📌 MAROKO133 Hot crypto: Trump Meme Team Pulls $33M From Liquidity Again – $94M Gon

The wallet managing the official $TRUMP meme coin withdrew another $33 million in USDC from its liquidity pool and deposited the funds into Coinbase.

Over the past 30 days, the team has extracted a total of $94 million from the pool, according to blockchain analytics firm LookOnChain.

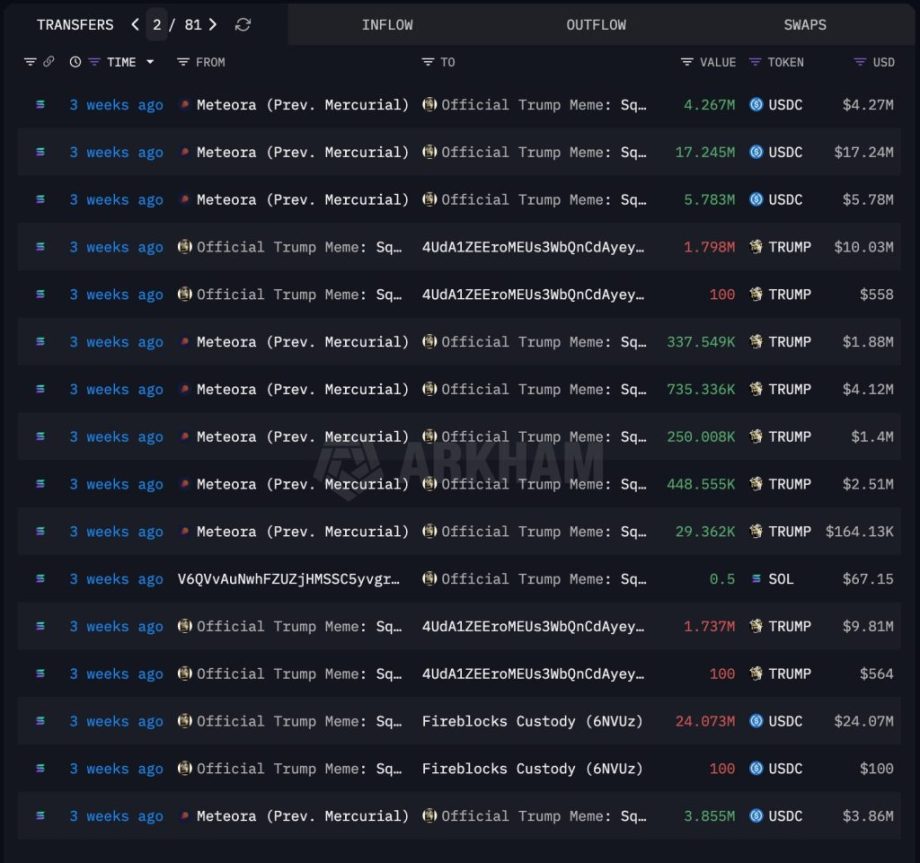

On-chain data from Arkham Intelligence shows the Official Trump Meme wallet executed multiple transactions over a 24-hour period.

The wallet pulled USDC in batches ranging from $2 million to $17.2 million from Meteora’s liquidity pools, then consolidated the funds and transferred them to Fireblocks custody addresses linked to Coinbase.

Systematic Withdrawals Follow Established Pattern

Three weeks ago, the team conducted similar operations, withdrawing $33 million in two separate transfers to Coinbase-linked custody addresses.

Those transactions followed the same pattern, multiple smaller withdrawals from Meteora pools, followed by consolidation and transfer to Fireblocks custody wallets.

The systematic removal of liquidity comes as President Trump’s crypto ventures face intensifying scrutiny.

Back in October, it was revealed that the Trump family has generated approximately $1 billion in pre-tax gains from digital asset projects over the past year, according to Financial Times analysis.

The $TRUMP and $MELANIA meme coins alone produced roughly $427 million in revenues, capitalizing on brand recognition and political influence.

World Liberty Financial, the family’s flagship DeFi venture, raised $550 million through token sales.

Trump’s official financial disclosure revealed he personally received $57.4 million in income from his association with the firm, which is primarily run by his sons.

He holds 15.75 billion WLFI tokens, representing 15.75% control of the entire project.

The venture’s governance token began trading on major exchanges in September, briefly valuing the Trump family’s stake at over $6 billion when prices touched $0.30.

At that time, trading volumes exceeded $1 billion within the first hour, though prices later retreated 16% to $0.23.

Trump Media Emerges as Major Bitcoin Holder

Trump Media & Technology Group has positioned itself among the world’s largest institutional holders of Bitcoin.

The Nasdaq-listed company currently holds approximately 11,542 BTC, valued at over $1 billion, representing roughly 20% of its total market capitalization.

The strategy places TMTG eleventh among publicly traded companies with Bitcoin treasury positions, ahead of Tesla, Block, and Galaxy Digital.

