📌 MAROKO133 Breaking crypto: Ethereum Staking Entry Queue Surpasses Exit Queue Aft

After three straight months of selling pressure driven by unstaking, the Ethereum network is showing a positive signal. The staking entry queue has now surpassed the exit queue.

How do analysts interpret this shift? What could it mean for ETH’s price?

Why Could ETH Potentially Double When Unstaking Pressure Weakens?

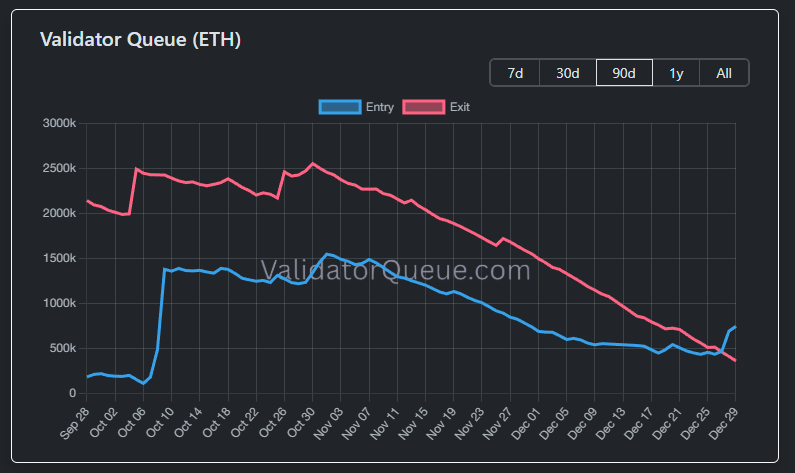

Ethereum’s entry and exit queues track ETH waiting to begin staking or to unstake.

Previously, analysts believed that selling pressure could intensify if the amount of ETH in the entry queue continued to rise.

ValidatorQueue data shows that the entry queue has exceeded the exit queue since September 10. This trend has now officially reversed the prior imbalance.

Currently, approximately 745,600 ETH are in the entry queue, while around 360,500 ETH remain in the exit queue.

Analyst CryptoHuntz described the recent period as a “Great Migration” of ETH. This movement significantly contributed to ETH’s steady decline from $4,800 in early September to around $3,000 today.

“The Great Migration is over… finally, the selling pressure from the last three months is drying up. Demand to enter ETH staking is back in the driver’s seat. Nature is healing,” CryptoHuntz said.

Additionally, Abdul, Head of DeFi at Monad, provided a more optimistic outlook based on historical price behavior.

He estimated that around 5% of ETH’s supply, worth roughly $15 billion, has changed hands since July. He also projected that the validator exit queue could reach zero by January 3.

Abdul also noted that the last time the entry queue exceeded the exit queue was in June. ETH’s price doubled shortly afterward.

This observation suggests a similar scenario could unfold. ETH may recover from its current price zone of $3,000.

The outlook gains further support from a recent decision by Tom Lee, chairman of BitMine. BitMine holds the world’s largest ETH treasury, valued at around $12 billion, and has chosen to participate in staking.

BeInCrypto reported that BitMine deposited approximately 74,880 ETH, worth about $219 million, into Ethereum’s staking contract. This amount represents only a small portion of its total 4.07 million ETH holdings. The goal is to generate yield, which could reach $371 million per year if the entire balance were staked at a 3.12% APY.

CryptoQuant data indicate that the total amount of ETH deposited by investors into protocols and contracts has remained relatively stable at around 36 million. This level has held since ETH peaked near $4,900. Despite the positive signals above, it remains too early to declare a shift away from the current sideways trend.

Moreover, this optimistic scenario may face headwinds. Several on-chain indicators suggest that selling pressure from US-based investors remains present.

The post Ethereum Staking Entry Queue Surpasses Exit Queue After 3 Months — What’s Next for ETH? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: Bitcoin Mining Difficulty Nears Record High as 2026 A

Bitcoin’s mining difficulty is once again edging closer to uncharted territory as the network prepares for its first adjustment of 2026.

Key Takeaways:

- Bitcoin’s mining difficulty is likely to rise again in January 2026 as block times remain slightly too fast.

- Higher difficulty is tightening margins for miners after a volatile 2025.

- Regular adjustments help protect Bitcoin’s decentralization and network security.

Data shows that difficulty rose to 148.2 trillion in the final adjustment of 2025 and is on track to climb further in early January, underscoring the continued expansion of computing power securing the blockchain.

According to projections from CoinWarz, the next difficulty adjustment is expected on January 8, 2026, at block height 931,392. If current trends hold, mining difficulty could increase to around 149 trillion.

Faster Block Times Point to Higher Difficulty After a Turbulent Year for Miners

Average block times are currently hovering near 9.95 minutes, slightly faster than Bitcoin’s 10-minute target, signaling that an upward adjustment is likely to slow block production back to schedule.

The steady rise follows a volatile year for miners. In 2025, network difficulty hit multiple all-time highs, including two sharp increases in September during Bitcoin’s price rally.

Those gains came just weeks before the market suffered a historic crash in October, leaving many mining firms squeezed between rising operational costs and falling revenue.

Higher difficulty directly translates into tougher conditions for miners. As the cryptographic puzzle becomes harder, operators must deploy more powerful machines and consume more energy to compete for the same block rewards.

For an industry already defined by thin margins and heavy capital requirements, each upward adjustment raises the bar for survival.

Bitcoin’s difficulty adjustment is a core mechanism designed to keep the network stable and decentralized.

The protocol recalibrates difficulty every 2,016 blocks, roughly every two weeks, based on how quickly miners are finding blocks. When blocks are mined too quickly, difficulty increases; when mining slows, it decreases.

This self-correcting system prevents any single miner or coordinated group from dominating the network by suddenly adding massive amounts of computing power.

Without it, an entity with sufficient resources could mine blocks faster than others, collect a disproportionate share of rewards, and undermine trust in the system.

Bitmain Slashes Bitcoin Miner Prices as Industry Pressure Mounts

As reported, Bitmain is cutting prices aggressively across multiple generations of Bitcoin mining hardware as pressure builds across the mining sector, according to recent promotional campaigns and internal price lists circulated to customers.

One promotion dated Dec. 23 offered a package of four S19 XP+ Hydro units paired with an ANTRACK V2 container, implying an effective price of roughly $4 per terahash for the 19 J/TH machines.

Shipments for that batch are scheduled to begin in January 2026, suggesting Bitmain is willing to lock in low pricing well ahead of delivery.

Meanwhile, Bitcoin’s network hashrate fell 4% in the month through Dec. 15, a development that could set the stage for stronger price performance in the months ahead, according to analysts at VanEck.

“When hash rate compression persists over longer periods, positive forward returns tend to occur more often and with greater magnitude,” the analysts wrote.

The post Bitcoin Mining Difficulty Nears Record High as 2026 Approaches appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!