liquidity pools mean lower slippage for users converting crypto to fiat at the point of sale.

The OP Stack itself processed a staggering 3.6 billion transactions in the second half of 2025, representing 13% of all crypto transactions in that period.

What Does This Mean for the L2 Landscape?

For Scroll, this represents a notable loss of volume. The ZK-powered chain had relied on Ether.fi as a significant driver of daily activity.

Conversely, Optimism reinforces its position as a dominant hub, securing a high-retention consumer product just as internal ecosystem dynamics shift, notably with Base signaling moves toward a bespoke chain platform.

This consolidation reflects a maturing Ethereum ecosystem where projects prioritize battle-tested liquidity over novel tech stacks.

It aligns with broader institutional positioning, similar to how funds like Founders Fund have adjusted their ETH-related exposure to align with prevailing market realities.

For the end user, the backend plumbing changes, but the card in their digital wallet simply becomes more efficient.

Discover: Diversify your crypto portfolio with these top picks

The post Ether.fi Moves Crypto Card Product to OP Mainnet From Scroll appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Hot crypto: Tom Lee’s BitMine Adds 35,000 ETH, But BMNR Stock Breaks D

Tom Lee’s BitMine Immersion Technologies just bought another 35,000 ETH, expanding its already massive Ethereum treasury. Normally, such aggressive accumulation would signal confidence and support the stock price. Instead, the BitMine stock price fell nearly 2% in the past 24 hours and is now down more than 8% since February 13.

This creates a strange contradiction. BitMine keeps buying Ethereum, yet its stock keeps falling. At first glance, it looks like two different stories. But underneath, it might all be the same.

BitMine Adds More Ethereum, But the Stock Breaks Down

BitMine’s latest Ethereum purchase reinforces its strategy of becoming one of the largest ETH treasury companies. Buying 35,000 ETH, in two batches, in a single day, shows long-term conviction. The purchase pushed its total holdings to 4.371 million ETH, with combined cash and crypto reserves now worth around $9.6 billion.

Want more insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Companies usually increase holdings when they expect higher future prices, not lower ones. However, the stock price reaction tells a very different story. Since February 13, BitMine stock has dropped over 8%, and the technical chart now shows a breakdown.

The stock recently fell below the lower boundary of a bear flag pattern. A bear flag forms after a sharp drop, followed by a weak recovery.

When the lower support breaks, it often signals that the prior recovery structure has weakened and the stock has entered a technically fragile zone. Based on the pattern structure, the ongoing breakdown path could extend by over 50% if the weakness persists. However, this price decline does not automatically confirm active investor selling, which we will see in the next section.

This creates a disconnect between BitMine’s strengthening treasury position and its weakening stock price, suggesting that other external factors may be influencing the move.

Retail Buying Improves, But Big Money Remains Cautious

Despite the falling price, investor behavior beneath the surface shows some early strength. One key indicator is On-Balance Volume, or OBV. This metric tracks cumulative buying and selling pressure. When OBV rises, it means investors, possibly retail, are buying. possibly retail, are accumulating, even if the price has not responded yet.

Between February 9 and February 13, BitMine’s stock price formed a lower high, showing weakening price strength. However, OBV formed a higher high during the same period. It signals that buying activity is increasing quietly. This suggests retail investors were still accumulating BitMine stock despite the falling price.

Another important indicator, the Chaikin Money Flow, or CMF, also shows improving conditions.

CMF measures whether large capital is entering or leaving a stock. The indicator has been rising recently, showing improving inflows and showing divergence similar to OBV.

However, CMF remains below the zero line, which means overall capital flow into BitMine is still negative. This suggests that large institutional investors are not fully supporting the recovery yet. Retail investors are stepping in, but institutional money remains cautious.

Together, the rising OBV and improving CMF suggest that underlying participation is stabilizing rather than collapsing. This indicates that the recent breakdown may not be driven by aggressive selling from BitMine investors. Instead, the stock’s weakness appears more closely linked to Ethereum’s own price pressure, reflecting BitMine’s growing role as a high-beta proxy for ETH rather than a stock moving independently.

Ethereum Weakness Is Dragging BitMine Stock Price Lower

The biggest reason behind BitMine’s stock decline becomes clear when comparing it with Ethereum. BitMine’s price is highly correlated with Ethereum’s price. Correlation measures how closely two assets move together. BitMine’s correlation with Ethereum has increased from 0.50 to 0.52. This means the stock is behaving more like a direct proxy for Ethereum.

At the same time, Ethereum’s futures market shows rising bearish sentiment. The Ethereum long-short ratio has dropped to extremely low levels. This ratio measures how many traders expect prices to rise compared to fall. A low ratio means most traders expect further declines.

This bearish positioning directly impacts BitMine. Because BitMine holds a massive Ethereum treasury, its stock tends to weaken when Ethereum itself faces bearish pressure.

<p…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!