Only MicroStrategy, Marathon Digital, and Block maintain larger reserves. CEO Devin Nunes said the Bitcoin holdings “help ensure our Company’s financial freedom, help protect us against discrimination by financial institutions.“

Despite the substantial Bitcoin holdings, TMTG shares have significantly underperformed the crypto itself.

While Bitcoin declined 4.9% year to date, TMTG plunged nearly 64% the same period.

Legal Challenges Mount Across Trump Crypto Empire

The family’s crypto ventures face mounting legal pressure.

Federal prosecutors filed a class-action lawsuit against Meteora co-founder Benjamin Chow, alleging he orchestrated pump-and-dump schemes using Trump family endorsements to defraud retail investors of at least $57 million.

The lawsuit targets operations involving $MELANIA, $LIBRA, $M3M3, $ENRON, and $TRUST tokens.

Hours after the filing, three Trump-linked addresses received a $4.2 million Meteora token airdrop, which they immediately deposited into the OKX exchange.

The $MELANIA token has crashed from its peak of $13.73 to $0.118, erasing over 99% of its value.

Forensic analysis identified coordinating wallets that funded deployer accounts and financed sniper wallets capturing early supply.

Kelsier Ventures CEO Hayden Davis admitted in a YouTube interview: “We sniped our own coin to prevent snipers from sniping our own coin.“

Meanwhile, earlier this month, it was reported that ALT5 Sigma, a Nasdaq-listed company backed by World Liberty Financial, <a href="https://crypton…

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

📌 MAROKO133 Update crypto: An 80% Wipeout Hasn’t Stopped Korean Retail From Chasin

An 80% collapse would normally mark the end of a speculative trade. In South Korea’s retail-driven crypto ecosystem, it has done the opposite.

BitMine Immersion Technologies, the Tom Lee–backed US-listed firm that reinvented itself as an Ether hoarding vehicle, now ranks second only to Alphabet among the most purchased overseas stocks by South Korean investors in 2025.

Korean Retail Keeps Buying Tom Lee’s BitMine Even as the Stock Implodes

That position has held even as BitMine’s shares plunged roughly 82% from their July peak, wiping out most of the gains from its explosive rally earlier this year.

According to on-chain analyst AB Kuai Dong, despite BitMine and USDC issuer Circle both collapsing more than 70% from their highs, they still landed in the top 10 overseas securities bought by Koreans this year. BitMine sat just behind Google’s parent company, Alphabet Inc.

“Korean bros are putting on a show of buying more the more they lose,” he wrote.

At the center of the trade is BitMine’s radical pivot. Once a marginal Bitcoin miner, the company rebranded itself as an Ether treasury, explicitly mirroring the playbook popularized by Michael Saylor’s Strategy, only with ETH instead of BTC.

The shift briefly turned BitMine into a market phenomenon, sending its shares up more than 3,000% to a July peak. The surge came as retail traders rushed to gain equity exposure to Ethereum accumulation.

The hangover was swift. BitMine’s stock collapsed, volatility spiked, and leveraged products tied to the shares cratered. Yet Korean traders kept buying.

According to data from the Korea Securities Depository, cited by Bloomberg, South Korean retail investors invested a net $1.4 billion in BitMine shares in 2025. They even funneled $566 million into a 2x leveraged ETF linked to the stock as losses mounted.

Faith Capital, Hoarding Logic, and Korea’s Willingness to Buy the Pain

To outside observers, the behavior looks irrational. Within crypto-native circles, it follows a familiar logic. Korean community members ascribe it to the “hoarding logic,” arguing that faith-driven capital flows do not track price curves.

“Faith capital flow ≠ price curve, this wave in Korea is just like the on-chain hoarding logic,” they said.

The idea is that infrastructure matters more than drawdowns. If Ether is a long-term settlement layer, then an ETH-heavy treasury vehicle becomes more attractive as prices fall, not less. Social sentiment mirrors this perspective.

“When it comes to loyalty in the crypto circle, Koreans are number one globally,” another user wrote, echoing a long-standing view of South Korea as a market where retail conviction often overwhelms risk management.

Circle Becomes the Parallel Bet as Korean Retail Chases Crypto Infrastructure Over Price

BitMine is not the only beneficiary of this mindset. Circle Internet Financial, the issuer of USDC, has also attracted heavy Korean inflows.

Korean investors poured close to $1 billion into Circle shares, making it one of the most popular overseas crypto-linked stocks despite sharp post-IPO volatility.

This demand likely stems from optimism around stablecoin regulation, both in the US and under South Korea’s new administration, which is pushing to expand domestic crypto market access and allow local stablecoin issuance.

BeInCrypto reported in October that Circle registered $2.4 trillion in Asia-Pacific stablecoin activity in the June 2024-2025 financial year.

In Japan, the FSA (Financial Services Agency) approved JPYC as the first yen-denominated stablecoin for launch later this year. Circle invested in JPYC through Series A funding, raising approximately 500 million yen total.

Together, BitMine and Circle point to a broader thesis at work. Korean retail…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!