📌 MAROKO133 Breaking crypto: US Shutdown Odds at 75% — How Hard Will Bitcoin Be Hi

The US federal government is heading toward a partial shutdown, putting bitcoin markets on alert. However, unlike last year’s 43-day full shutdown, the smaller scale of this potential closure suggests price impact may be contained.

With six of twelve spending bills already passed and historical data showing 60% of shutdown crises end in last-minute deals, markets appear to be pricing in a limited disruption scenario.

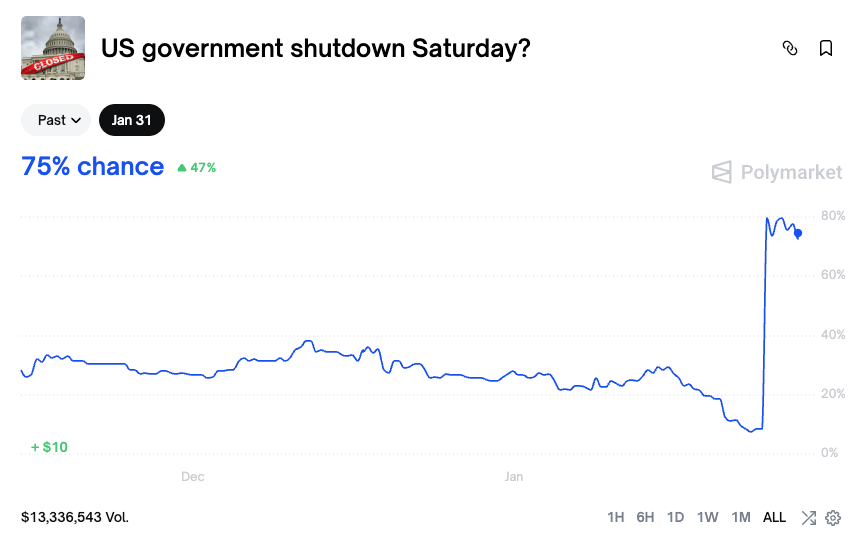

Shutdown Odds at 75% with $13.3 Million Wagered

According to the prediction market platform Polymarket, the probability of a shutdown on January 31 is 75% in the Asian morning hours. Total betting volume has exceeded $13.3 million. The impasse stems from Democrats’ opposition to the Department of Homeland Security (DHS) funding bill.

Senate Minority Leader Chuck Schumer stated, “I will vote no on any legislation that funds ICE until it is reined in and overhauled.” If no agreement is reached by midnight on January 30, some federal agencies will cease operations.

Partial Shutdown: A Different Scenario from Last Year

This potential shutdown differs significantly from the one in October 2025. Back then, all 12 appropriations bills were blocked, triggering a record 43-day full government shutdown. This time, six spending bills have already been signed into law.

According to the Committee for a Responsible Federal Budget, the departments of Agriculture, Veterans Affairs, Commerce, and Energy have secured full fiscal-year funding. DHS also holds approximately $178 billion from the “One Big Beautiful Bill Act” passed last year. This allows the agency to continue operations largely uninterrupted.

A pseudonymous market analyst known as “CryptoOracle,” who correctly predicted last October’s shutdown days before it began, had warned that a full shutdown would send shockwaves through both traditional and digital markets. “The shutdown will break liquidity first, then fix it later,” he wrote at the time. “Expect a 30–40% Bitcoin correction — and then the rally of the decade.” His downside target was $65,000–$75,000, a zone he called the “fear range.”

However, CryptoOracle’s prediction was based on the full shutdown scenario from last October. A partial shutdown may not drain liquidity from markets as much as a full shutdown.

During last October’s full shutdown, the Treasury General Account swelled to $1 trillion. This drained approximately $700 billion in liquidity from markets. BitMEX analysts described it as “starving risk assets of capital.”

This time, half of the appropriations bills are already signed into law. DHS also holds $178 billion in reserve funding. The TGA buildup — and the resulting liquidity squeeze — would be significantly smaller.

Last-Minute Deal Remains Possible

Historically, shutdown crises have often been resolved at the eleventh hour. According to analyst SGX on X, between 2013 and 2023, only three of five shutdown crises actually materialized — a 60% rate of last-minute deals.

