📌 MAROKO133 Update crypto: VanEck and Kraken to Redefine ICOs With Onchain Complia

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as familiar names from Wall Street and the digital asset space step forward with a new vision that blends traditional structure with blockchain openness.

Crypto News of the Day: VanEck and Kraken Signal a New Chapter for Onchain Fundraising

Crypto fundraising is entering a new era, as VanEck and Kraken throw their weight behind Legion.

The move, marked by Legion’s $5 million seed round co-led by VanEck and Brevan Howard, signals a sharp turn in how capital formation may change in digital markets.

In an exclusive with BeInCrypto, Juan C. Lopez, General Partner at VanEck Ventures, described Legion as a potential catalyst for a new era of compliant, globally scalable ICOs (initial coin offerings).

For Lopez, the opportunity is about reshaping the opaque structure of private markets.

“The reality is the best companies want to pick who their investors are…The downside of this is that all the upside is kept for insiders. The opportunity with Legion goes beyond crypto. It’s about enabling companies to raise capital instantly from aligned investors while letting retail invest early and have skin in the game,” Lopez explained.

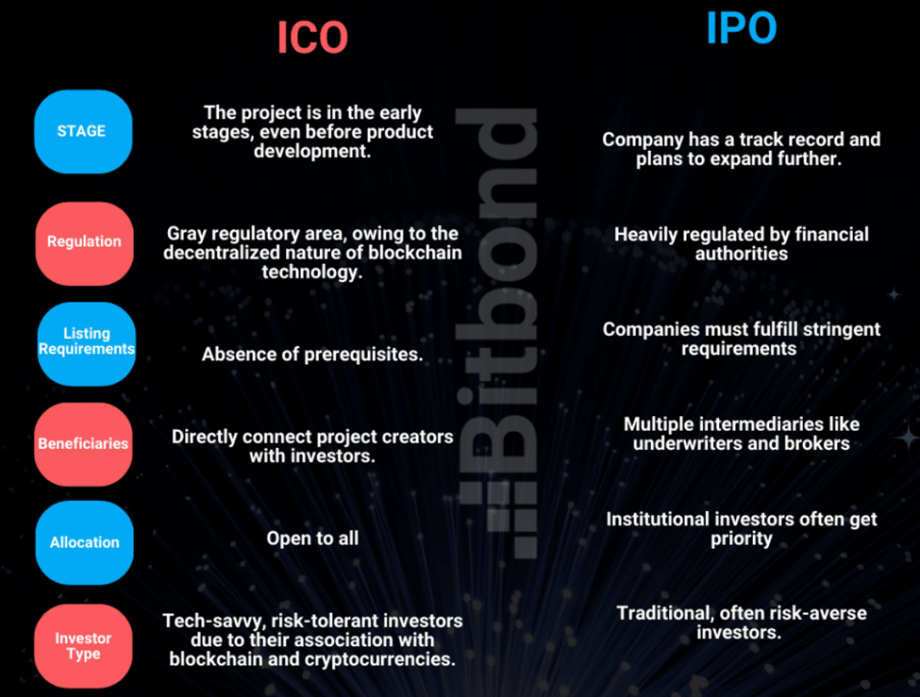

Founded in 2023, Legion aims to fuse the rigor of traditional IPOs (initial public offerings) with the accessibility of ICOs.

Compliance is baked directly into smart contracts, while disclosures are automated throughout the token lifecycle.

This alignment creates equal footing for institutional and retail participants. It addresses what Lopez called “persistent opacity and limited disclosures” in today’s markets.

Coinbase Ventures, GSR, Crypto.com Capital, and Kraken exchange joined the raise, which includes $1 million set aside for community allocations.

Legion’s model could bridge the divide between Wall Street credibility and blockchain openness. Such a move would create an environment where tokenized assets and hybrid equity rounds evolve under transparent, regulated frameworks like Europe’s MiCA.

Kraken to Make ICOs More Like IPOs

The Kraken exchange has also extended Legion’s compliance-first fundraising model directly to its global customer base.

Millions of users will gain access to transparent token sales that integrate Legion’s merit-based allocation system. For many retail investors, this could be the closest crypto equivalent to IPO participation.

However, Brett McLain, Head of Payments and Blockchain at Kraken, indicated there will be sharper disclosures and community-driven access.

“Kraken is building the foundation of tomorrow’s financial infrastructure with crypto at its core,” read an excerpt in the press release, which cited McLain.

Together with Legion, Kraken is scaling a product that democratizes token sales and aligns communities with builders.

“It’s not just better fundraising, it’s better infrastructure for the next generation of finance,” McLain added.

Unlike previous ICO booms that rewarded bots and speculative inflows, Legion’s system evaluates participants by industry contributions.

Developers with open-source commits, DeFi users, and active community leaders can be prioritized over passive wallets.

The partnership also ensures sales are MiCA-compliant, with strong due diligence and disclosure requirements.

Whitepapers, allocations, and investor protections are standardized to eliminate hidden deals and insider advantages.

“The next Figma or Reddit won’t IPO. It will launch to its community on-chain. This partnership makes that possible,” Legion Co-Founder Matt O’Connor said.

Kraken’s backing adds scale and liquidity, giving founders Wall Street-level transparency and retail distribution.

For investors, it offers regulated, trusted access to early-stage opportunities previously gated by venture insiders.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Can Bitcoin fix US housing? FHFA’s crypto mortgage move gains attention as crisis deepens.

- ETH exit queue hits all-time high after Kiln withdrawal sparks $11 billion unstake.

- Bitget’s chief analyst explains what it would take for Ethereum to outperform Bitcoin.

- Tether CEO’s Africa pitch revives ETHSafari questions on web3 infrastructure.

- SEC commissioner Hester Peirce rejects OpenVPP’s misleading crypto cl…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: Arthur Hayes: Fed Shift Could Catapult Bitcoin to $1

Arthur Hayes, co-founder of BitMEX, has reignited the debate over a seven-figure Bitcoin price, presenting a new bullish case for the cryptocurrency.

His projection hinges on what he sees as an imminent shift in the Federal Reserve’s policy.

Powell’s Stance vs the Potential New Era

In a recent post on his X (formerly Twitter) account, Hayes pointed to comments made by Stephen Miran, a recent nominee for the Fed’s Board of Governors. The comments were made during his congressional hearing. According to reports, Miran mentioned that “moderate long-term interest rates” would be one of the Fed’s new duties.

Hayes interprets this as a strong signal that the Fed is moving toward a Yield Curve Control (YCC) policy.

Current Fed Chair Jerome Powell has been at odds with the Trump administration regarding monetary policy. He has instead focused more on the Fed’s other mandates of maximum employment and stable prices, rather than long-term rates.

However, Powell’s term is set to expire in May of next year, and Hayes believes it would open the door for the Fed to implement aggressive long-term rate control if a pro-Trump figure is appointed as the next chair. He argues that if the Fed were to adopt YCC, real interest rates would likely turn negative.

This scenario would lead to a decline in the dollar’s value, prompting capital to flow into alternative assets. In this environment, Hayes projects that Bitcoin could soar to $1 million due to the dollar’s declining purchasing power.

A Bullish Bet on the Trump Era

Hayes’s observations are supported by recent public statements from Trump administration officials who have repeatedly emphasized the need to “moderate long-term interest rates.”

Treasury Secretary Scott Bessent also explicitly dubbed this in a September 5 op-ed for The Wall Street Journal, where he criticized the Fed for neglecting its legal mandate to maintain moderate long-term interest rates.

Arthur Hayes is confident the cryptocurrency market could grow significantly under a Trump administration. In an August post, he projected that the current crypto bull market could extend through 2026.

He specifically analyzed the likelihood that a Trump administration would initiate economic stimulus measures in mid-2026, a policy he believes has the potential to support a market rally.

The post Arthur Hayes: Fed Shift Could Catapult Bitcoin to $1 Million appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!