SGX outlined several reasons why this shutdown might be averted: Republicans could separate DHS funding and pass remaining bills with a 60-vote threshold; some Democrats are privately willing to compromise if the harshest border provisions are removed; and a one-week shutdown costs the economy $4–6 billion with 2–3% market drops — political liability neither party wants.

“Historical pattern + economic pressure + exit plans from both sides = likely deal by Jan 31 via DHS compromise,” SGX wrote. “But it’s theater. No guarantees.”

Bitcoin Holds Steady Despite Uncertainty

Bitcoin spot ETFs recorded $1.33 billion in net outflows for the week ending January 23. However, analysts attribute this to multiple factors, including the Federal Reserve rate decision and Big Tech earnings, rather than shutdown fears alone.

Bitcoin is currently trading at $89,177 at press time, up 0.9% over the past 24 hours. The price remains approximately 29% below its October all-time high of $126,000.

The post US Shutdown Odds at 75% — How Hard Will Bitcoin Be Hit? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Eksklusif crypto: South Dakota Lawmaker Revives Bill to Allow State Bi

A South Dakota lawmaker has reintroduced legislation that would allow the state to invest a portion of its public funds in Bitcoin, reviving a proposal that stalled during last year’s legislative session.

Key Takeaways:

- A South Dakota bill would allow the state to invest up to 10% of eligible public funds in Bitcoin through multiple exposure options.

- The proposal includes strict custody and security rules for any state-held Bitcoin.

- The effort reflects a broader trend as US states explore Bitcoin-backed reserve strategies.

Republican Representative Logan Manhart introduced House Bill 1155 on Tuesday, seeking to amend South Dakota’s public investment statutes to permit the State Investment Council to allocate up to 10% of eligible state funds to Bitcoin.

The bill would allow exposure through direct holdings, qualified custodians or regulated exchange-traded products.

South Dakota Bitcoin Bill Sets Strict Custody and Security Rules

“I am proud to say I have released my bill that would allow the State of South Dakota to invest in Bitcoin,” Manhart wrote in a post on X. “Strong money. Strong state.”

The proposal outlines detailed custody and security requirements for any state-held Bitcoin.

These include exclusive control of private keys, encrypted hardware storage, geographically distributed secure facilities, multi-party governance controls and regular security audits.

House Bill 1155 has received its first reading and has been referred to the Committee on Commerce and Energy, according to the official legislative journal.

The measure closely resembles House Bill 1202, which Manhart introduced during the 2025 legislative session.

That earlier effort sought to add Bitcoin to the list of permissible state investments but failed to advance after being deferred beyond South Dakota’s 40-day legislative session limit.

The renewed push comes as interest in Bitcoin-backed reserves grows among US states.

Lawmakers in Kansas and Florida have advanced similar proposals, while Arizona, Texas and New Hampshire have already passed legislation allowing some form of crypto reserve strategy.

At the federal level, the US government established a strategic Bitcoin reserve last year following a March executive order signed by President Donald Trump.

The reserve is funded using Bitcoin seized in criminal and civil cases, assets that are legally barred from being sold.

Supporters argue that Bitcoin could serve as a long-term hedge against inflation and currency debasement, while critics have raised concerns about price volatility and risk management.

Kansas Weighs Bitcoin Reserve Fund

As reported, lawmakers in Kansas are considering legislation that would create a state-managed Bitcoin and digital assets reserve funded entirely by unclaimed digital property already held by the state.

Senate Bill 352, introduced by Senator Craig Bowser, proposes establishing a reserve within the state treasury overseen by the Kansas state treasurer, without using taxpayer funds or direct cryptocurrency purchases.

Under the proposal, the reserve would be built from abandoned digital assets such as unclaimed Bitcoin, other cryptocurrencies, airdrops, staking rewards and interest that fall under Kansas’ unclaimed property laws.

The bill specifies that 10% of each deposit would be transferred to the state’s general fund, while Bitcoin would remain locked within the reserve.

Internationally, countries such as El Salvador and Bhutan have already taken more direct approaches, incorporating Bitcoin into national strategies through state holdings, mining initiatives, and development projects tied to digital assets.

The post South Dakota Lawmaker Revives Bill to Allow State Bitcoin Investment appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!